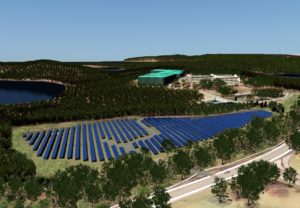

Swiss Re’s solar power installation at its U.S. headquarters in Armonk, N.Y., a 2-megawatt facility expected to be up and running by late spring 2017, is just one part of a green theme that the carrier has been writing for itself over several years.

Work began in October on the power plant, which will occupy roughly 10 acres of land on Swiss Re’s property. It is expected to generate 60 percent of the power required by the 700-plus employees working there.

One of those employees is Megan Linkin, the company’s natural hazards expert, who spoke to Insurance Journal on behalf of the carrier about its commitment to the environment.

“The company definitely practices what it preaches,” Linkin said. “We’ve acknowledged that climate change poses a significant risk to our society.”

Swiss Re Americas President and CEO Eric Smith in a statement said that the power plant “honors our brand and is what we are all about.”

“Our mission is to make the world more resilient and a big part of that is helping society protect against natural catastrophes,” his statement reads. “It is sustainable projects like this that demonstrate this commitment to making a difference.”

The solar facility is in keeping with the company’s participation in RE100, a global collaborative initiative of businesses committed to 100 percent renewable electricity and working to increase renewable energy demand and delivery.

Swiss Re helped form the initiative, which was launched during Climate Week NYC in 2014.

The carrier’s efforts to be green have garnered it recent recognition. It was called out in an annual report by sustainability leadership advocate Ceres that assessed insurer disclosures on climate change risks.

The report, “Insurer Climate Risk Disclosure Survey Report and Scorecard,” evaluated the quality of responses from insurance companies in the annual National Association of Insurance Commissioners Climate Risk Disclosure Survey.

Only 22 of all insurers studied earned the “High Quality” rating. One of those was Swiss Re.

Another of the carrier’s initiatives focuses on closing the protection gap.

Linkin described this as a “multifaceted approach to try and increase insurance penetration throughout the world.”

The approach includes:

- Diversifying its product offering – such as creating parametric products – to provide more options to consumers in hopes of spurring interest in purchasing insurance to increase financial resilience after a natural disaster;

- Working with microfinance and micro-lending institutions in low-income economies to offer solutions to the poorest individuals, and increase the financial resilience of that population;

- Expanding its target clients to include the public sector.

“We are the first reinsurer to put together a team that focuses exclusively on the public sector,” she said.

It’s “Global Partnerships” team consists of 35 individuals located globally, with members in the U.S., Mexico, Switzerland, China, Singapore, India and England.

The sole purpose of the team is developing insurance products to address the needs of the public sector, which Linkin believes is facing the prospect of taking an even bigger role in footing the bill after a natural disaster than it already does.

The rate of growth of total losses has outpaced the growth of insured losses over the last 35 years, according to Swiss Re’s annual Sigma report issued earlier this year.

In 2015, the global protection gap was USD $55 billion. In terms of 10-year rolling averages, insured losses grew at 10 percent between 1979 and 2015, and total losses by 10.4 percent, the report shows.

“If those losses aren’t picked up by the private insurance market, those losses are going to have to be picked up by the government,” Linkin said.

Beyond creating new products, Swiss Re played a part in addressing the needs of the public sector when it contributed to a climate change adaption report commissioned by the city of New York and released in June 2013 in the wake of Superstorm Sandy.

The city applied Swiss Re’s natural catastrophe models to NYC to shine a light on the potential impacts of wind and storm surge on the city assuming a world of rising sea levels and more intense storms.

The city and Swiss Re combined three sets of inputs:

- Hurricane models: Swiss Re uses data from the National Hurricane Center that includes nearly 1,200 observed tropical storms and hurricanes in the Atlantic Basin between 1851 and 2008. The model then “tweaks” each of these historical storms hundreds of times to create more than 200,000 storms that could form in the area, and then uses established models for atmospheric pressure, speed, size, and angle of landfall to assess the resulting storm surge and wind fields.

- Climate change scenarios: The city provided Swiss Re with guidance on projected sea level rise in the 2020s and 2050s, based on work of the New York Panel on Climate Change, and instructed the company to assume of a sea level rise by the 2020s and the 2050s based on those projections.

- City-level asset and economic activity: Consultants worked with city agencies to develop a working model of asset value divided into several categories, including buildings, transportation, telecommunications and utilities. These values were further broken down by ZIP code, as was the city’s economic activity.

An overview in the report states: “In setting out to define plans for strengthening New York City’s resiliency to climate change, it was critical to anchor the development of those strategies in the best possible understanding of the magnitude of the risks facing New York – including its infrastructure and its neighborhoods.”

Linkin said studies like this help government put a price tag on what climate change can potentially cost them in the future and how much they can save if they initiate resiliency measures now.

The green theme is found within the company as well.

Employees are incentivized to make environmentally friendly changes to their homes though subsidies to purchase energy efficient appliances or energy efficient windows. And there are incentives for purchasing bicycles, or incentives to purchase an electric or hybrid car, depending on the area.

“It really gives me a sense of pride,” Linkin said. “Because I am a scientist and because I study climate change, I want to work for a firm that has the same ideas I do, and cares about science, and the environment and the planet.”

Editor’s note: This is the final in a series of columns looking at carriers that are recognized as green. The first piece focused on The Hartford and the second on Zurich.

Related:

- Zurich’s Sustainable U.S. Campus Is One Part of Its Green Ambitions

- The Hartford Goes Green for Millennials

- Could More State Commissioners Require Climate Disclosure?

- You Should Be Able to Buy Stock in This Climate-Friendly Beer

- What Climate Change Has to Do with Earthquakes, Volcanoes and Tsunamis

Topics Carriers USA New York Climate Change Swiss Re

Was this article valuable?

Here are more articles you may enjoy.

Chubb to Acquire MGA Healthy Paws From Aon

Chubb to Acquire MGA Healthy Paws From Aon  Marsh McLennan Agency to Buy Fisher Brown Bottrell for About $316M

Marsh McLennan Agency to Buy Fisher Brown Bottrell for About $316M  Progressive Gains as Drivers Shop Around for Auto Insurance—Again

Progressive Gains as Drivers Shop Around for Auto Insurance—Again  Vintage Ferrari Owners’ Favorite Mechanic Charged With Theft, Fraud

Vintage Ferrari Owners’ Favorite Mechanic Charged With Theft, Fraud