The updated estimate of the insured property market loss for floods that hit February 9 to 29, 2020, across the United Kingdom is £375 million.

PERILS, the independent Zurich-based organisation providing industry-wide catastrophe insurance data, said it based its estimate on claims data from the majority of the affected insurance companies,

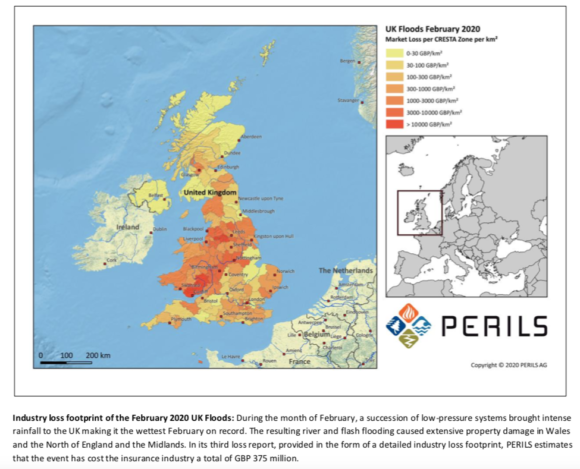

The February floods in the UK were the result of record-breaking rainfall which led to extensive river and flash flooding. Heavy rainfall was mainly associated with the three named storms, Ciara, Dennis and Jorge. Flood damage during the period occurred throughout the entire UK. The worst affected regions were Wales and the Midlands, North West and Yorkshire and the Humber in England.

In total, an estimated 4,800 properties were flooded, although many more buildings were successfully protected by flood defences.

The £375 million figure compares to PERILS’ previous loss estimate of££297 million.

While the industry loss from the February 2020 floods was not out of the ordinary, it added to other weather- related losses experienced during the winter 2019/2020 period, according to PERILS. Floods in November and December 2019, plus windstorms Ciara, Dennis and Jorge in February 2020, are estimated by PERILS to have cost the UK insurance industry an additional £400 million approximately. The resulting total industry loss figure from both the storms and floods during the 2019/2020 UK winter is in the region of £775 million.

PERILS is an independent Zurich-based organisation providing industry-wide natural catastrophe exposure and event loss data.