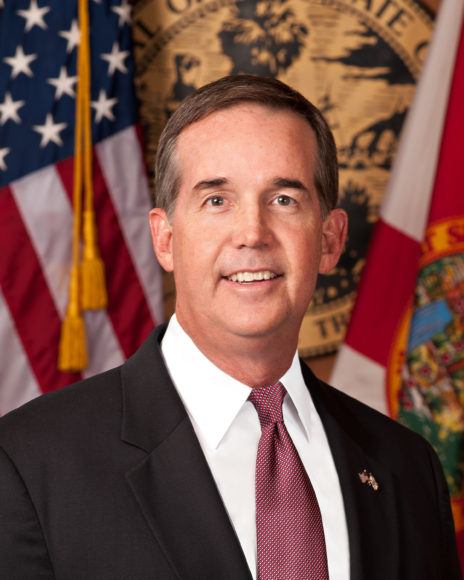

Lifelong Florida resident, long-time Florida politician, and head of the Florida Department of Financial Services (DFS), Jeff Atwater shocked the state when he announced in February he would step down as chief financial officer at the end of the 2017 legislative session to become vice president of strategic initiatives and CFO for Florida Atlantic University (FAU).

As Florida’s CFO, a position he has held since 2011, Atwater has worked closely with the insurance industry. DFS oversees the Florida Office of Insurance Regulation (OIR), as well as the office of the Florida Insurance Consumer Advocate, who assists Florida residents with insurance-related questions or concerns.

DFS is also home to the Division of Investigative and Forensic Services (DIFS), which handles all insurance fraud-related investigations. One of Atwater’s biggest priorities since he took office, and no doubt one of his legacies after he leaves, has been his commitment to rooting out fraud that he says drives up the cost of insurance for all Floridians.

Before he departed DFS, Atwater was adamant about completing a mission he began three years ago: passing legislation to put a comprehensive system in place to track and prosecute insurance fraud.

And this past session, his work paid off when HB 1007 and HB 1009 were passed by state legislators. The passed bills (still awaiting the governor’s signature) will require state attorneys’ offices that receive money for prosecuting fraud to report their progress to DIFS, which will file annual reports with the legislature.

The bill also expands requirements for insurers’ anti-fraud efforts and reporting. Beginning Dec. 1, each insurer must file annual reports with DIFS that contain a detailed description of their insurance fraud investigative unit or a copy of the contract with the investigation firm, and a copy of the anti-fraud plan.

Atwater said he worked first-hand with the insurance industry during his 25 years working in the banking industry, though on a much smaller scale than over the last six years as CFO. But he said he has always understood the importance of insurance and the role that it plays in economic development.

“For a growing economy, you need investment. For investment, you need risk takers. Risk takers must mitigate that risk, and insurance is what mitigates that risk,” he said.

Shortly before departing from DFS, Atwater spoke with Insurance Journal to discuss his experiences with the insurance industry as CFO, including what about the industry has surprised him and frustrated him through the years, and how he thinks the industry could improve its customer relationships and gain support in its fight against insurance abuse. The following interview has been edited for brevity.

IJ: Did you have any personal opinions on the industry before you began this position?

Atwater: I certainly did. I would say that from the standpoint of being a banker, and when you have a portfolio the size of portfolios that we would hold in the banking institutions that I was a part of, there is going to be events that would ultimately require that the insurance policy itself might well have been a source of repayment — a fire; a hurricane; a tragic accident. I saw players perform and I saw players that did not perform well. …

Regrettably, I think we acknowledge that almost in any industry — and insurance might well be at the top of that list — the poor performance of the few is going to create a perception and a narrative that could be detrimental to the perception of the entire industry … that occurs in all industries. The insurance industry has not been immune from that fact [and] when local television and local media gets a hold of a story where a player has underperformed, there is no sympathy for an insurance company that has accepted premiums, made promises and then, for whatever reason, has not fulfilled those promises.

Sometimes, it may be a real legitimate dispute. But that narrative is rarely covered equally in the communication that the media will bring to the story.

IJ: What have you learned about the industry that you didn’t know before? What has surprised you the most?

Atwater: What has surprised me … is the magnitude of the fraud that exists in the marketplace across virtually every line of insurance that is available to Floridians, personally and in a commercial nature. That has been an eye opener.

I was aware of fraud, just not aware of how many really organized crime rings there were designed specifically to exploit opportunity. …

I think it was learning the depths of both the true fraud that is taking place within the market and where individuals who have developed — again, I would call it organized crime, without question — who have developed business practices that while yet might not be identified as illegal should be because they are clearly exploiting portions of Florida law to make money. Some might call it overutilization, but I think that’s awfully generous and I think they’ve created their own cottage industries.

IJ: Do you think that the abuse of assignment of benefits (AOB) and personal injury protection (PIP) is making consumers more aware of how fraud impacts their insurance rates and coverage?

