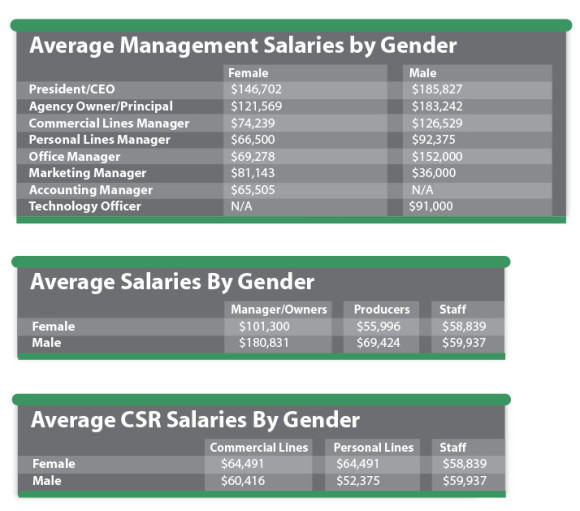

Women who are top leaders or producers in property/casualty insurance agencies make materially less than men in the same positions.

While females make up almost half of all agency employees (48.3 percent), across the board females earned 109 percent less than male agency employees, according to Insurance Journal‘s 2016 Agency Salary Survey.

The Agency Salary Survey also found that:

Even when comparing the same job, such as commercial lines manager where respondents to the survey were equally men and women, men out-earned their female counterparts by 70 percent on average ($126,529 to $74,239), according to the survey.

Nearly 1,400 respondents – owners, producers and agency support staff – from every state participated in this year’s annual survey.

Why the Compensation Gap?

According to some experts, it’s an opportunity gap, more the result of fewer women being in the higher paying jobs than it is agencies paying men more than women for the same job. It may also reflect age and experience.

The exact reasons are difficult to quantify, says Paul Osborne, senior consultant at Demotech Inc., Insurance Journal’s official research partner, who provided data analysis for the 2016 Agency Salary Survey.

“For instance, for a commercial lines manager, does that pay difference tend to happen at smaller agencies or in certain regions? Are there other factors that would help account for the discrepancy like experience or age?” he asked.

Even so the data shows a difference in pay by gender, Osborne said. “I think it is pretty clear that there is a bias, as the numbers are significantly different, but pinning it down is difficult unless you have two people doing the exact same job.”

In management, the survey revealed that in five of the eight agency management positions, men outpaced women in average salaries. See “Average Management Salaries by Gender” chart below. The survey showed:

Not Unique to Insurance

The gender salary gap is not unique to the insurance agency business.

According to the U.S. Census Bureau, women in the U.S. earned 78.6 percent of what men earned in 2014 compared with 77.6 percent in 2013.

In 2014, the U.S. median annual earnings for women working full-time, year-round was $39,621, compared with $50,383 for men, the Census reported.

At the current rate, if trends are projected forward, women will not receive equal pay until 2059, according to a 2015 analysis of the most recent U.S. Census data by the Institute for Women’s Policy Research (IWPR). This date is one year further out from the 2014 IWPR analysis, which signifies the gender wage gap isn’t closing.

“For decades, women have been increasing their level of educational attainment and gaining job experience, which economists would call increasing their human capital,” said IWPR president and economist Heidi Hartmann. “Yet, their earnings have not kept pace with these increases.”

In another analysis, online publisher 24/7 Wall St. identified the largest gender wage gap to be that of the insurance agent.

A 24/7 Wall St. article titled, “Jobs with the Widest Pay Gaps Between Men and Women,” where the publication reviewed U.S. Bureau of Labor Statistics earnings data from 2012, said women insurance agents earned just 62.5 percent of men’s earnings. According to the 24/7 Wall St. analysis, which reviewed data for 389,000 workers, women agents earned just $641 per week on average compared to men agents who earned $1,026 per week on average.

