Trust is hard to come by, and the proof for that cliché is now in the pudding – at least in the world of workers’ compensation.

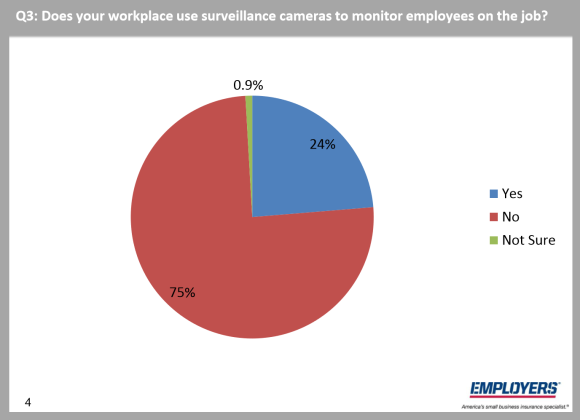

While roughly one-in-10 small business owners say they’re concerned that one of their employees would commit workers’ comp fraud, nearly one-fourth of small business owners have installed surveillance cameras to monitor employees on-the-job, a survey by Reno, Nev.-based workers’ comp carrier Employers shows.

This mistrust may be negative in the eyes of some, but there are those who think the suspicion doesn’t run deep enough.

Ranney Pageler, vice president of fraud investigations at Employers, said the message of protecting a business from fraud resonates more deeply with those who have already been ripped off and seen their worker’s comp premiums rise.

“You may have 90 percent of policyholders who aren’t paying attention,” he said, adding that for those who have been burned, “Boy, that is their hot button.”

It’s a hot button for some agents too.

Pageler and Employers conducts an occasional continuing education course for producers on workers’ comp fraud, and he’s noticed those agents who have had clients experiencing fraud are more attentive when the topic of prevention is mentioned.

“When we address agents, the same thing comes up,” Pageler said of the fraud topic.

He said he’s seen more policyholders installing cameras, and that action has literally paid dividends.

In the last 18 months Employers had three cases in California where workers’ comp fraud was proven because of videos, which showed the workers staging their injuries, according to Pageler.

Two cases were in restaurant kitchens, and the other was in a warehouse, he said.

The videos show the workers rearranging furniture or objects, kicking the objects, then screaming out in pain and getting hauled off in an ambulance.

“That proves they weren’t injured, that they staged an accident,” he said.

By his account all three cases were investigated, criminal complaints were filed and convictions resulted in merely a matter of months – hyper-speed for the state’s unwieldy system.

“All were decided well within a calendar year,” Pageler said. “What that (video) did was keep that claim from ever showing up on the policyholder’s experience rating.”

The reason there was no impact on the rating, or a corresponding premium increase, was because the cases were handled quickly, and total fraud was easily proved, he said. Unlike in partial fraud, a total fraud claim can be entirely removed retroactively with no impact to the rating.

This is the reason that in the continuing education class for producers Pageler also suggests that agents advise their clients to consider installing video cameras when feasible.

Beyond the level of caution about worker’s comp fraud, a number of small business owners believe they are unprepared or are unsure of their ability to identify workers’ comp fraud. The survey shows that 21 percent of those interviewed feel that way.

The survey also asked small business owners to identify potential indicators of claim-related workers’ comp fraud. Activities cited by more than half of respondents included:

For the survey 501 U.S. small businesses with fewer than 100 employees were interviewed. The survey was conducted from May 14 through May 29. The reported margin of error is plus or minus 4.4 percent.

Related: