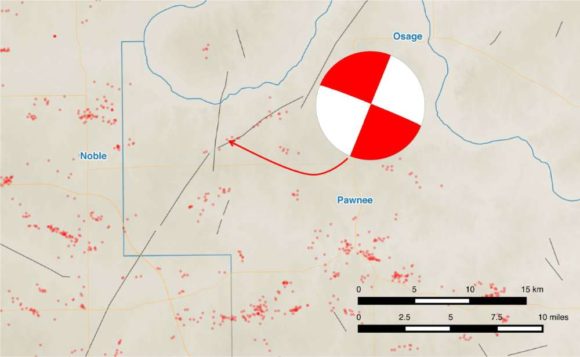

An earthquake that hit Pawnee, Okla., in the north central part of the state on Sept. 3 was upgraded on Sept. 7 from the preliminary 5.6 magnitude estimate to a 5.8 magnitude temblor by the U.S. Geological Survey, making it the strongest quake recorded in Oklahoma to date.

The USGS said the magnitude revision was based on greater analysis of the seismic recordings of the event. The federal agency concurrently updated the official magnitude of the quake that previously held the record for the strongest quake to hit the state — the temblor that struck Prague, Okla., on Nov. 6, 2011 — revising it from a 5.6 magnitude quake to a 5.7.

“USGS analyses indicate that the two earthquakes are very similar in size — to within typically-cited uncertainties of 0.1 magnitude units,” Gavin Hayes, USGS research geophysicist, said in a media release. “However, the 2016 Pawnee event is slightly larger than the Prague earthquake in 2011.”

In an email, Oklahoma Insurance Department Assistant Commissioner of Communications Kelly Dexter said the department expects to have damage estimates of insured losses from the Sept. 3 quake in early October. She noted that the OID would only have data based on claims filed and paid for insured losses.

Most earthquake coverage in Oklahoma is written as an endorsement on the homeowners insurance policy, but only about 15 percent of Oklahomans carry earthquake insurance. That’s up from about 2 percent in 2011, according to the OID.

Oklahoma in recent years has seen an unprecedented rise in the number of earthquakes of magnitude 3.0 and stronger. In 2013 the state experienced 109 quakes of that size; in 2015 there were 907 magnitude 3-plus earthquakes, according to information from the Oklahoma governor’s office.

In 2008 the state averaged only two 3-plus magnitude quakes per year, according to a report published by the reinsurer, Swiss Re.

The Oklahoma Geological Survey has attributed the increase in earthquakes in central and north-central Oklahoma to the injection of wastewater from oil and gas activities into underground disposal wells.

While other states, including Kansas and Texas, have experienced an increase in induced earthquakes, Swiss Re’s report on the link between oil and gas activity and seismic events suggests “that Oklahoma sees more induced earthquakes than other states due to the combination of high volumes of wastewater injection, a pre-existing level of seismic hazard, and its particular geological formations.”

In response to the increased activity, insurers that provide earthquake coverage in Oklahoma have been cutting back on exposures there. Complaints to the insurance department about extensive rate increases and higher deductibles for earthquake insurance prompted Oklahoma Insurance Commissioner John Doak to hold a hearing in May to examine the availability and affordability of earthquake coverage.

In June, Doak deemed the earthquake insurance market in his state to be “non-competitive” and ordered insurers to change the way they file rates for the coverage. The commissioner issued an order at that time requiring property/casualty insurers to file their earthquake insurance rates before using them.

“There needs to be a valid basis for any rate increase,” he said.

While there are more than 100 carriers offering earthquake coverage in Oklahoma, the market share of the four largest providers of earthquake insurance in the state has topped 50 percent for the past six years, according to the commissioner. Doak has said evidence of insurance companies’ cost to revenue during that time “demonstrates that current rates appear to be excessive” and not based on “objective criteria.”

Swiss Re points out that “insurers have little experience with settling earthquake claims” in Oklahoma and that most quakes in the state have not “been damaging enough to cause much loss above the level of a typical deductible.”

According to the insurance department, the cost of earthquake coverage for Oklahoma homeowners typically ranges between $50 and $300 per year. However, the department notes that deductibles for earthquake claims are based on a percentage of the insured value of the home, rather than a fixed amount, such as $500 or $1,000, that is typical of a standard homeowners policy.

High deductibles and accumulated loss from multiple, stronger, seismic events could become problematic for consumers, according to Swiss Re. “Since deductibles are typically applied to each individual event, small to medium repeated events can build up sizeable uncovered damages over time. The cost to repair these damages can be a large financial burden to many homeowners and businesses,” the Swiss Re report states.

The reinsurer suggested that insurers have the opportunity to create “a more meaningful product” for the type of earthquake risk that exists in Oklahoma. One option could be “a product that incorporates an aggregate cover for those suffering multiple small losses.” Insurers might also consider decreased deductibles and limits “for those more concerned about smaller levels of damage,” Swiss Re noted.

Whether or not damage from quakes deemed to be caused by human activities like oil and gas production is covered depends on the policy language of the particular insurance product. Swiss Re reports that 70 percent of insurers responding to an insurance department survey, reportedly clarified that their policies cover oil and gas-related earthquakes.

Still, Doak has warned insurers against abusing any man-made earthquake and preexisting damage exclusions in earthquake policies in order to deny claims.

Wastewater Volume Reduction

Beginning in 2013, the Oklahoma Corporation Commission, which has regulatory authority over oil and gas activities, asked wastewater well owners to reduce disposal volumes in parts of the state that have seen a significant increase in seismic activity due to the connection between the injection of wastewater and earthquakes.

Following the Sept. 3 Pawnee earthquake, the OCC ordered 37 wells in a 514 square-mile area around the epicenter of the temblor to shut down within seven to 10 days of the event.

Federal regulators also shut down 17 wastewater disposal wells in the Osage Nation, the Associated Press reported. Covering more than 2,300 square miles in northeastern Oklahoma, the Osage Nation Reservation, also known as Osage County, is the largest of the state’s 77 counties. The tribe owns all of the mineral rights and the OCC has no jurisdiction over oil and gas operations there.

The U.S. Environmental Protection Agency authorized the closure of Osage Nation wells located in a 211-square mile area near where the magnitude 5.8 temblor struck, according to the AP.

State of Emergency

Governor Mary Fallin declared a state of emergency for Pawnee County following the Sept. 3 earthquake, which was felt in multiple states.

“This emergency declaration will start the process to helping individuals, families and businesses impacted by the earthquakes and serves as a precursor to requesting any necessary assistance,” Fallin said upon issuing the declaration.

She said the Department of Emergency Management and Department of Transportation would assess damage of the affected area, including the safety of state highway and turnpike bridges.

Fallin and state emergency management officials have asked residents to submit photos of earthquake damage to their homes or businesses through the OK Emergency mobile application. The OK Emergency app is available for Apple, Android, and Blackberry devices as well as any other smartphone, tablet or computer through the mobile site: www.emergency.ok.gov.

The AP reported that a man suffered a minor head injury in the Sept. 3 quake when part of a fireplace fell on him, and emergency management officials said there have been reports of damage to more than a dozen buildings.

Topics Trends Catastrophe Carriers Natural Disasters Energy Oil Gas Homeowners Oklahoma Pollution Swiss Re

Was this article valuable?

Here are more articles you may enjoy.

California Sees Two More Property Insurers Withdraw From Market

California Sees Two More Property Insurers Withdraw From Market  North Carolina Adjuster and Son Charged With Embezzlement in Roof Jobs

North Carolina Adjuster and Son Charged With Embezzlement in Roof Jobs  Investment Funds File New Suits Over Lighthouse Insurance Collapse in 2022

Investment Funds File New Suits Over Lighthouse Insurance Collapse in 2022  UnitedHealth Says Hackers Possibly Stole Large Number of Americans’ Data

UnitedHealth Says Hackers Possibly Stole Large Number of Americans’ Data