The designation of MetLife as a systemically important financial institution by the Financial Stability Oversight Council (FSOC) is a done deal. But exactly what that means in terms of higher regulatory standards is still not clear.

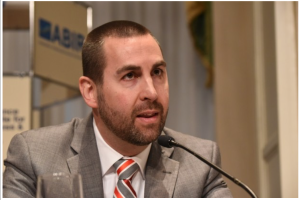

Those details could come this year, said Adam Hamm, a non-voting member of FSOC representing state insurance regulation, who spoke about his experience at an insurance industry conference. His remarks came less than an hour before news broke about MetLife’s plan to preempt any potential issues by pursuing a separation of its retail insurance operations.

“There hasn’t been an answer from the Federal Reserve Board on exactly how those SIFIs (systemically important financial institution) are going to be regulated. I wouldn’t be a bit surprised if those final rules, or at least initial building blocks that resolve [how] Prudential and MetLife are going to be regulated at the holding company level, come out from the Federal Reserve Board in 2016,” he predicted.

Hamm spoke during a panel titled, “A View From the Outside Looking In,” at the Property/Casualty Insurance Joint Industry Forum in New York on Jan. 12. Moderator Charles Chamness, president and CEO of the National Association of Mutual Insurance Companies, asked Hamm and other experts to prognosticate about changes in the political and regulatory environment in the presidential election year. He also specifically asked Hamm, who is a non-voting member of FSOC, to give an insider’s view of the work of the Council.

After predicting a level of turnover in state insurance commissioners that is consistent with 2015, Hamm told attendees to keep an eye on data breach legislation in Congress. Hamm who has decided not to run for reelection in 2016 and who currently chairs the National Association of Insurance Commissioner’s task force on cybersecurity said, “There’s some motivation and some consensus developing around that” cybersecurity bill, although he ultimately predicted that the typical gridlock of a presidential year would keep it from being finalized in 2016.

Addressing Chamness’s question about FSOC, Hamm described the struggles that he and Roy Woodall, the former Kentucky insurance regulator, face in trying to help the rest of the members understand state insurance regulation. “They are serious but intelligent people,” mostly with banking backgrounds, he said, rattling off names like Jack Lew, Secretary of the Treasury and FSOC Chair, Janet Yellen, Chair of the Board of Governors of the Federal Reserve System, Martin Gruenberg, Chair of the Federal Deposit Insurance Corporation and Mary Jo White, Chair of Securities and Exchange Commission, who are among the 12 federal government representatives and 10 voting members of the Council.

Woodall, who participates as “an independent member with insurance expertise,” is a voting member, while Hamm and two other state regulators – one from banking and one for securities – are nonvoting members. Michael McRaith, director of the Federal Insurance Office, is also a nonvoting member.

Noting his respect for the rest of the group, Hamm said it’s not easy to defend insurance in that room.

“It is an uphill battle to make positive movement with my colleagues…not just to understand the difference between banking and insurance but to actually make decisions that incorporate that.” At the end of the day, we have seen in the designations of Prudential and MetLife [as SIFIs], which I strongly disagree with,” he said.

“It is disturbing that the Council continues to diminish the role of the state insurance regulatory framework,” he wrote in the dissenting opinion on MetLife late last year. “It is unclear…what additional tools beyond those already at an insurance regulator’s disposal could effectively address the risks the Council identifies, which are, in large part, concerns emanating from insurance legal entities that state insurance regulatory authorities are specifically designed to address.”

“It is disturbing that the Council continues to diminish the role of the state insurance regulatory framework,” he wrote in the dissenting opinion on MetLife late last year. “It is unclear…what additional tools beyond those already at an insurance regulator’s disposal could effectively address the risks the Council identifies, which are, in large part, concerns emanating from insurance legal entities that state insurance regulatory authorities are specifically designed to address.”

The Forum attendees also weighed in on their views of the participation of the federal government in the insurance industry. As part of an audience poll, attendees were asked, “Do you think the federal government is interested in further expanding its regulatory oversight of insurers?”

A whopping 87 percent said yes. That was the largest majority vote on any question in the survey that also touched up views about economic growth and industry financial results.

Hamm’s co-panelist, Michael Pritula, director and senior leader of the Global Insurance Practice of McKinsey & Co., offered the view of the majority. “The Fed and FIO will grow in importance for the industry. Their toe in the water is going to become a foot,” he told said.