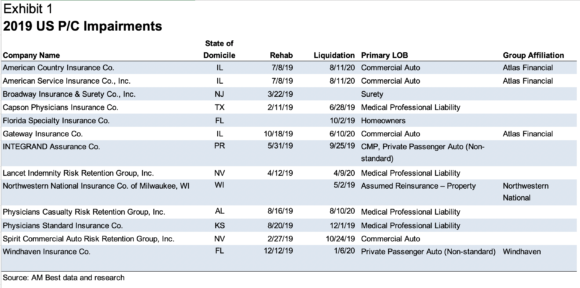

The U.S. property/casualty industry saw 13 new insurance company impairments in 2019, two more than in 2018, involving entities operating in a mix of lines of business and a variety of states, according to a new AM Best special report.

The Best’s Special Report, titled, “2019 U.S. Property/Casualty Impairments Update,” states that four impairments of medical professional liability writers, and another four commercial auto writers, led the 2019 impairments.

Overall, from 2000 to 2019, there were 388 property/casualty insurers impairments, according to AM Best. “These impairments consisted of 314 insolvent liquidations and 74 rehabilitations, of which 37 were closed during the period; 37 remained open as of this report.”

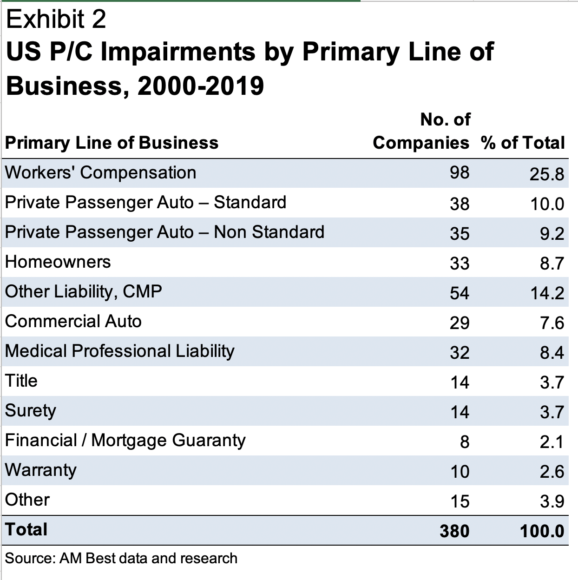

Primary line of business details was determined for 380 of the 388 impairments as well, and for these 380 impairments, the leading line of business was workers’ compensation, which accounted for 26% of the impairments.

AM Best defines impairments as a situation in which a company has been placed, via court order, into conservation, rehabilitation, or insolvent liquidation. Supervisory actions undertaken by insurance department regulators without court order are not considered impairments, unless delays or limitations were placed on policyholder payments.

Personal lines insurers had more impairments than workers’ comp insurers. Personal lines insurers accounted for 28% of all impairments, split between private passenger auto (19%) and homeowners (9%). Commercial lines insurers accounted for 22%, split between other liability/commercial multi-peril (14%) and commercial auto (8%), with the remaining 24% in specialty lines.

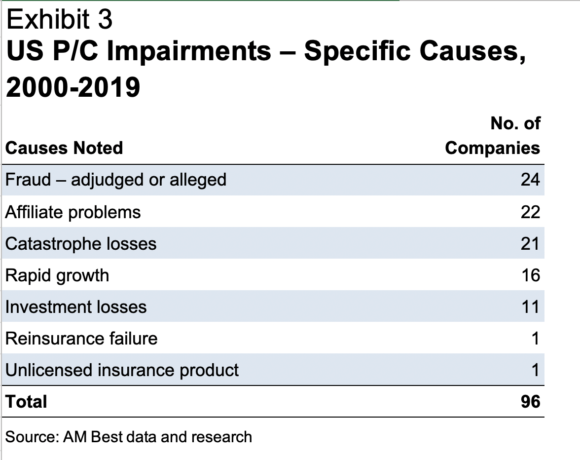

There were specific causes identified for 96 insurers impairments.

Fraud or alleged fraud was the leading cause, and was present in 24 impairments, while 22 were related primarily to affiliate problems.

Catastrophe losses caused 21 impairments, while 16 companies became impaired after experiencing rapid growth.

Investment losses were a significant factor in 11 impairments.

One insurer became impaired because of reinsurance failure and another company was placed into liquidation after marketing warranty insurance products without a license.

The rise in risk retention group (RRG) impairments in recent years continued in 2019, accounting for three of the 13 impairments. During the 2000-2019 period, 41 RRGs became impaired, representing 11% of the total. To some extent, the growth in RRG impairments reflects the growth in the structure’s popularity, but they may also be due to business plans with unrealistic loss, operating expense, and pricing assumptions as these self-insurance.