Last year more than $6 billion in advertising was pumped into the marketplace to encourage consumers to shop and switch their auto insurance providers. Everywhere consumers look, they are being hit with insurance ads – television spots, blimps, even field-goal netting at college football games. That steady bombardment of messaging is affecting consumers, but perhaps not in the manner intended.

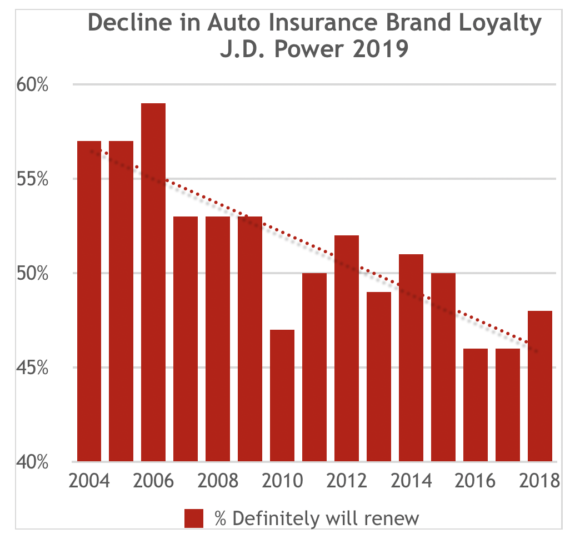

According to recent analysis performed by J.D. Power, the number of “at-risk” insurance consumers has risen to its highest level since the metric started being tracked 20 years ago. The rate of auto insurance loyalty, as measured by those customers who will “definitely renew” their policy with their incumbent carrier, has fallen to 48% today from 59% in 2004 – constituting a 27% drop in auto insurance consumer loyalty. Over the past year, the rate of switching among insurance shoppers has increased to 35% from 31%, helping to drive down overall insurance customer retention by two percentage points to 88%.

While advertising has played a role, so has the shift in consumer interaction with insurance carriers. Shopping for a quote used to take days. Now, it can now be completed in a matter of minutes or hours from the comfort and convenience of home.

Another key factor has been the rising cost of auto insurance. According to the J.D. Power 2019 U.S. Insurance Shopping Study, the average cost of auto insurance has risen at twice the rate of median household income across the U.S. over the past decade. That means that not only is auto insurance taking a larger share of consumers’ wallets, it’s also having a big effect on customer loyalty to their existing insurance carriers.

The broader significance of this trend is that the decline in brand loyalty is disproportionately benefiting carriers that are best-positioned to capitalize on increased in-market movement, or, more specifically, those carriers that have optimized their cost of acquisition. Over the past decade, carriers with a lower cost of acquisition have grown at four times the rate of higher-cost carriers. These carriers have been able to re-allocate expenses, such as commissions, back into the brand in the form of advertising, which in turn creates more shopping churn and lower brand loyalty. This has forced the hand of rival carriers to either follow suit and attempt to replicate lower-cost acquisition models in a race to the bottom, or, alternatively, to place their bets on features that justify higher costs, such as superior customer service delivery.

Many popular tactics that some carriers have implemented to increase loyalty have been ineffective. Consider Net Promoter Score (NPS)1, which many carriers have deployed to tie compensation and bonuses to improved scores. These carriers have made large investments to move customers along the continuum from detractors to promoters, which they believe will drive higher satisfaction and increased loyalty. However, while many carriers have witnessed improved NPS scores, they have failed to achieve corresponding improved levels of loyalty. Last year, the rate of shopping among all consumers stood at 33%, while promoters shopped at a healthy 25% rate – a mere 8% gap. This suggests that customer loyalty may be more nuanced than simply converting more customers into promoters, and that such pursuits have been proven largely ineffective in stemming the tide of customer defection.

Further, evidence suggests that carriers have inadvertently accelerated consumer shopping behaviors. Take, for example, the recent push by auto insurers to better customize their insurance coverages through tools such as usage-based insurance (UBI). In theory, personalized pricing should lead to greater transparency and therefore greater control among consumers to affect their rates. Instead, a disconnect between personal rate factors (such as driving fewer miles) and market factors (such as rising price of repairs or medical costs) of which consumers have no control is emerging. Based on a multi-year longitudinal data analysis performed by J.D. Power from 177,000 consumers, customized, UBI-type pricing with larger pricing swings has led to higher shopping rates compared with carriers that have focused more on price stability. Customers with stable rates are 57% less likely to shop than those who experience variability.

The lesson here is that carriers need to step up their level of sophistication when it comes to improving customer loyalty. Through a combination of incomplete metrics, poor understanding of the drivers of customer behavior and resulting poor strategies, many carriers have inadvertently accelerated this trend, placing lower-cost providers in the driver’s seat. Warren Buffett, at his recent 2019 Annual Shareholders Meeting2 , confidently declared that it’s now a two-horse race between GEICO and Progressive to take on State Farm in home and auto insurance. “We will see five years from now and 10 years from now, which one of us passes State Farm first,” said Buffett. Will carriers be able to course-correct, or will he be proven right?

Buffett’s prediction is not a foregone conclusion. If carriers can stop blindly chasing cost optimization and start delivering strategies that positively impact customer experience at scale, they can shift the tide. But it’s going to require a more nuanced approach than a big ad campaign or a clever product offering.