UK insurers and businesses are urging the UK Treasury not to further penalize insurance customers by raising the insurance premium tax (IPT), which currently costs each household an average of £200 ($262) annually.

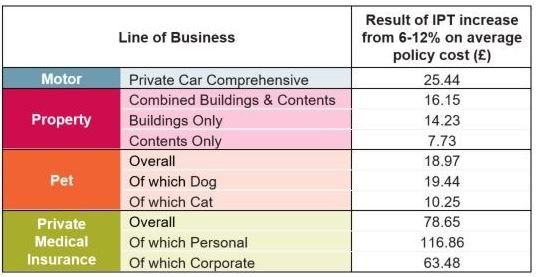

The UK has the sixth highest IPT in Europe since the standard rate has been increased three times between November 2015 and June 2017, from 6 percent to 12 percent, said the Association of British Insurers, noting that it applies to the vast majority of policies sold, including property, motor, health, pet or business insurance.

The Centre for Economic and Business Research (CEBR) calculated 200,000 people moved away from health insurance and onto care provided by the National Health Service (NHS) as a result of the trio of IPT increases, said the ABI in a statement.

The Chancellor of the Exchequer should realize “a raid on the responsible is the wrong way to balance the books,” said Huw Evans, director general of the ABI. Chancellor Philip Hammond is due to unveil his IPT plans in his on budget on Oct. 29.

“People buy insurance because it is a legal requirement or because they are wisely protecting their homes, businesses, families and health,” said Evans.

“Punishing these people with another tax rise would be inexcusable. Given the need to fund the NHS, it would be particularly counter-productive to make health insurance even more expensive, forcing more people to rely on over-stretched NHS resources,” Evans added.

In response to the government’s plans to raise the IPT, ABI said it was re-launching its #IPTsUnfair campaign.*

The UK Federation of Small Businesses (FSB) also registered a protest about the government proposal.

“The Insurance Premium Tax deters small firms from making the right choices,” according to Mike Cherry, chairman of the FSB, which is a business support group, representing small businesses and the self-employed.

“It’s hard for us to persuade small businesses to take on the different kinds of protection they need when they’re constantly being hit with increases to this stealth tax,” Cherry said in a statement.

“Whether it’s income protection, trade credit or cyber insurance – small businesses are thinking twice about purchasing the right cover because of the ridiculous Insurance Premium Tax,” he said, adding that “enough is enough.”

“If the government wants to encourage responsible behavior among small firms, it should rule out any further hikes to this ludicrous levy,” he emphasized.

Independent research commissioned by Allianz Insurance in the UK has revealed anxiety among SME business leaders. Allianz said 85 percent of the 250 small-and-medium-sized enterprises (SMEs) that took part in its research said they were concerned about the financial impact on their businesses if there is another rise in the rate of IPT.

Dave Martin, Allianz’s director of SME and Corporate Partnerships, said: “At a time of significant uncertainty for SMEs about what the future holds post Brexit, we are calling on the Chancellor not to increase the tax burden on businesses by increasing insurance premium tax.”

The survey also showed the tax is unpopular because of its underlying unfairness. Allianz said that 76 percent of SMEs agree IPT is a tax on prudent businesses that take out insurance to protect their property and people.

The research found that nearly one in three small businesses did not know they are paying the tax, which shows that “IPT is also something of a stealth tax,” said Allianz.

“We hope our broker partners will flag up to SMEs the level of IPT in the overall cost of their insurance and the unwanted role of tax collector the industry plays on behalf of the government,” Martin went on to say.

Allianz commissioned the survey because as a “provider of SME insurance it’s important we understand the demands our customers face and show we are in a partnership with them,” he said, noting that “IPT is clearly a significant financial burden on businesses and we want to show we’re trying to do something about it.”

The Allianz survey of 250 SME business leaders was carried out by the independent research company OnePoll between Sept. 11-18, 2018.

* As part of its #IPTsUnfair campaign, the ABI has produced a video, which features an insurance premium tax inspector handing fines to people who are doing responsible things, such as securing their properties and obeying signs about putting their dogs on a lead.