Response Time, Service Crucial When Selecting E&S Brokers, IJ Survey Reports

Retail agents and brokers consider service and response time delivered by excess and surplus lines brokers to be critical factors when reeling in wholesale firms they do business with, according to a survey conducted by Insurance Journal.

Eighty-one percent of retailers who participated in the survey said service and response time are the most important factors to maintain a good relationship.

“The key (to maintaining good relationships) is response time and not leading us (retailers) to believe they will perform when they may not,” one retailer wrote.

The survey, which polled nearly 11,000 agents and brokers nationwide, revealed that certain criteria must be met to maintain strong and beneficial relationships with E&S brokers vying for their business. Aside from service and response time, reputation, variety and quantity of markets, financial strength, location of the E&S broker, commission and price were also important in building and maintaining strong relationships.

The majority of survey respondents (58 percent) described the E&S industry as a very important part of their business.

But in a marketplace where relationships are crucial, and where competition and choices for business partners are plentiful, agents and brokers can be highly selective when accessing E&S brokerage firms to work with.

“The best are quickly rising to the top as the market softens,” one respondent said. “The less effective wholesale brokers are moving out. Responsiveness and performance (getting the deals done) are the biggest keys in selection … most seem to have the markets.”

The IJ survey asked respondents to rate criteria important to retailers on a scale of “Least Important” to “Very Important” that might be considered when selecting E&S brokers to do business with.

Most survey respondents (61 percent) considered response time to be very important when selecting an E&S broker.

According to the survey, another important factor to consider when selecting a broker is service. More than half of survey respondents (53 percent) rated service as a very important factor to consider when choosing an E&S broker.

The “number of markets” and “variety of markets” E&S brokers offered were also critical factors.

Forty-six percent of respondents rated market variety as very important, while 43 percent said the number of markets was merely important when selecting E&S brokers to do business with.

Despite the high-level of competition throughout the industry, price did not rate high on the list of respondents’ criteria.

“Price is not everything,” commented a retailer in one survey.

More than one-third (34 percent) of the survey respondents rated price as only somewhat important when selecting one E&S broker over another.

Other deciding factors that were less important in a retailer’s decision to use one E&S broker over another included reputation, financial strength and commission structure.

Less than half of all respondents viewed the commission structure (48 percent), reputation (42 percent) and financial strength (41 percent) of the E&S broker as important criteria when selecting a broker to do business with.

The location of the E&S broker didn’t seem to matter to retail agents and brokers. Location was the least important criteria, with 84 percent claiming it was not important at all.

While location may not have been relevant, the number of E&S brokers retailers preferred to deal with did seem to matter tremendously.

“We believe it is important to develop a relationship with a few good surplus lines brokers than to have a wide array,” one respondent commented. The majority of retail agents and brokers surveyed used 10 or fewer E&S brokerage firms (72 percent), but close to half (39 percent) used only five or fewer E&S brokerage firms.

According to survey respondents, strong relationships are key when selecting surplus lines brokers and those relationships can only be built through experience and trust.

“Being in the industry for over 40 years, I have used the E&S market extensively,” one respondent wrote. “Mainly I go with two wholesalers and do occasionally use a third. Flooding several wholesalers with the same submissions will only work against you. Their markets will decline since they are seeing the same submission from several wholesalers. It is much easier to deal with one, two or three wholesalers and develop a good working relationship.”

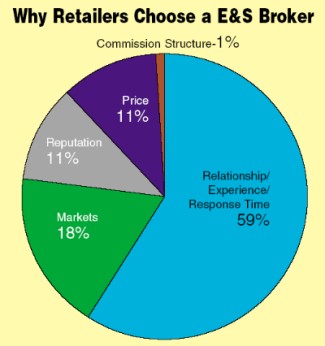

More than half (59 percent) of the survey respondents said the most important reasons they chose their E&S brokers were their relationships with them, and the response time and experience of the brokers.

Doing business online

In terms of technology, the ability to submit business online did not play a critical role in the retailers’ decision to use a particular E&S broker. According to the survey, less than one-third of respondents (28 percent) said they could submit business to their E&S brokers online, however, the majority (67 percent) admitted it did not affect their decision on whether or not to use the broker.

Nevertheless, one respondent commented, “Some have the ability to receive applications via e-mail, but not all. I think this will become more critical in the future.” Another respondent said, “It would be nice if the surplus lines industry could get automated. We only deal with standard companies who are automated. But so far have not found a surplus lines broker that was automated and neither are their companies.”

The survey also asked agents whether the wholesalers they work with offer sufficient training for the retail agency staff when they introduce a new technology such as online submissions. Only 16 percent said, “Yes.”

Ease of doing business is an important element in any business relationship. Perhaps technology will be the deciding factor when choosing surplus lines brokers in the future.

Marketing the markets

Visits from E&S brokers did not seem to matter much to retailers, despite aggressive tactics by E&S brokers to conduct targeted visits each year to their agency customers.

According to the survey, most retailers (69 percent) felt face-to-face calls from E&S brokers were not that important. Only a fraction (11 percent) of the survey respondents considered face-to-face marketing calls from E&S brokers to be very important to their business.

Finally, the survey asked how and where they locate excess and surplus lines markets.

One respondent commented, “As a marketing person, I wish they (E&S brokers) would use insurance publications or mailings more often so it would be easier to find them for specific industry programs.”

So how do retailers locate markets? According to the survey, more than one-third of the respondents (31 percent) said they locate E&S markets via online advertising and print advertising. Slightly less than one-quarter of the respondents located markets via their peers (22 percent) and by word of mouth (21 percent). Other options included agent associations, Internet searches, direct mail solicitations, and online market finder services.

“They (E&S brokers) are a very necessary part of insurance but sometimes they forget they need to market to us, just like we need to market to the public,” another respondent wrote. “The good ones interact electronically and maintain communication, the poor ones don’t.”

Who responded?

The majority of the respondents to IJ’s survey were decision makers and leaders in their agencies. Most were either an owner or principal in the retail agency (51 percent) and more than one-third (31 percent) were classified as retail agents or brokers. The remaining respondents were service staff, such as CSRs or marketing representatives in retail agencies nationwide.

The respondents primarily live and conduct business in cities with a population over 250,000 (62 percent) and wrote more than $10 million in property/casualty premium each year (51 percent). Nearly half (43 percent) described their agency’s annual premium volume as containing 76 to 100 percent commercial lines business.

Topics Agencies Excess Surplus

Was this article valuable?

Here are more articles you may enjoy.

USAA to Lay Off 220 Employees

USAA to Lay Off 220 Employees  Harvard Study Again Stirs the Pot on Demotech Ratings of Florida Carriers

Harvard Study Again Stirs the Pot on Demotech Ratings of Florida Carriers  JPMorgan Client Who Lost $50 Million Fortune Faces Court Setback

JPMorgan Client Who Lost $50 Million Fortune Faces Court Setback  Employers Can’t Use Vicarious Liability to Block Negligence Claims, TN High Court Says

Employers Can’t Use Vicarious Liability to Block Negligence Claims, TN High Court Says