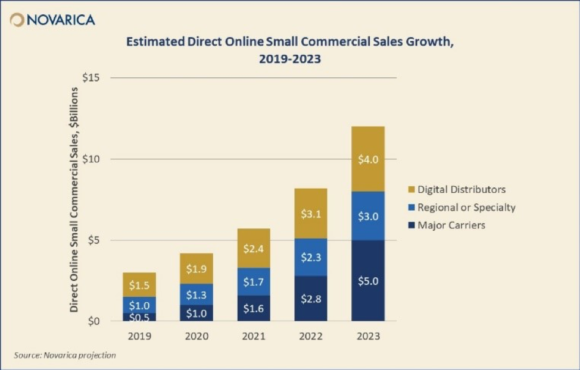

Changes in small business owners’ online habits and new market entrants are driving market demand for online purchasing of insurance, according to a report from advisory firm Novarica, which sees direct online sales capturing as much as 15 percent of the market within five years.

“As more small business owners conduct more of their business and personal lives online, the growth of online small commercial insurance is inevitable,” said Matthew Josefowicz, president and CEO, and lead author of Novarica’s report.

He said that while online sales are unlikely to exceed 10 to15 percent of the market within the next five years, it nevertheless will be an “important segment for small commercial insurers, especially for those turning to small commercial as a bulwark against pressures on their personal lines businesses.”

Novarica profiles 22 current market participants in its report, Direct Online Small Commercial Insurance: 2019 Update. Among the findings are:

Novarica profiles 22 current market participants in its report, Direct Online Small Commercial Insurance: 2019 Update. Among the findings are:

Changes in business owners’ online habits likely to drive market demand. Younger business owners are comfortable buying coverage online, and a significant portion expressed preference for buying that way. Owners of all ages are comfortable managing their businesses online.

Insurtech entrants designing experiences to meet customer need. Well-funded, customer-focused digital distributors are demonstrating the value of offering simplified products and experiences focused on the moment of customer need.

Major commercial players are making moves. While no one has yet committed the significant advertising dollars that drove the transformation of the personal lines markets, top-tier commercial insurers are entering the market through dedicated operations and acquisitions.

Source: Novarica

Related:

- Agent-Inspired Insurtechs ‘Self-Disrupt’ Small Commercial Lines

- Could Allstate’s ‘5 Minute’ Small Business Policy Transform Commercial Lines Sales?

- Small Business Insurtech CoverWallet Expands to Offer Its Tech, Markets Access to Agents

- Travelers Completes Purchase of UK Small Business Insurer, Simply Business

- Berkshire Hathaway Goes Small with biBERK Online Commercial Site

- Workers’ Compensation Insurtech Pie Insurance Enters 5 Additional States

- Why Small Mutual P/C Insurers, Insurtechs May Need Each Other: A.M. Best

Was this article valuable?

Here are more articles you may enjoy.

Soaring Insurance Costs Hit as US Buyers Finally Get a Break on Car Prices

Soaring Insurance Costs Hit as US Buyers Finally Get a Break on Car Prices  DeSantis Signs Bill Barring Local Worker Heat Protection Measures

DeSantis Signs Bill Barring Local Worker Heat Protection Measures  Undercover St. Louis Officer Beaten by Colleagues Awarded $23.5M

Undercover St. Louis Officer Beaten by Colleagues Awarded $23.5M  AIG Sues Newly Launched Dellwood Insurance and Its Founders

AIG Sues Newly Launched Dellwood Insurance and Its Founders