This article is part of a sponsored series by Cotality.

Insuring property along our nation’s coastlines can be either extremely lucrative or laden with risk. Many coastal residents are underinsured—which puts property owners and the insurance industry at risk.

That’s why, with this year’s Atlantic hurricane season upon us, it’s a good time to take a comprehensive approach to mitigating risk associated with all commercial and residential policyholders—but especially those in vulnerable coastal regions.

1. Ensure your small business policyholders have the appropriate amount of coverage: Small business owners wear multiple hats and assuring property is adequately covered in the event of a natural disaster is not always at the top of their priority list. Many small business owners mistakenly assume the “cost to rebuild” and “current market value” is one and the same. This is why it is important to obtain and verify accurate exposure data, insure to value and educate policyholders before the next disaster strikes.

By creating an effective and efficient point-of-sale workflow, small business as well as residential policyholders are more likely to be properly protected and can therefore re-rebuild after a hurricane-related disaster.

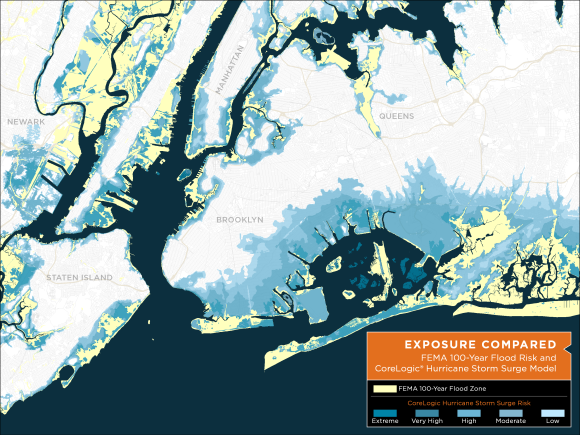

2. Ensure all policyholders have the appropriate type of coverage on their property: It’s safe to say that most coastal properties have some sort of flood risk. By understanding which properties are at risk of storm surge this season, you can not only mitigate flood-related risk, but also uncover opportunities to ensure policyholders carry the appropriate type of coverage at point-of-sale.

For example In a New York Federal Summary of a Poll that looked at Hurricane Sandy’s impact on small business, of 950 respondents located in FEMA-declared disaster areas, roughly one third of affected firms had no insurance at all and only a few had business disruption or flood insurance.

And, even though flood insurance is federally mandated in FEMA flood zones, nearly *25% of all National Flood Insurance Program (NFIP) flood insurance claims come from folks outside mapped high-risk flood areas. While many assume federal disaster assistance will help them recover, what they don’t understand is that Federal disaster assistance is usually a loan that must be paid back with interest.

The below map from CoreLogic indicates the discrepancies between FEMA Special Flood Hazard Areas and storm surge risk

*Click here for more flood facts.

3. Same building. Same apartments. Same risk? Multi-family coastal development continues to replace single-family structures as more and more Americans choose to rent instead of purchase. A coastal renter’s contents could include expensive furniture, electronics, artwork, etc; of which, for various reasons, homeowners often grossly undervalue. If you count on a policyholder to value their own contents, you could be exposing them to severe underinsurance. It’s time to take a granular approach to pricing renter’s policies.

Topics Catastrophe Natural Disasters Flood Hurricane Numbers

Was this article valuable?

Here are more articles you may enjoy.

Experian Launches Insurance Marketplace App on ChatGPT

Experian Launches Insurance Marketplace App on ChatGPT  Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows

Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows  Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  Preparing for an AI Native Future

Preparing for an AI Native Future