The commercial general liability (CGL) policy is the standard insurance policy used for construction liability risks. Because of this, a question often arises as to whether or not the policy that’s in force when the work was done will pay for construction defects. To answer the question, we need to look at how different policy forms and jurisdictions handle construction defects.

The CGL policy is sold to contractors in three different forms:

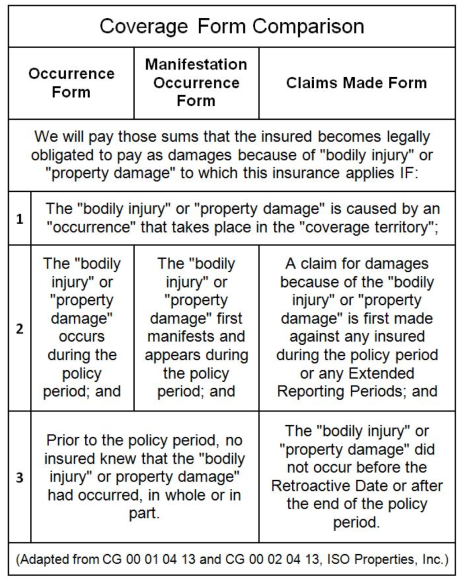

- The Occurrence Form is designed to cover occurrences that take place during the policy period.

- The Manifestation Occurrence Form is designed to cover occurrences that first manifest during the policy period.

- The Claims Made Form is designed to cover claims that are reported during the policy period.

To explain the form differences, imagine that my grandparents go to the same coffee shop every day for 20 years. They like this coffee shop because they use these special blue metallic cups that make your lips tingle when you have your first few sips of coffee. Every year the coffee shop has an annual occurrence form CGL policy with $1 million per occurrence and per aggregate limits. After 20 years, my grandparents learn that it is not necessarily a good idea to drink coffee every day out of a metallic cup that makes your lips tingle. It turns out that the metal is dangerous and my grandparents are now experiencing various lip and throat cancers arising out of their contact with the metal cups for the past 20 years.

The occurrence form policy states that it will pay bodily injury or property damage that occurs during the policy period. When did the bodily injury to my grandparents occur in the example above? I imagine that their attorney will think the bodily injury occurrence took place at least once during each of the past 20 years. The attorney would have 20 million reasons to find that an occurrence took place during each of the past 20 policy periods because if it occurred during a policy period, the policy should pay. The insurance company might have thought that the most they would pay for any one occurrence is $1 million.

It is true that the most they would pay for any one occurrence during any one year is $1 million, but we have 20 annual policies each with $1 million limits. All together, that would be $20 million worth of coverage available for the 20 occurrences that took place over 20 different policy terms.

Unlike the occurrence form policy, the claims made and manifestation occurrence policies would each only pay $1 million in the above situation. The claims made form pays for claims that are made during a policy period. It would only pay $1 million because the claim for damages would only be paid by the one claims made form policy in force when the claim was made.

The manifestation occurrence policy would only pay $1 million because it only covers occurrences that first manifest during a policy period. Sometimes “manifest” is defined as “to become apparent to a common observer.” Sometimes “manifest” is defined as the time when an occurrence is reported to the insurance company. However manifest is defined, it is clear that it can only “first” manifest once. Even if the occurrence occurred over multiple policy years, it could only “first” manifest itself during one policy. The manifest occurrence form in force when the occurrence first manifests would be the only policy obligated to pay for the occurrence.

Construction Defect Coverage

When analyzing the coverage forms for construction defect coverage, we have to ask whether a construction defect is ever, by itself, an occurrence.

The ISO CGL policy defines an occurrence as “an accident, including continuous or repeated exposure to substantially the same general harmful conditions” (CG 00 01 04 13, ISO Properties Inc., 2012, Section V, Paragraph 13). The occurrence, claims made, and manifestation occurrence policies all require “bodily injury” or “property damage” that was caused by an “occurrence.”

A construction defect is a problem with the design or construction of a structure resulting from a failure to design or construct in a reasonable workmanlike manner. For example, if I build a concrete wall without the appropriate rebar and it looks likely that the wall will fall over during the first breeze, we might say that the absence of the rebar is a construction defect. But, before the wind blows and the wall falls down, do we have an occurrence?

States have answered whether a construction defect is an occurrence in three different ways.

