A consumer advocacy group said its analysis shows some of New York State’s largest auto insurers are charging higher premiums to motorists who have less education and non-professional, non-managerial jobs.

The New York Public Interest Research Group (NYPIRG) said it is urging New York regulators to undertake a thorough review of rate-making practices by auto insurers in New York. NYPIRG suggested it may also turn its attention to the New York State Legislature to try to bring changes to the insurers’ rate-setting practices in New York State.

NYPIRG said that according to its analysis, for the minimum liability coverage required by New York State, three of the top five auto insurers considered education when setting premiums, while two considered occupation.

The group examined the use of education and occupation by four of the five largest auto insurers in New York by market share – GEICO, State Farm, Liberty Mutual, and Progressive – who together have over half the private auto insurance market in New York. (The analysis does not include Allstate, the second largest insurer in New York, because the company did not allow the gathering of pricing information without authorizing a credit check, NYPIRG said.) NYPIRG published its results on April 3.

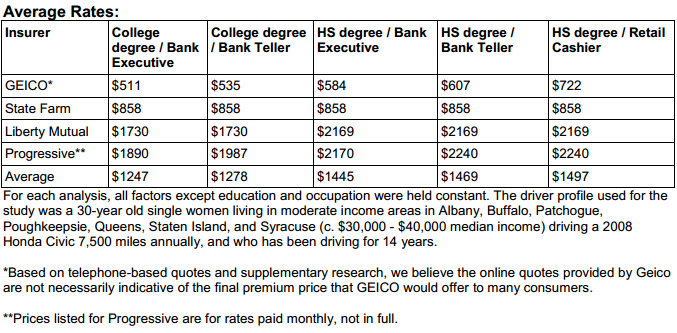

NYPIRG said it used the websites of these insurers to determine whether they consider education and occupation as factors in their pricing and, if so, the impact those factors have on rates. For each analysis, all factors except education and occupation were held constant, NYPIRG said.

The driver profile used in NYPIRG’s analysis was a 30-year old single women living in moderate income areas in Albany, Buffalo, Patchogue, Poughkeepsie, Queens, Staten Island, and Syracuse (c. $30,000 – $40,000 median income), driving a 2008 Honda Civic 7,500 miles annually, and who has been driving for 14 years.

Based on an online review of major auto insurers’ price quotes, a driver with a high school degree working as a bank teller paid 18 percent more annually than her college educated, executive counterpart ($1469 vs. $1247), NYPIRG said.

Among other findings:

• NYPIRG said GEICO, the state’s largest auto insurer, would charge 19 percent more annually for a bank teller with a high school degree than for a bank executive with a college degree ($607 vs. $511) — all other things being equal. And a high school graduate who worked in retail would pay 41 percent more annually than the same bank executive ($722 vs. $511).

• NYPIRG said Progressive, the state’s fifth largest insurer, would charge 19 percent more annually for a bank teller with a high school degree than for a bank executive with a college degree ($2240 vs. $1890). It said Progressive also would charge drivers who opted for monthly payments 21 percent more than drivers who paid their premiums in full.

• The group said Liberty Mutual, the state’s fourth largest insurer, did not appear to consider occupation in their pricing, but did consider education. NYPIRG said the insurer would charge a high school graduate 25 percent more annually than a college graduate ($2169 vs. $1730).

• NYPIRG said that according to its analysis, State Farm, the state’s third leading writer of auto insurance, does not use education or occupation to price auto insurance.

“We looked at some of the top insurers in New York, and we found that all things being equal, some companies are charging high school graduates with blue collar jobs more than college-educated professionals for the exact same coverage,” Andy Morrison, consumer advocate at NYPIRG, said in an interview.

“We obviously have concerns about the disparate impact,” he said. “We see that as a big problem and that’s why we are calling on regulators in New York State to take a look at this issue, and we are hoping that they will share our view that insurance rates should be based on how you drive, not who you are.”

“It’s a widespread practice for sure,” Morrison said, adding that “that’s why we forwarded our findings and our take on this to the New York State Department of Financial Services. Our hope is that they will share our view. If the regulators don’t share our view, then we will turn our attention to the legislature.”

Morrison said NYPIRG worked closely with the Consumer Federation of America, a national consumer advocacy group, and its director of insurance, J. Robert Hunter, as it analyzed the New York data.

Industry Comments

In response to NYPIRG’s analysis, the New York Insurance Association (NYIA), an industry association, defended the insurers’ rate-setting practices. NYIA said these factors are correlated with risk, which is why regulators have allowed the use of education and occupation in determining how much a consumer pays for insurance.

“Companies are only allowed to use factors that are predictive of loss. Never once does NYPIRG concede that there is not an association with risk,” said NYIA’s President Ellen Melchionni.

Melchionni said there are more than 60 insurance companies writing auto insurance in New York vying for the consumers’ business, and these companies compete on price and underwriting.

“New York’s insurance market is vibrant and delivers a great deal of choice to consumers,” she said. “New York’s residents benefit from choice — there are a range of prices and options. Companies use a variety of underwriting factors to determine the price of a policy, all of which have been approved for use by regulators.”

Never before in history has the price of auto insurance been more transparent, NYIA’s Melchionni said. “You can get a multitude of quotes literally within minutes — either through an agent or by contacting a company directly.”

GEICO did not immediately respond to a request for comment. A Progressive spokesperson said the company works to price each driver’s policy as accurately as possible, so that every driver pays the appropriate amount based on his or her risk of having an accident.

“To do this, we use many different rating factors, which sometimes include non-driving factors that have been proven to be predictive of a person’s likelihood of having a claim,” the Progressive spokesperson said. “Each insurer uses different information to price drivers, which can cause rates to vary widely.”

“We encourage consumers to shop around to find the combination of price and service that’s best for them, as well as to take insurance rates into their own hands by using tools like our usage-based insurance program Snapshot,” the Progressive spokesperson said.

A Liberty Mutual spokesperson said that while the company did not review NYPIRG’s analysis, the company only uses criteria that are actuarially justified and permitted by state insurance regulation.

A State Farm spokesperson said the company sets auto rates by using prior claims experience and other factors, to project what the number and cost of future claims will be.

Related Articles: