AM Best said it expects insured losses from Hurricane Fiona in Puerto Rico to be influenced by business interruption caused by widespread power outages but losses should be manageable for the industry.

“It could take some time for claims adjusters in Puerto Rico to assess and estimate damages,” said David Blades, associate director, industry research and analytics. “However, since Hurricane Maria in 2017, insurance companies on the island have taken significant action to manage their risk profiles better by tightening underwriting guidelines, sharpening risk management techniques, improving pricing and getting significant rate increases.”

Fiona was more of a water event than Maria, which hit the island five years ago with winds of about 155mph and caused about $10 billion of insured losses in Puerto Rico. Therefore, Blades added, losses from Fiona (a Category 1 storm) are likely to be flood-related – a peril not covered by a standard homeowner policy. Flood losses fall under the Those losses would fall under the National Flood Insurance Program.”

Hurricane Maria exposed vulnerabilities in Puerto Rico’s power grid and, though efforts have been ongoing to improve it, Fiona “clearly indicates that more is yet to be done,” AM Best in a commentary.

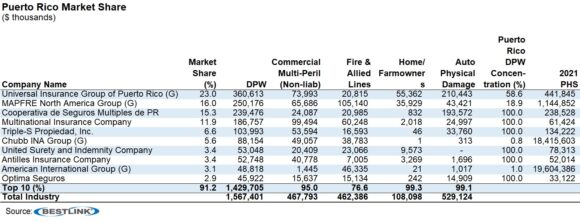

The top 10 insurers in Puerto Rico account for over 90% of the market share for auto, fire and allied, homeowners, and commercial multiperil lines, the rating agency noted. Of them, Chubb INA Group and AIG are well diversified but six companies on the list are insurers with 100% exposure on the island, and they make up 43% of the market share.

Was this article valuable?

Here are more articles you may enjoy.

FBI Says Chinese Hackers Preparing to Attack US Infrastructure

FBI Says Chinese Hackers Preparing to Attack US Infrastructure  Uncertainty Keeps Prices Up; No Prior-Year Loss Development: Travelers

Uncertainty Keeps Prices Up; No Prior-Year Loss Development: Travelers  North Carolina Adjuster and Son Charged With Embezzlement in Roof Jobs

North Carolina Adjuster and Son Charged With Embezzlement in Roof Jobs  Survey Shows Majority of Florida, California Homeowners Seeing Higher Insurance Costs

Survey Shows Majority of Florida, California Homeowners Seeing Higher Insurance Costs