1) If the damage was the result of the intentional act of construction, it is not an occurrence.

The first school asks if the damage was the result of an intentional act. If it was the result of an intentional act, it was not an accident. If it was not an accident, it does not meet the definition of an occurrence. This position favors insurance companies and makes it difficult for a policyholder to find coverage for a construction defect because the act of construction is an intentional act. (For example, see Kvaerner Metals Division of Kvaerner U.S., Inc. v. Commercial Union Insurance Co. (Pa. 2006). 908 A.2d 888).

2) If the damage is the unintended result of faulty workmanship, it is an occurrence.

The second school focuses on whether or not the damage was unintended. If it was unintended, it sounds like it was an accident. If it was an accident, then it sounds like an occurrence. This position favors coverage for the policyholders. (For example, see United States Fire Insurance Co. v. J.S.U.B., Inc.(Fla 2007). 979 So. 2d 871).

3) Whether or not there was an occurrence depends on what property is damaged.

The third school holds that if there is damage to a property other than to the contractor’s work, there is an occurrence. If the damage is to the contractor’s own work, there is no occurrence. (For example, see French v. Assurance Co. of America, (4th Cir. 2006) 448 F.3d 693).

You may recognize this from the CGL policy’s exclusions for the insured’s product and work. However, policyholders are usually not required to prove the absence of exclusions. They only need to prove the occurrence. The insurance company then has the duty to defend, pay, or prove any applicable exclusions. This school inappropriately forces the policyholder to prove not only that an occurrence took place, but that it was not excluded.

I offer information on all three schools because of the fluid nature of construction defect litigation. States can change from one school of thought to another with the passing of a law or new court decision.

If a jurisdiction follows the first school, the construction defect will probably not be an occurrence because construction is an intentional act, intentional acts are not accidents, and therefore are not occurrences.

If a jurisdiction follows the second school, the construction defect probably will be an occurrence because the damage was unintended and if it was unintended, it can be an occurrence.

If a jurisdiction follows the third school, the construction defect will only be an occurrence if the damage is to property other than the property worked on by the policyholder.

Digging Deeper into the Definition

When analyzing coverage for construction defects under a manifestation occurrence policy, we need to dig deeper into the definition of a construction defect.

A construction defect can be either a patent defect or a latent defect. A patent defect is one that is readily discoverable or “apparent by a reasonable inspection” (CA Code of Civil Procedures § 337.1e). A latent defect is one that is not readily discoverable or apparent by a reasonable inspection.

The manifestation occurrence form is designed to cover only “bodily injury” or “property damage” that first manifests and appears during the policy period. Since a latent defect is one that, by definition, is not readily discoverable or “apparent by a reasonable inspection,” the manifestation occurrence form would not provide coverage for latent defect occurrences even in a jurisdiction that views construction defects as occurrences. The only construction defects for which the manifestation occurrence policy would provide coverage would be for patent defects because only patent defects would have the ability to manifest and appear during the policy period.

Even if a policyholder is able to prove that the construction defect was an occurrence triggering coverage, the insurance company will have the opportunity to prove that coverage should be denied because of an applicable exclusion. The most common exclusions cited for construction defects are the CGL policy’s exclusions for:

- J) that particular part of real property on which you or your subcontractor was performing operations;

- K) your product; and

- L) your work.

These exclusions suggest that what the CGL policy is intending to cover is not a contractor’s defective product or work, but the damage resulting from a contractor’s defective work. Repairing defective materials or poor workmanship is a commercial risk not passed on to a liability insurer (F&H Construction v. ITT Hartford Ins. Co. (2004) 188 Cal.App.4th 364, 372).

Topics Claims Property Contractors Construction

Was this article valuable?

Here are more articles you may enjoy.

How California’s Huge Raises for Fast-Food Workers Will Ripple Across Industries

How California’s Huge Raises for Fast-Food Workers Will Ripple Across Industries  Vintage Ferrari Owners’ Favorite Mechanic Charged With Theft, Fraud

Vintage Ferrari Owners’ Favorite Mechanic Charged With Theft, Fraud  Uncertainty Keeps Prices Up; No Prior-Year Loss Development: Travelers

Uncertainty Keeps Prices Up; No Prior-Year Loss Development: Travelers  Wildfires Are Upending Some of the Safest Bets on Wall Street

Wildfires Are Upending Some of the Safest Bets on Wall Street