Investment in infrastructure development is set to be one of the main drivers of growth in emerging markets after the COVID-19 crisis subsides, according to Swiss Re’s latest sigma report.

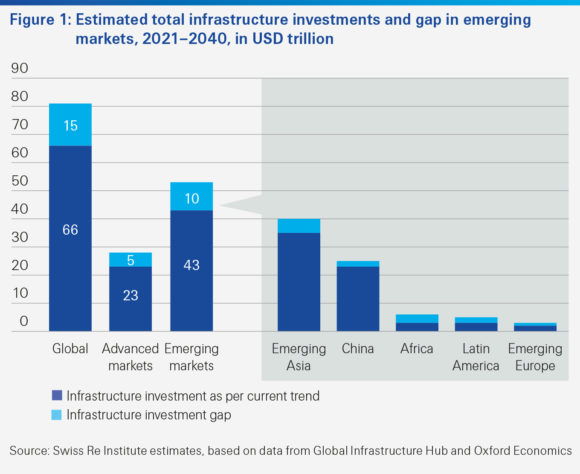

Emerging markets will invest US$2.2 trillion in infrastructure annually over the next 20 years, equal to 3.9% of gross domestic product (GDP), compared with just over 2% in advanced markets, according to the report, titled “Power up: investing in infrastructure to drive sustainable growth in emerging markets.”

These infrastructure-related projects will generate more than US$50 billion in premiums for the insurance industry over 10 years, mostly from engineering, property and energy, said sigma. At the same time, the report added, emerging market infrastructure represents an annual investment opportunity of US$920 billion for long-term investors, including insurers.

The main lines of business to benefit from infrastructure investments during the next decade will be engineering, which sigma estimates will generate construction-all-risk premiums of US$22 billion. The report further estimated that premiums of US$9.7 billion would be generated from renewable energy projects across the EM7 (Brazil, China, India, Indonesia, Mexico, Russia, and Thailand).

Drivers of Investment

Swiss Re said the main drivers of infrastructure investment in emerging markets will include: ongoing urbanization; the digitalization of (smart) cities and infrastructure; an increasing focus on resilient infrastructure to withstand severe weather-related shock events and to mitigate the impact of climate change; and the move to renewable energy.

The construction and operational phases of infrastructure projects will also generate new demand for insurance solutions, with engineering, property and energy lines of business set to benefit most.

China, which is on track to be the world’s biggest insurance market overall by the mid-2030s, will be the home of most infrastructure-related business, accounting for 60% of the premiums over the coming decade.

Emerging Asia will invest an estimated US$1.7 trillion annually in infrastructure, equal to 4.2% of GDP, with China accounting for 54% of overall emerging market spend (or about 4.8% of its GDP), sigma continued.

Infrastructure investments will help support sustainable growth in emerging markets over the coming decade; they will be key to improving productivity and resilience in a global slowdown environment, the report said.

Indeed, sigma forecasts a 4.3-percentage-point slowdown in emerging market GDP growth in 2020 to -0.5% as a result of the COVID-19 pandemic.

“The pandemic has also led to supply chain disruptions, weaker commodity and energy prices, and rising debts, which in turn will add to what was an already weakening longer-term outlook for the global and emerging economies,” it continued.

“Spending on infrastructure could be one of the ways to kickstart parts of the economy after the COVID-19 pandemic and help drive strong and sustainable growth over the next decade,” said Jerome Jean Haegeli, group chief economist at Swiss Re, in a statement accompanying the report. “Most infrastructure spending will be in emerging Asia, which we also expect to be the engine of global economic growth.”

Prior to the COVID-19 pandemic, many emerging markets had already put into motion multi-year infrastructure projects, and these associated investments are not expected to drop off to the same extent as seen in previous periods of crisis, sigma continued.

Beyond the recession inflicted by the COVID-19 pandemic, emerging markets are forecast to grow by around 4.4% annually over the next decade, slower than the yearly average of 5.5% in 2010-19, but much faster than the projected 1.8% growth in advanced markets, said the report.

Source: Swiss Re’s sigma

Photograph: A view of a solar power plant outside of Shanghai.

Was this article valuable?

Here are more articles you may enjoy.

Dubai Floods Expose Weaknesses to a Rapidly Changing Climate

Dubai Floods Expose Weaknesses to a Rapidly Changing Climate  Coral Gables, Florida Tops Beverly Hills as Ritziest Home Market in US

Coral Gables, Florida Tops Beverly Hills as Ritziest Home Market in US  JPMorgan Client Who Lost $50 Million Fortune Faces Court Setback

JPMorgan Client Who Lost $50 Million Fortune Faces Court Setback  FBI Says Chinese Hackers Preparing to Attack US Infrastructure

FBI Says Chinese Hackers Preparing to Attack US Infrastructure