Admiral Group plc on Thursday announced record profit for last year, and the CEO of one of its biggest brands is taking that as an endorsement of his popular online insurance shopping business model.

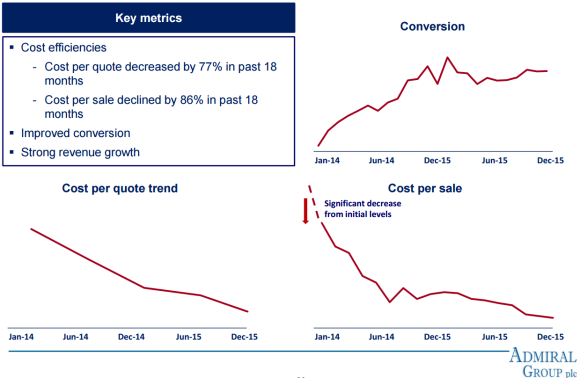

Compare.com CEO Andrew Rose called out highlights of the online comparison shopping business within Admiral’s annual earnings report, which showed Compare.com’s cost per quote fell by 77 percent and the cost per sale fell 86 percent in last 18 months.

Rose attributed the strong showings to better advertising, adding carriers, an improved quoting process and good word of mouth.

Admiral issued its earnings on Thursday around 4 a.m. EST. The company, traded under ADM on the London Stock Exchange, reported group profit before tax of £377 million (U.S. $534 million) for 2015, up 6 percent from £357 million ($506 million) in 2014.

The company reported a 14 percent increase in international car customers to 673,000 in 2015 from 592,600 a year earlier. International car insurance losses in 2015 totaled £22.2 million (U.S.$31.51 million), up from £19.9 million (U.S.$28.24 million) in 2014, the company reported.

The combined price comparison business made losses of £7.2 million (U.S.$10.22 million) compared with a 2014 profit of £3.6 million (U.S.$5.11), which Admiral said reflects the ongoing investment in Compare.com.

Compare.com is just coming off a failed business partnership with Google on its Google Compare shopping business launched a year ago. Google announced last month it was shutting down Google Compare, which included comparison shopping for insurance, mortgages and other financial products.

Google cited a lack of profit as its reason for pulling out, which was something Rose took issue with at the time of the announcement. It was revealed that Compare.com and Google had agreed to part ways months earlier, though Compare.com reportedly continues to work with Google until the site is completely shuttered.

On Thursday Rose took the opportunity to contrast Google’s online comparative shopping experience with the numbers in Admiral earnings report.

“We’re seeing a different story than what Google Compare was telling us,” Rose said.

Compare.com, which has a strong presence in Europe and a growing presence in the U.S., recorded a loss on Admiral’s books. Admiral owns 71 percent of Compare.com, while White Mountains Insurance Group (the former owners of esurance) owns 22 percent and Spanish insurance company Mapfre owns nearly 7 percent.

Rose said to expect more losses to be recorded while Compare.com beefs up its advertising spend and continues on an aggressive expansion pace.

“Our advertising could eclipse $100 million this year,” he said. “We’re continuing to invest and accelerate the investment. We’re very successful with this business model internationally.”

Compare.com recently rolled out two new advertisements appearing on national television in the U.S.

Compare.com reports partnerships with roughly 60 insurance brands, and that it provided more than 1 million insurance quotes last year.

According to Rose, Compare.com signed another “big carrier” on as a partner on Thursday following the signing on of carriers on Monday and last week.

He declined to offer further details on those deals.

“The influx of carriers coming onto our platform is quite aggressive,” he said.

Other Admiral brands include Admiral, one of the largest auto insurance providers in the U.K., Confused.com, Elephant and Elephant Auto, Diamond, Gladiator and Qualitas Auto.

Admirals’ shares rose 9.03 percent, or £159.00 (U.S.$225.58) in trading following the news.

Related: