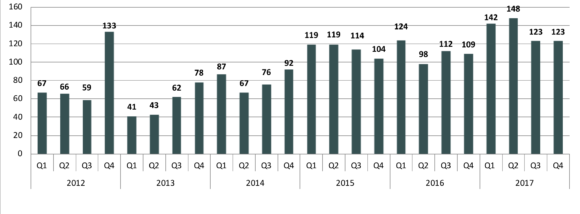

The number of announced U.S. insurance broker deals in 2017 was the highest in recorded history, at 536. This year also had the highest number of deals closed in the fourth quarter since 2012 (when the capital gain tax rates were set to change after year-end, spurring significant fourth quarter (Q4) deal activity). The tax legislation signed into law in December 2017 possibly encouraged some additional activity in 2017, specifically in geographic areas that are negatively affected by the loss of the state income tax deduction by waiting until 2018.

Nevertheless, the merger and acquisition (M&A) market continues to be very active across the United States, with a steady supply of agency owners looking to sell, and demand by firms looking to acquire.

Private equity (PE)-backed buyers continued to dominate M&A activity, with 57 percent of all announced transactions, compared with 55 percent in 2016 and 47 percent in 2015. Other classes of buyers in 2017 included independent insurance brokers (completed 24 percent of the announced deals), public insurance brokers (7 percent of deals), banks and thrifts (4 percent), insurance carriers (3 percent), and “other” (5 percent), which includes private equity groups, underwriters, specialty lenders, and insurtech.

Top 10

The top 10 acquirers closed 50 percent of the announced deals in 2017.

The top four were Acrisure LLC, HUB International Ltd., BroadStreet Partners Inc., and Arthur J. Gallagher & Co. (AJG).

AssuredPartners Inc. and Seeman Holtz Property and Casualty Inc. tied as the fifth-most-active acquirers.

Acrisure had 67 announced deals in 2017 and the firm, generally, does not announce all its deals, so the total is likely higher. Acrisure is private equity-backed, but majority owned by management and former agency principals.

HUB was the second-most active acquirer, with 42 announced deals in the United States. The firm has a broad network across the U.S. and Canada, where its acquisition activity is generally focused.

BroadStreet closed 29 deals in 2017. BroadStreet has a unique ownership structure with a longer term primary investor, the Ontario Teachers’ Pension Plan.

AJG was the fourth-most-active and the only public broker to make the top 10 list of acquirers. The firm is acquisitive globally and announced 25 deals in the United States in 2017.

Assured had 23 announced transactions. The Florida-based firm is PE-backed and is an active acquirer across the United States. Assured has averaged 25 deals per year over the past five years.

Seeman Holtz, a newer entrant, also had 23 announced deals in 2017. The firm has been aggressively acquiring across the U.S. and is backed by Hudson Structured Capital Management.

The next four most active acquirers in 2017 were all private equity-backed firms.

NFP Corp. had 20 announced deals in 2017, and has been an active acquirer of employee benefit and consulting firms, as well as property/casualty (P/C) focused firms.

Alera Group Inc., formed in late 2016 by a group of 24 insurance advisory firms that joined together as one firm, backed by Genstar Capital LLC, completed 15 deals in its first year.

Hilb Group LLC, which has a large presence on the east coast and is working to expand west, closed 12 deals in 2017.

Risk Strategies Co. Inc., based on the east coast and backed by Kelso & Co., closed 11 deals.

Demographics

In 2017, a significant amount of the deal activity (37 percent) occurred in the most populous states: California, New York, Texas, Florida, and New Jersey.

The next five most active were: Pennsylvania, Massachusetts, Illinois, Ohio, and North Carolina, which held 19 percent of all announced deals.

The majority of 2017 deals were with P/C firms (52 percent), which is slightly higher than in prior years.

Employee benefit firms comprised 22 percent of deals, and 26 percent were multiline firms, which advise on both P/C and employee benefits insurance.

High-Quality Agents

Overall, 2017 was a very active year for M&A and another year where we saw the entrance of new private equity-backed firms quickly looking to make a mark the industry.

We are seeing more acquirers continue to be attracted to the space, keeping the level of competition strong for high-quality agents and brokers looking to liquidate or diversify their holdings through selling some or all ownership to another firm. High-quality agencies are those that would generally be characterized by younger, vibrant leadership, a strong track record of producing new business, a focus in niches that enable scalable growth, compensation structures in line with the market and a base of operations in an attractive area, with significant population density. (This is not necessarily the average agency.)

Topics USA Agencies Property Casualty

Was this article valuable?

Here are more articles you may enjoy.

Cargo Owners in Baltimore Disaster Face ‘General Average’ Loss Sharing, MSC Says

Cargo Owners in Baltimore Disaster Face ‘General Average’ Loss Sharing, MSC Says  AIG Sues Newly Launched Dellwood Insurance and Its Founders

AIG Sues Newly Launched Dellwood Insurance and Its Founders  USAA to Lay Off 220 Employees

USAA to Lay Off 220 Employees  Zuckerberg Avoids Personal Liability in Meta Addiction Suits

Zuckerberg Avoids Personal Liability in Meta Addiction Suits