Atwater: I think that consumers are becoming aware, but I still think there is a significant void from consumers understanding the magnitude of that fraud. Therefore, I would say that there is still tremendous rate sensitivity by the consumer market in Florida that is unfamiliar with the magnitude of what fraud might be loading into those rates.

IJ: How could the industry help consumers better understand?

Atwater: I think that the industry could go a long way by communicating the actual evidence that it has in its databases that could show the magnitude of the losses that are occurring that are being built right back into the rate formula. It’s not coming from disputes over attorney’s fees, etc., it’s coming from these claims. These are the losses that we are now experiencing from these claims and we want the public to see this and really focus on communicating that this is an issue. [Saying] we want to work with you on developing the policies that could, and should, be able to still offer a fair product with a very rapid response to a consumer when there’s a legitimate claim filed, but does not allow a collection of individuals to exploit the opportunity to make money. Let’s work at this hand-in-hand.

Instead, it becomes a number of lobbyists that take on the challenge. … The conversation takes place in the halls of the state capitals and the consumers are just seeing rates go up, rates go up, rates go up. …

I think consumers believe that the rates that come [are because the] insurance company just wants more rates and the government just keeps giving it to them. I don’t think that, again, most consumers, without the right public communication, understand that these losses are required to be built into the rate filing. And they’re going to be granted.

When the public does understand it then they turn back and they say, “What is the insurance company doing to help me fight this fraud? They know the data. They know the bad actors. They know the trends before everybody else does. Why aren’t they fighting this target?” I think that’s a question for the industry to answer.

Atwater said the industry came together more than ever this session to encourage legislation against AOB abuse, though that didn’t turn out to be enough as no AOB bills were passed. Atwater said the industry’s pushback in sharing information that would help consumers to understand the magnitude of fraud taking place in Florida is partly to blame, and hasn’t just occurred with recent AOB legislation.

Atwater: There are some players in the industry that believe any bit of data that they hold is proprietary and it’s a trade secret, and they’re not going to help … [but] my fraud investigators can only begin to act when a referral is made. … I do believe there is more that the industry could do in the development of strategic initiatives, the sharing of data in trend lines, the identification of the [abusers], seeing where the abuses are taking place, and acting faster; than for us to be trying to collect that from referrals of neighbors who saw somebody get a whole new roof or possibly a referral from someone who heard someone say that that guy got a big water claim and got a new kitchen out of it.

That’s hardly the trend line in data that the insurance industry itself holds. I would hope that they would be excited and desiring to work together and to work with our division in helping provide data on trends and narrowing our search to go after the bad actors. That would be very helpful.

IJ: Let’s talk about the anti-fraud legislation that just passed. Why did the industry fight this legislation?

Atwater: There have been, over the last three years, players within the industry that just said, “No. We don’t want to have to provide more information to you all. We don’t want to have to be held in any kind of account of sharing that data. This is our proprietary data. This is our business model. Everything we do is a trade secret.” There are others within the industry who said, “We are not concerned in the least.” Regrettably, the industry itself was not altogether onboard.

IJ: Looking back at your time as CFO and your experiences specifically with the insurance industry, what has really stood out to you?

Atwater: We just had a hurricane season last year, where we had two named storms, both that caused hundreds of millions of dollars in damage. I was impressed with the reaction time that I saw from most of the industry, how quickly they were onsite, calling upon those who had reported a claim, as well as those who were in the same general vicinity who had not reported a claim, to try to be on their game and trying to serve their client.

I was impressed and glad to see that kind of self-motivated initiative to quickly get in there and address those claims. I would say that was a really pleasant experience.

There’s always going to be a case, no matter what industry you’re a part of, where someone makes a mistake on a loan file, on an application or on a claim. It happens in every industry. Our responsibility is to see that nothing systemic begins to take place by any particular carrier. We did not see any of that during these past two storms that hit Florida. We really believe people were trying to do their best and, knowing that if they did their best, they could probably take care of the claim in a fast and efficient way, which is what the expectation of their client would be.

IJ: What advice would you give your successor in working with the industry?

Atwater: When I look back on what we have done working with the industry, I’m incredibly proud and happy. … We haven’t always been on the same page, but I would tell the individual that would step into this role to work to build the relationships with these players in the industry; that the industry has the first sense of what’s going right and what’s going wrong and to be able to work with them to try, even though sometimes it’s difficult.

Get your hands upon the best data that can help you make the case for public policy change. That’s important. And to stay mindful that the insurance industry is providing one of the most key ingredients into the economic success of the state of Florida. Again, without insurance, people don’t buy a home; the bank is not going to take that risk. Without insurance, they’re not going to make the loan for the small business. Without insurance, the developer isn’t going to build the building.

It is incredibly important to be able to build these relationships, to be able to speak frankly and know that inside that frank conversation is tremendous respect. It’s not built in a day, but it’s built over time and it’ll serve both the people of Florida well and this process of public policy making.

Listen to the full interview with CFO Atwater below: