Direct premium written (DPW) for property/casualty insurance companies continues to increase, albeit gradually. At year-end 2015, approximately $585 billion of DPW was reported, a record high for the industry. For 2015, total DPW for all P/C insurers aggregately increased 2.5 percent over 2014, an increase of nearly $14.4 billion. Through the first quarter of 2016, the insurance industry’s growth trend has continued, as DPW for all P/C insurers aggregately increased 4.3 percent over 2015.

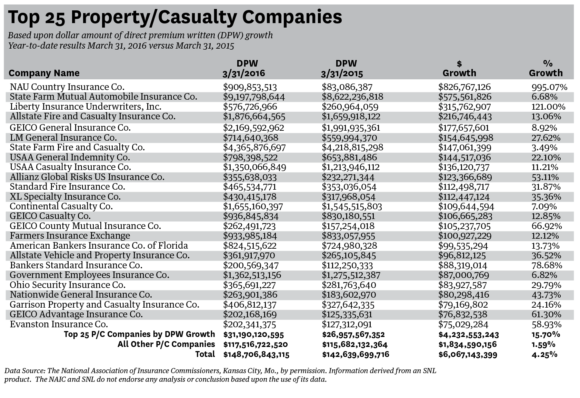

For the three months ending March 31, 2016, P/C companies comprising the Top 25 insurers in terms of DPW growth increased their DPW 11.3 percent over the first three months of 2015. This continues the Top 25 insurers’ impressive display of premium growth and financial stability. The Top 25 accounted for nearly 70 percent of the growth in the P/C insurance industry’s DPW. In contrast, the remainder of the industry reported an increase in DPW of 1.6 percent, or $1.8 billion year-over-year.

It is important to note that while increasing DPW, P/C companies have aggregately maintained a sufficient level of policyholders’ surplus (PHS). One measure that indicates P/C companies are conservatively leveraged is the DPW to PHS ratio. An insurer’s DPW to PHS ratio is indicative of its premium leverage on a direct basis, without consideration of the effect of reinsurance. Since 2010, this ratio for P/C companies has remained stable at approximately 70 percent.

Although the market continues to exhibit signs of firming and DPW continues to increase, P/C insurers should not expect a traditional hard market in the near future. It is more realistic that expectations should relate to gradual, stable growth.