Drawing off the massive flooding in Colorado and Naval shipyard shootings in Washington, D.C., the second in a series of webinars being put on for National Preparedness Month focused on unforeseen crises as examples of the need for organizations to have well thought out emergency plans.

Titled “The New 10 Steps to Preparedness,” the webinar was presented by Agility Recovery and the United State Small Business Administration. The webinar followed last week’s webinar, “Protect Your Organization by Preparing Your Employees.” Next week’s webinar is “Crisis Communication for Any Origination.”

The webinars are timed with National Preparedness Month in September, an idea that sprang out of the tragedies of the Sept. 11, 2001 terrorist attacks.

They are timely, as the need to be prepared for any event is being driven home for U.S. businesses and citizens. The widespread flooding in Colorado is being viewed as an “unprecedented” event in which losses will take quite some time to calculate. The impact of the D.C. shootings that left 13 dead is also still being assessed.

“Already this month we have seen two gigantic tragedies impact the United States,” said Bob Boyd, Agility’s president and CEO.

The lesson take away from these events, he said, is “if you don’t already have a plan…it doesn’t mean it’s impossible for you to recover, but boy it makes is hard.”

During the webinar Boyd offered 10 Steps to preparedness:

- Assess your risk – both internally and externally

- Assess your critical business functions

- Back up your data

- Prepare your supply chain

- Prepare your employees

- Create a crisis communications plan

- Assembly emergency supplies

- Plan for an alternate location

- Review your insurance plan

- Test your plan

Prioritize

Good planning starts with a risk manager, executive, or insurance agent advising clients, asking themselves and the organizations they represent several questions.

“You need to think about it,” Boyd said. “What are the different departments or services or functions that you provide to you stakeholders?”

This enables business managers to prioritize those functions and figure out what must be taken care of first in crisis.

For example, member services for some businesses may be a critical function, whereas accounts payable may not be a priority.

“The day after a disaster, I’m probably not worried about writing a lot of checks,” Boyd said.

Following that assessment, it enables organizations to cross-train employees to serve in alternate functions during an emergency, such as having accounts payable employees learn to work in customer services, he said.

Backing up data is another important planning step, according to Boyd. Again, he suggested asking questions: Is this the data backup automated? Is it backed up daily? Is tit stored in an off-site, secure location? Is the data backup plan tested regularly? Is the organization’s regional footprint, who the customers are and where they are, being taken into consideration?

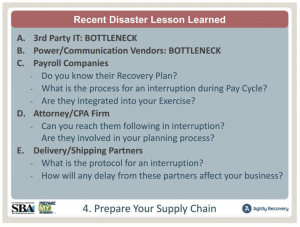

Also essential, but not always obvious when designing an emergency plan for a company, is communicating with key vendors and suppliers about their recovery plans, Boyd said.

“Call them up and ask them,” he said. “That’s not an unreasonable request to call them and say I really depend upon you.”

He added, “(Superstorm) Sandy was a great example of this. There were lot of people that didn’t get directly impacted by Sandy, but they had vendors go down.”

He also suggested developing relationships with alternate vendors to “eliminate single points of failure.”

Beside company-wide preparedness, employee preparedness is equally important, he said.

Steps suggested to prepare employees include:

- Involving employees in planning and testing the emergency strategy

- Preparing employees for work from home challenges

- Cross-training employees, even between departments

- Addressing family preparedness

- Providing build a kit workshops or other family involvement days

- Formally sharing the plan with new hires

- Participating in local emergency management drills

Beyond just the steps, there are considerations to be made with each measure. Preparing employees to work from home in the case of an emergency isn’t always the best answer, Boyd said, adding that working from home during Superstorm Sandy wasn’t effective for many organizations cause power wasn’t just on in the office, but there was not power in people’s homes as we;;.

“There are lots of big events where that won’t work,” he said. “It’s a great option to have, but it just can’t be your only option.”

Bringing in a mobile unit, or going to a hotel to keep workflow going may be other options to be prepared for possible power outages, Boyd advised.

Crisis Communication

“Creating a crisis communication plan is so critically important,” he said. “You need to make sure you have a variety of different ways that you can communicate with your stakeholders after a disaster impacts you.”

Some ideas offered include:

- 24-hour phone tree

- Password protected web page

- Previously established radio/TV/print news partners

- Call-in recording system

- Email alert system

- Text/data alert system

Boyd suggested making an emergency call list for employees that includes a home phone, alternate mobile phone, personal email and family contact information.

Lest no one forget, one of the most important parts of being prepared is to make sure proper insurance coverage is in place, Boyd said.

“Please, please review your insurance coverage,” he said.

Insurance considerations include:

- Be sure the organization is insured for all potential risks

- Consider business interruption insurance and added expense insurance

- Keep up-to-date photos of the property, equipment lists and policy information stored in safe and secure offsite location

- Asset management program

“There are hundreds of thousands of employers fighting with their insurance carriers because they thought they had coverage,” Boyd said.

Finally, he suggested, conducting annual exercises to work the kinks out of the plan.

“Conduct a test of it, at least once a year,” he said.

Testing data restoration, the alert notification system, employees’ knowledge of the emergency plan, vendors resilience and knowing power needs are all checks that should be made at least annually, Boyd said.

“Find the failures and simply update your plan, make it better,” he said.

The next webinar is “Crisis Communication for Any Origination” on Sept. 25 from 2 to 3 p.m. EST. Stay tuned to InsuranceJournal.com for coverage of that webinar.

Topics Flood Training Development Colorado

Was this article valuable?

Here are more articles you may enjoy.

USAA to Lay Off 220 Employees

USAA to Lay Off 220 Employees  California Sees Two More Property Insurers Withdraw From Market

California Sees Two More Property Insurers Withdraw From Market  FBI Says Chinese Hackers Preparing to Attack US Infrastructure

FBI Says Chinese Hackers Preparing to Attack US Infrastructure  How California’s Huge Raises for Fast-Food Workers Will Ripple Across Industries

How California’s Huge Raises for Fast-Food Workers Will Ripple Across Industries