Moody’s has released estimates showing property/casualty insurers and reinsurers total insured losses at $10 billion $15 billion from the California wildfires, which destroyed more than 20,000 residential and commercial structures, and damaged nearly 1,000 structures.

Moody’s says it expects insured losses to reduce fourth-quarter earnings for primary insurers and reinsurers, though the losses will be manageable.

The Camp and Woolsey wildfire losses could surpass the $12.3 billion of wildfire losses that P/C and reinsurers reported for the October and December 2017 California wildfires.

Moody’s estimates are in line with estimates from catastrophe modeler RMS, which over a week ago reported insured losses from the wildfires expected to be at $9 billion to $13 billion, including property and auto damage, business interruption, additional living expenses and contents loss.

Industry data provider CoreLogic earlier this week reported total losses from the wildfires in Northern and Southern California could reach from $15 billion to $19 billion.

Industry data provider CoreLogic earlier this week reported total losses from the wildfires in Northern and Southern California could reach from $15 billion to $19 billion.

Losses could be around $19.9 billion assuming CalFire’s estimate of 18,793 structures destroyed by the Camp Fire and 1,500 structures destroyed by the Woolsey Fire and a statewide average wildfire loss value of $981,000 per structure, according to Moody’s.

However, the average claim size for the Camp Fire will likely be lower than statewide averages because home values in the affected area are relatively low, while the average claim size for the Woolsey Fire will likely be significantly higher than the statewide average, Moody’s said.

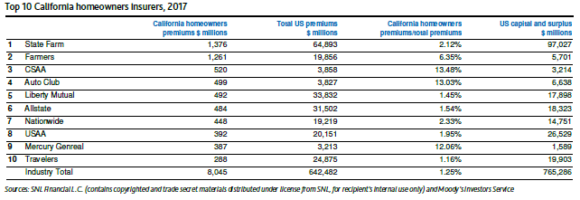

Losses from the fires will likely be concentrated among insures with high exposures in the fire areas, including State Farm, Farmers, CSAA, Auto Club, Liberty Mutual and Allstate, according to information from SNL Financial and Moody’s.

California P/C insurers may also be hit by wildfire losses from properties insured by the California Fair Access to Insurance Requirements (FAIR) Plan, which insures “a disproportionate share of property in remote locations and regions with high wildfire exposure,” Moody’s said.

Each California insurer is required to participate in FAIR plan losses in direct proportion to its market share.

Related:

- Negative Credit Implications from California Wildfire Could Emerge for Reinsurance, Fitch Says

- PG&E Decided Not to Cut Power as Winds Raged Before California Wildfire

- Latest Estimates of Insured Losses from California Wildfires at $9B to $13B

Topics California Catastrophe Carriers Natural Disasters Profit Loss Wildfire Reinsurance Property Casualty

Was this article valuable?

Here are more articles you may enjoy.

Cargo Owners in Baltimore Disaster Face ‘General Average’ Loss Sharing, MSC Says

Cargo Owners in Baltimore Disaster Face ‘General Average’ Loss Sharing, MSC Says  How California’s Huge Raises for Fast-Food Workers Will Ripple Across Industries

How California’s Huge Raises for Fast-Food Workers Will Ripple Across Industries  Wildfires Are Upending Some of the Safest Bets on Wall Street

Wildfires Are Upending Some of the Safest Bets on Wall Street  Progressive Gains as Drivers Shop Around for Auto Insurance—Again

Progressive Gains as Drivers Shop Around for Auto Insurance—Again