The Target Markets Program Administrators Association (TMPAA) released the results of its annual research to document the size, characteristics, growth and other base-line information about the program insurance market. The “State of Program Business Study” was presented at the association’s 13th Annual Summit in Scottsdale, Arizona.

The study pegged the program administration market in 2012 at $27.4 billion in premiums — up from $24.7 billion in 2011.

TMPAA said premium revenues increased 10.8 percent in 2012, more than three times the rate of premium growth in the overall commercial insurance markets. Premiums in the commercial lines market increased only 3.3 percent, according to figures from A.M. Best. Roughly one-in-10 commercial insurance dollars are distributed through the program business distribution channel, TMPAA said.

Among the report’s other findings:

• Carriers and program administrators report an estimated 2,075 individual programs — an increase of 3.5 percent from the 2,000 individual programs estimated for 2011.

• The number of confirmed organizations in the United States that meet the definition of program administrator remains relatively unchanged. From the estimated 950 program administrators estimated in the 2012 survey, TMPAA recorded a slight increase to 1,000 for this year’s survey.

• Program administration is a growing and vibrant market. Many administrators reported growth in their book in a challenging market place. They are also optimistic that this growth will continue in the future.

Program Administrators reported an 84 percent renewal rate in 2012, unchanged from 2011. The research consisted of two surveys — one distributed to program administrators and a second distributed to insurance carriers that use the program distribution channel.

TMPAA said the response to the survey rose by 13 percent over 2012 with 198 separate program administration firms responding. Another 43 insurance carriers also responded to the study and completed the survey. The research study and survey was conducted by Advisen, the commercial insurance research and data analytics firm. The analysis included a survey of program administrators, carriers and managing general agents. Additional data was drawn from the Advisen databases of retail brokers, managing general agents and underwriters and wholesale brokers.

Program Considerations

The survey also found that when considering partnerships, administrators and insurers seem to be looking for the same thing: track record.

• When asked about the most significant carrier attributes in terms of their importance to a successful program, the administrators said underwriting appetite for new programs, scope of underwriting authority, responsiveness to referrals outside of underwriting guidelines, history of supporting programs long-term, and flexibility of underwriting guidelines are the most significant.

• As with the previous survey, a program administrator’s experience with other programs and time in the business are the two most important factors that carriers consider when deciding whether or not to partner with administrators.

Program Success Criteria

TMPAA also found in the survey that, as would be expected, program administrators and insurers are in sync when it comes to their view of what matters most when establishing a successful program.

• Underwriting profitability and the carrier topped the list of most valuable factors that program administrators find important in terms of building a successful program for the third year in a row. A new factor added in the 2013 survey is customer service experience with claims, which also ranked high.

• Similar with the previous survey, estimated profitability and strength of administrator are the most important factors needed to build a successful program.

Challenges Faced by Program Business

The study also looked at the challenges faced by the program business. TMPAA said a look into views on top issues and challenges facing the program business reveal a number of similar responses between administrators and insurers.

One major similarity is that both administrators and insurers are looking for good partners. The program administrators want insurers who are able to commit as long-term stable partners. And insurers want a program administrator who will work with them in underwriting and risk selection.

• Like the rest of the insurance industry, the program business is faced with a host of issues and challenges. For administrators polled, many of the responses revolve around their carrier partners with the top issue cited being the lack of patience and long-term commitment by carriers.

Among the challenges cited by respondents under this topic are the carrier’s willingness to work cooperatively with administrators in developing new programs, the limited number of carriers in the program space, carriers not truly partnering with program administrators; and carriers’ unwillingness to consider smaller programs.

• In the case of insurers, the top issues are the soft market, technology, and underwriting skill and discipline.

• Program administrators and insurers polled are in agreement that technology is a key challenge. Some players in the program business are finding it difficult to keep up with and leverage use of technology.

• Both administrators and insurers are also faced with the lack of qualified applicants.

• Finally, it is worth noting that many administrators mentioned a lack of workers’ compensation markets, TMPAA said.

Program Administrators Bullish on Future Prospects

• The survey found many program administrators remain bullish on future prospects for the program business. Program administrators who provided comments expressed optimism over continued growth of the industry.

• An analysis of the percentage increases in premiums from 2010 to 2012 shows that program administrators fared better in 2012. Compared to 52 percent in 2010 and 72 percent in 2011, 82 percent of program administrators surveyed reported increases in premiums administered for 2012. The average increase reported for 2012 was 10 percent, compared to 9 percent in 2011 and 4 percent in 2010.

• Administrators polled also continued to report a high renewal rate of 84 percent — the same level as with the two previous surveys.

• Seventy-six percent of the program administrators polled reported increases in net revenues (before tax change) in 2012.

Administrators Rank Top Carriers

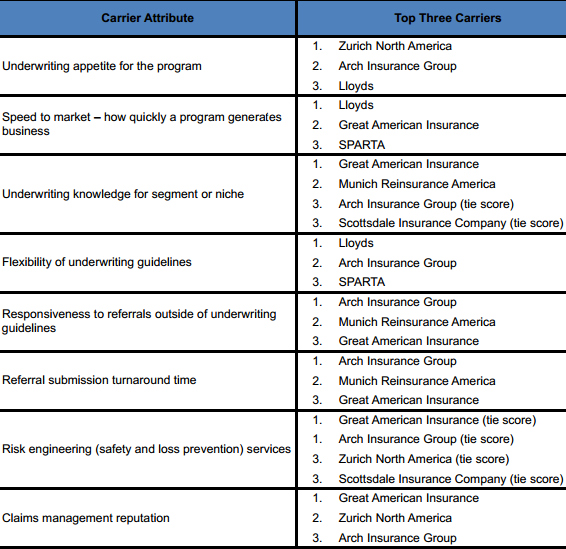

In the survey, respondents were asked to rate 13 carrier attributes in terms of their importance to a successful program. After identifying the most important carrier attributes, administrators were then asked to rate their top three carriers in terms of (a) underwriting appetite for the program, (b) speed to market – how quickly a program generates business, (c) underwriting knowledge for segment or niche, (d) flexibility of underwriting guidelines, (e) responsiveness to referrals outside of underwriting guidelines, (f) referral submission turnaround time, (g) risk engineering (safety and loss prevention) services, and (h) claims management reputation. The chart below shows the composite score based on the average of the values provided.

TMPAA defines “program business” as insurance products targeted to a particular niche market or class, generally representing a group of similar risks placed with one carrier. Administration is done through program specialists who have developed an expertise in that market.

Administrative responsibilities are negotiated between the specialist and carrier, but would include underwriting selection, binding, issuing, billing, and often times marketing, premium collections, data gathering, claims management/loss control and possibly risk sharing. Program specialists typically target their niches through differentiation either in product, risk management services, delivery mechanism or price. Specialists can distribute these programs on a retail, wholesale or direct basis.

Source: Target Markets Program Administrators Association

Topics Carriers Commercial Lines Business Insurance Underwriting Market

Was this article valuable?

Here are more articles you may enjoy.

Vintage Ferrari Owners’ Favorite Mechanic Charged With Theft, Fraud

Vintage Ferrari Owners’ Favorite Mechanic Charged With Theft, Fraud  Progressive Gains as Drivers Shop Around for Auto Insurance—Again

Progressive Gains as Drivers Shop Around for Auto Insurance—Again  Allstate Reports $731M in Q1 Pretax Catastrophe Losses

Allstate Reports $731M in Q1 Pretax Catastrophe Losses  Why New York’s Attorney General Objects to Trump’s Bond Insurer

Why New York’s Attorney General Objects to Trump’s Bond Insurer