Gender disparity may be most noticeable in top leadership roles of commercial property/casualty insurance carriers and reinsurers, where a 2012 study by St. Joseph’s University showed that just 6 percent of top executive positions were held by women.

One area where female workers in agencies appear to come close to their male counterparts in pay, according to the Insurance Journal Agency Salary Survey, is that of support staff. However, females are almost six times (5.87) more likely to hold a support staff position as a male, while males are about two-and-a-half times more likely (2.64) to be a manager, the survey revealed.

In terms of producers, the genders are fairly even in number, the survey showed.

Salary Gap Concerns

Some industry experts have been talking about the gender pay gap in insurance for awhile.

Sharon Emek, who runs Work At Home Vintage Experts LLC (WAHVE), a company that looks for ways to outsource retired baby boomers from the insurance industry back to insurance firms, brokers and carriers, says the insurance industry has a long way to go to close the gender salary gap.

“The salary gap is closing, but it still has much to go,” Emek said. A more significant concern to Emek is the lack of gender diversity among insurance industry leaders.

“There are still few women in the c-suite and few women in ownership positions at insurance brokerages,” Emek said.

In her view, technology is helping to address this issue. “With technology enabling work from home, women in the future will no longer be penalized for having to manage a career and family.”

Tracey Carragher, CEO of Breckenridge Insurance Group, agrees that the industry has a long way to go when it comes to closing the gender salary gap.

Carragher has been outspoken on gender and diversity issues. She was honored last year at the annual Association of Professional Insurance Women Awards as Insurance Woman of the Year.

“The salary disparity is still there,” Carragher said. “It’s ridiculous if you take a look at studies; (female) MBAs getting out of school start at around the same salary (as men). What happens four years later – the disparity between men and women is significant.”

Carragher believes that the salary gap exists in all levels of insurance industry. “So while we have made a lot of progress, I don’t think we’ve gotten close enough at all,” Carragher told Insurance Journal last year in a podcast interview.

Carragher says she’s not surprised by the most recent Agency Salary Survey findings. “Clearly this is an issue that continues to prevail,” she said. “Constant conversation about this situation has not materially moved the needle.”

Carragher says she could cite other studies that are similar but they are not going to change the industry’s reality. “I think we have to talk about solutions that are actionable and measureable by us as individuals. Every one of our businesses will suffer if we don’t take diversity seriously,” she said.

Others see the issue less as gender bias in salaries and more as bias against giving women opportunities to occupy the higher paying jobs in agencies.

“I can’t remember the last time it was addressed in a real life situation,” said Al Diamond, president of the Cherry Hill, N.J.-based Agency Consulting Group (ACG), an independent agency valuation and consulting firm serving organizations nationwide.

That’s not to say that all gender issues have all been overcome, he added.

According to Diamond, the real problem remains getting the “good old boys” to recognize that females are just as qualified to become producers as their male counterparts. “But rarely do I see salary differences between compensation of different genders in the same roles,” he said.

Producer compensation is generally defined by the same commission percentages, regardless of gender, Diamond says. The gender gap in service positions is generally attributable to agency owners tending to hire females in service roles over males. “But the salaries are generally defined similarly whether the service reps are male or female,” he adds.

Diamond says in ACG’s own analysis of producer compensation, which includes more than 4,000 agencies, the commission rates do not differ for compensating male and female producers. “So, if the ‘female’ group sold less overall insurance than the ‘male’ group, wouldn’t it look like they were earning less than their male counterparts when the reality is that an artificially created group (all females) may simply have sold less than the other artificially created group male producers?”

For Mary Newgard, partner and senior search consultant at Capstone Search Group, a staffing and recruiting firm that exclusively serves the insurance industry, a gender wage gap is not a big concern.

“I haven’t seen a ton of it on the agency side, for the most part,” Newgard said. If there is a disparity in pay, Newgard says it is not a result of malicious intention. “But it’s still a segmented group, where most of your client service support staff are female, and the producers are male,” she said.

Newgard agrees with Diamond that producer compensation is producer compensation. “It would be very easy to call out a problem if you noticed that producers, in particular, were being paid differently based on their gender,” she said. “I have not seen anything like that.”

With support staff, Newgard says, she hasn’t seen enough hires of men in those roles to really say if there is a salary disparity by gender. “Probably, 99.9 percent of your account managers and client service staff are female, at least the positions, and candidates, and employees that we see. … It would be pretty easy to call out.”

Closing the Gap

Erin Hamrick, a partner and founder of Sterling James, a New York-based global specialist in executive search and leadership advisory services for the insurance sector, has spent nearly 20 years negotiating compensation packages for industry leaders. Hamrick led the CEO search for Michael McGavick, XL’s CEO since 2008, and former chairman, president and CEO of Safeco Corp. While many of Hamrick’s top executive clients include men, she takes a personal interest in advocating and placing top female leaders throughout the industry.

Gender diversity in the insurance world is “an absolute passion,” Hamrick said. “I speak on the topic all the time and have a reputation of being a big promoter of women in the industry.”

Hamrick says some of the issues that create gender disparity in compensation in insurance sectors can be solved as women get better at asking for what they want.

“The reality is that any business is going to get away with paying whatever they need to pay in order to get the talent and keep them happy,” Hamrick said. “With women they tend not to ask for more money, ever.” And that’s a problem.

“If you are someone who is responsible for making a profit and you have a woman who is working and arguably very happy, there’s really no incentive to pay them more unless that woman asks,” Hamrick said. “You don’t get it if you don’t ask. So who’s fault is that? It’s not up to the manager to make sure that the woman gets fair pay.” It’s not up to the government either, she said.

“You don’t ask, you don’t get,” she said. “Women need to be much more forceful in standing their ground and asking for more money.”

Hamrick says in her experience, women do not negotiate in the same manner that their male counterparts do and that has led to pay disparity.

“I’ve been negotiating compensation for a long time and men negotiate their comp packages; women don’t,” she said. Women tend to be more focused on company culture and where they can make a difference. “Whereas a man will say, ‘I need all that plus I need this number. And if they don’t get it they don’t move.”

She also says that women don’t move as often for a number of reasons, including personal considerations as well as loyalty to their workplace.

“They do feel much more loyal so they will stay at one place for a long time and if anyone stays in the same company for a long time they will experience what we call salary compression,” Hamrick said. “A company can only give you so much of an increase on an annual basis whereas if you move you can get a 15 percent to 20 percent increase.”

Hamrick says these discussions with women can be painful. “But if you are not happy you need to move,” she said. “Don’t try to make the sandbox you are currently in better; just pick up your toys and go find a better sandbox. … The only person that can take care of you is you.”

WAHVE’s Emek says given the nature of the insurance industry and what it provides to consumers, more should be done to expand gender diversity, especially in top leadership roles. “Our industry, because it is a knowledge industry, should be at the forefront of enabling women to contribute their knowledge and experience in a flexible environment,” she said.

Breckenridge’s Carragher adds that even the industry’s business partners should be held accountable when it comes to diversity.

“We need to hold our business partners, our vendors, and ourselves responsible to establish and communicate gender and race parity,” Carragher said. Her recommendations: “Assess and then shine a light on the composition of your respective team, especially at the manager and senior levels. Clients see it. Investors see it. Talented women see it,” Carragher said. “You have to bring ‘the elephant in the room’ out and rally a few key supporters to develop a relevant plan of action.”

Doing so is “absolutely a strategic initiative – involving real work, plans and timelines,” she said. Then engage a diverse team within the agency to develop and implement the plan and report to executives and others on its progress. The most important part, she adds, is to start somewhere, anywhere. “But start.”

Insurance Journal‘s 2016 Agency Salary Survey collected 1,399 responses from independent insurance agencies and brokerages nationwide via an online survey. For more information, contact Andrea Wells at: awells@insurancejournal.com.