A new survey of New Jersey residents who have been displaced from their homes because of Superstorm Sandy shows many of them are not happy with their insurers.

The Monmouth University Polling Institute in West Long Branch, N.J., conducted a survey online and by telephone with 683 New Jersey residents who were displaced from their homes for a month or more due to Sandy. The poll was conducted between Sept.18 and Oct. 21, 2013. (39 percent of respondents are still displaced a year after Sandy and are waiting to move back, while an additional 14 percent said they don’t plan to move back.)

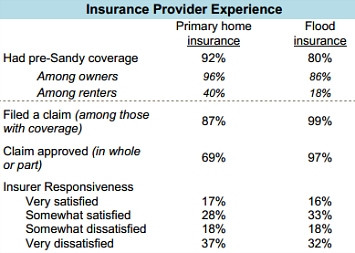

Ninety-two percent of respondents said they had primary home insurance pre-Sandy. Among these respondents with primary home insurance, 87 percent said they filed a claim after Sandy and 69 percent of them said their claim was approved in whole or part.

When asked about the insurer responsiveness, 55 percent of residents who filed a primary home claim said they are dissatisfied with their insurer responsiveness. (37 percent said “very dissatisfied” while 18 percent said “somewhat dissatisfied.”)

On the other hand, 45 percent said they are satisfied. (17 percent “very satisfied” and 28 percent “somewhat satisfied.”)

Among those who had a primary claim approved, 56 percent said they are satisfied with their primary home insurer’s responsiveness, while 22 percent of those whose claim was denied said they are satisfied.

Their experience with flood insurance was only slightly better. Eighty percent of respondents said they had federal flood insurance pre-Sandy. Among them, 99 percent filed a flood claim and 97 percent had their claim approved in whole or part.

When asked about the insurer responsiveness regarding federal flood insurance, 50 percent whose filed a flood insurance claim said they are dissatisfied. (32 percent “very dissatisfied” and 18 percent “somewhat dissatisfied.”) And 49 percent said they are satisfied. (16 percent “very satisfied” and 33 percent “somewhat satisfied.”)

Insurers Get More Negative Than Positive Marks

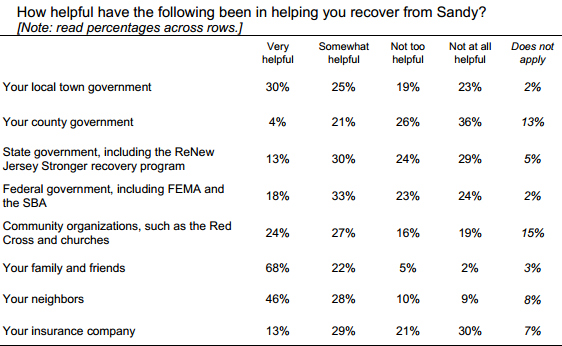

The survey also found insurance companies get more negative than positive marks — 42 percent of impacted respondents said their insurance company has been helpful (13 percent said “very helpful” and 29 percent said “somewhat helpful”) while 51 said not helpful (21 percent “not too helpful, 30 percent “not at all helpful”).

“Insurance providers get generally satisfactory, although not stellar, grades from New Jersey residents who were hardest hit by Sandy,” said Patrick Murray, director of the Monmouth University Polling Institute. “It’s worth noting, though, that twice as many give insurers the most negative rating of ‘very dissatisfied’ than the most positive rating of ‘very satisfied.'”

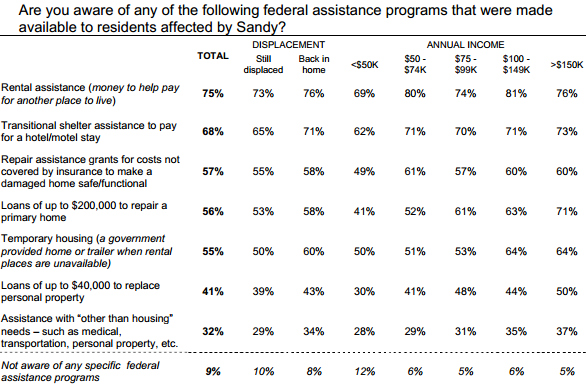

The survey also shows that, one year after Sandy, many are still unaware of various federal assistance programs available to residents affected by Sandy.

The following are additional survey data tables, courtesy of the Monmouth University Polling Institute.