The original criteria and objective definition for the Near Nationals was established in the Feb. 12, 2007, issue of Insurance Journal. The Demotech Company Classification System categorizes insurers into one of 11 categories based on an analysis of data reported by the companies to the National Association of Insurance Commissioners.

The 11 categories that comprise our classification system are National, Near National, Super Regional, Regional, State Specialist, Coverage Specialist, Strategic Subsidiary, Risk Retention Group, Surplus Lines Carrier, Reinsurer and companies with less than $1 million in direct premium written.

A company can be assigned to only one category in the Demotech Company Classification System. Therefore, a company not designated as a Near National is assigned to another classification, perhaps National, Super Regional, Regional, or State Specialist.

To qualify as a Near National, a carrier must meet the following criteria:

- More than $1 million of direct premium written in each of at least 35 states at Dec. 31, 2012.

- Policyholders’ surplus of at least $100 million at Dec. 31, 2012.

- $100 million or more of direct premium at Dec. 31, 2012.

- $50 million or more of net premium at Dec. 31, 2012.

- No line of business greater or equal to 90 percent of direct premium volume at Dec. 31, 2012.

- No state greater or equal to 90 percent of direct premium volume at Dec. 31, 2012.

- May not be a surplus lines carrier, risk retention group or reinsurer.

- Does not qualify as a National (more than $1 million of direct premium written in each of at least 45 states, $250 million or more of surplus, net premium written and direct premium written).

To develop our list of Near Nationals, Demotech reviewed 2,716 individual property/casualty insurance companies and assigned them to a category in the Demotech Company Classification System. Only 53 insurers met the criteria to be designated a Near National.

During our investigation of the companies classified as Near Nationals for 2013, we noted several interesting observations. Of the 53 individual carriers classified as Near Nationals for 2013, 40 were also identified as Near Nationals for 2012 and 2011, and 20 have been Near Nationals since the introduction of our classification system in 2007. The vast majority, 45 of the 53 companies, are stock companies. All but two of the Near Nationals are members of a property/casualty insurance group, with seven from Travelers Group and six from Liberty Mutual Group. No other group has more than three Near Nationals for 2013.

By count, the 53 Near Nationals comprised 2 percent of the 2,716 carriers that we reviewed; however, they wrote more than 7 percent of the 2012 direct premium reported by the P/C insurance industry. The Near Nationals also represented more than 5 percent of the P/C industry’s reported policyholders’ surplus at year-end 2012.

Clearly, this level of financial presence demonstrates the importance of the Near Nationals. They are critical to the smooth functioning of the P/C insurance market. The Near Nationals facilitate commerce and trade, and are an important component of the total P/C industry.

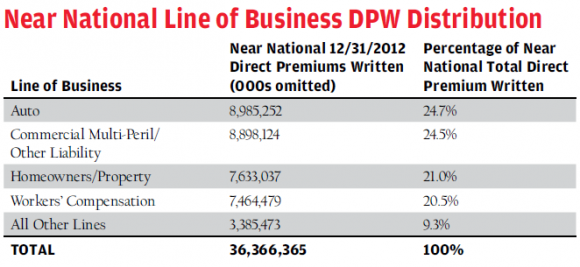

In reviewing the 2012 direct premium written by the Near Nationals, there were only eight states in which all 53 Near Nationals wrote at least $1 million: Arizona, Georgia, Illinois, Minnesota, Missouri, Oklahoma, Pennsylvania and Virginia. The 2012 direct premium written was distributed relatively evenly between auto, commercial multi-peril/other liability, homeowners/property and workers’ compensation. See the “Near National Line of Business” chart for distribution detail.

Near Nationals may be small in number; however, the 53 carriers comprising the Near Nationals for 2013 are substantial insurers, critically important to the P/C insurance industry, as demonstrated by their significant market share and impressive balance sheets. The coverages that they write permit consumers and businesses to transfer risk and thereby facilitate the placement of insurance products necessary to support the United States economy with this remarkably stable group of carriers capable of honoring meritorious claims.

Was this article valuable?

Here are more articles you may enjoy.

Florida Public Adjuster, Renter Charged With Filing Claim on Rental Home

Florida Public Adjuster, Renter Charged With Filing Claim on Rental Home  Trump’s Bond Insurer Tells Judge Shortfall Is ‘Inconceivable’

Trump’s Bond Insurer Tells Judge Shortfall Is ‘Inconceivable’  Grand Jury Indicts ‘Hole in Won’ Owner on Prize Insurance Fraud Charges

Grand Jury Indicts ‘Hole in Won’ Owner on Prize Insurance Fraud Charges  DeSantis Signs Bill Barring Local Worker Heat Protection Measures

DeSantis Signs Bill Barring Local Worker Heat Protection Measures