This post is part of a series sponsored by CoreLogic.

Wind is one of nature’s most difficult hazards to measure, and damage caused from it can go undetected for months. Unlike hail which can be visually seen and, more often than not, concentrates in the center of severe storms–wind is invisible and can vary widely over small geographic areas. Each year, extreme weather events including wind pose a growing threat to property and casualty insurers in the United States, costing billions of dollars in insured losses. Per recent CoreLogic analysis, 2016 brought wind speeds as high as 101 mph in Kennedy Space Center, Florida during Hurricane Matthew. Severe wind activity like this results in considerable collateral damage which can lead to very long claims cycles and have an adverse impact on overall customer satisfaction.

Often, to document a claim file, insurance claims adjusters have relied on public reports from the National Oceanic and Atmospheric Administration (NOAA) and nearby airport observations. Because neither of these sources represent the wind at or near the location of interest, claim denial or approval decisions were open to interpretation which led carriers to approve claims that were not necessarily valid. This was in addition to poorly understood post-storm exposure which led to significant challenges calibrating storm response, and estimating Incurred but Not Reported (IBNR) reserves.

The ability to understand the specific impact of each storm can be challenging for carriers who are looking to enable a more proactive approach rather than a reactive storm response. Thus, forensic wind verification technologies exist so that carriers can compare detailed storm maps and reports with their books of business. The ability to perform this analysis leads to a better understanding of the impact of each unique storm. With this new ability to accurately verify and pinpoint affected areas, more targeted response plans can be developed to improve customer satisfaction, catastrophe response efficiency, and confidently detect fraudulent claims.

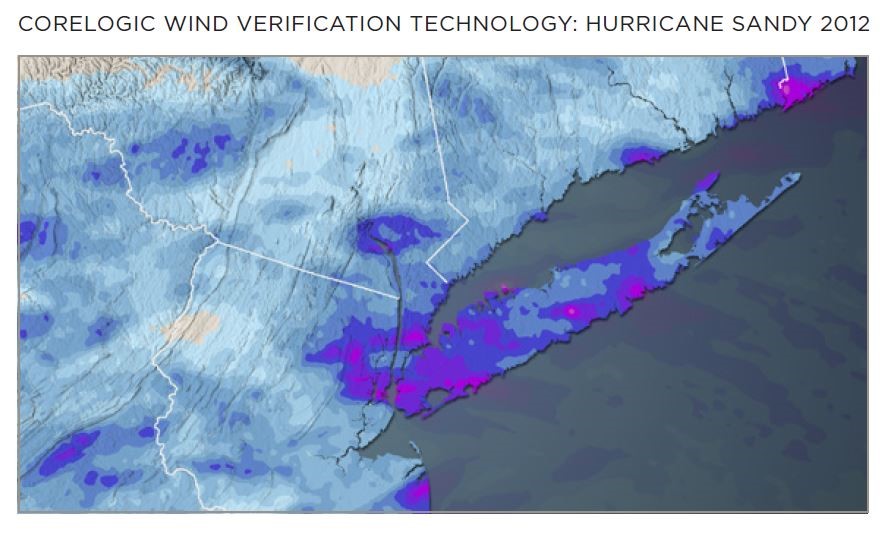

The proprietary wind verification technology from CoreLogic® uses both radar and observations taking advantage of the best aspects of each in the proprietary algorithm: the high-resolution patterns of radar, and the accuracy of observations. Our robust radar processing system determines which areas of radar-detected winds are likely and unlikely to be present near the ground, so we’re able to use radar even where beam height is very high. Additionally, using bias-correction to overcome some of the limitations of observations, we can utilize tens of thousands of additional wind observations that would otherwise be too inaccurate for use in verification. The final wind speed estimate is created by combining observational and radar-based wind data estimates, leading to a wind analysis that provides 500-meter resolution with neighborhood-level detail.

The P&C industry is exposed to billions in insured losses every year due to wind. Through using the unique business intelligence of our proprietary wind verification science, insurers can proactively respond to customer inquiries and deploy the appropriate resources with precision.

To learn more about our how wind verification technology works, download our white paper today.