Although there has been progress, the terrorism insurance market needs to do more to improve coverage at a time when “businesses and (re)insurers are confronted with an increasingly complex and multi-dimensional threat landscape,” according to a new report from JL Re.

According to the JLT Re Viewpoint Report – “Terrorism (Re)insurance: Achieving Resilience” – new terror-related risks are surfacing around impacts on people, loss of attraction, cyber and toxic agents. At the same time, terrorist groups continue to harbour ambitions of launching major attacks, meaning substantial property damage remains a real danger.

Further attacks are almost inevitable in the West, with wide-ranging threats emanating from so-called Islamic State returning fighters from Syria, an empowered al-Qaeda and even quasi state actors or proxies (with the latter raising serious questions about attribution). The threat from nationalist/separatist movements, right-wing extremism and other extremist groups should also not be underestimated.

“The impact of these shifting risk dynamics on businesses and the insurance terrorism market has been significant,” says Raj Rana, head of War and Terrorism at JLT Specialty. “In recent years, we have seen major terrorism losses suffered by clients in situations where they were not the primary target.”

Rana said that with property damage no longer necessarily the main loss driver, the limitations of traditional terrorism products are being exposed. “As our report shows, a number of specialty insurers have responded robustly to buyers’ calls for wider cover with an impressive array of new products being launched in the last two to three years, including threat, loss of attraction, active shooter, malicious attacks and cyber.”

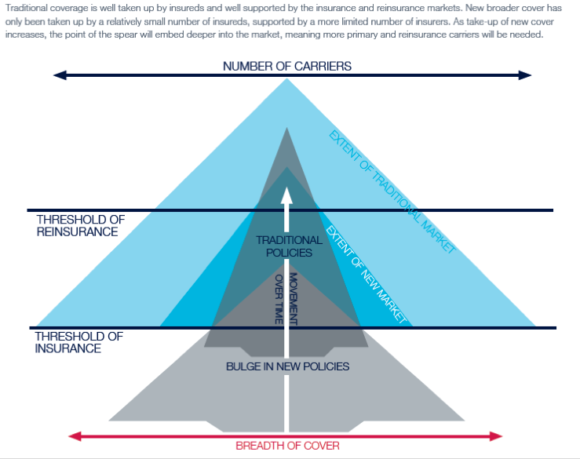

Stephen Hudson, senior consultant for Terrorism at JLT Re, said that the progress made to date by the primary market represents a “major step forward” in narrowing terrorism protection gaps. But new solutions are needed from reinsurers.

“As the ground swell for such cover grows, pressure is building on the terrorism reinsurance market to provide new solutions for the more dynamic primary carriers. This is compelling reinsurers to broaden risk appetites and adopt new approaches to account for the complexities that the new threat landscape brings,” Hudson said.

He said the role risk advisers play in developing sophisticated modeling and analytics tools, and communicating their results to risk carriers, will be crucial in bringing about this change. “Broad cohesive cover supported in depth by the market will achieve greater resilience for insureds, the market and the wider economy,” he added.

What still needs to be done? According to JLT Re, specifically, capacity for new forms of cover in the standalone market continues to be relatively modest when compared to more conventional terrorism risks. Perhaps even more importantly, awareness of the new coverages on offer needs to be extended beyond sophisticated buyers familiar with the intricacies of the insurance market.

Also JLT Re maintains that more consideration needs to be given to marketing and distribution channels to better target small and medium-sized enterprises (SMEs). Fewer than five percent of small businesses in the UK, for example, are currently estimated to have terrorism insurance. Those SMEs that have purchased traditional cover risk being left exposed given recent attacks have highlighted considerable protection gaps around non-damage business interruption losses in particular.

This, according to JLT Re, making new terrorism coverages available to SMEs is therefore crucial. “Ultimately, this will help propel demand for (re)insurance and make economies more resilient to future attacks,” the report days, adding that as awareness of these coverages grows, more capacity will be required, forcing other primary and reinsurance carriers to catch up with the innovators that have led the charge so far.

State terrorism pools are also likely to be crucial in facilitating greater awareness and accessibility, according to the report. Pools have a unique opportunity to increase penetration given their scale and influence in the market, along with the direct distribution channels they have built.