While the per barrel oil price has rebounded somewhat after it plunged to under $45 per barrel in March 2015, the energy industry — and by extension the energy-focused insurance sector — continues to adjust to the impact of the extreme price drop that began in summer 2014.

By the time the price of a barrel of oil topped out at more than $100 last year, oil and gas production activity in Texas was in the kind of upward spiral that tends to make would-be energy moguls out of people who really have no idea what they are doing.

What a difference a year makes. Now, those who jumped in thinking they could make money at $100 a barrel are out, receipts and payrolls are down for those that are still in, and some clients are seeking to cut back on their insurance costs.

But all that may not be such a bad thing, according to some insurance professionals who specialize in the area.

While the price bust has been traumatic for many people, with jobs lost and companies going under, the production activity “probably needed to taper off a little bit because it was going so crazy, especially in Texas. … It seems like there was carelessness out there. In my opinion it might weed out some of the people that don’t really know what they’re doing and they guys that do know what they’re doing, they’re the ones that are going to stay in business,” said Billie Gorrell, president of The Woodlands, Texas-based Ashley General Agency.

Bad Companies

The extreme price plunge definitely has had an impact on the industry, but “the bad companies are the ones that are feeling it. The bad companies are the ones that are being run out, they’re being forced to sell,” said Thomas Blanquez, an oil and gas specialist with San Antonio-based insurance wholesaler Quirk & Co. “But the resourceful companies, the ones that have been through this before and weathered the storm, they’re going to be able to come through and I believe probably stronger than they were before this.”

The sudden and drastic change “left a lot of people wondering what the game plan should be. … The direct immediate impact is that it’s going to affect insurance companies’ bottom line in written premiums. That’s because the account that you were writing last year, and year over year, that were expecting 10, 15, 20, even more — 40 to 50 percent — increases … as far as payroll and sales go, you’re actually seeing the exact opposite of that now,” said Blanquez.

In the current environment, firms are laying people off, decreasing fleet sizes and trying “to decrease their insurance limits if they can because they’re losing contracts that no longer require the higher umbrella or excess limits,” he said.

That’s a challenge for agents and brokers, said John Collado, Southwest Regional CEO at USI Insurance Services. “Insurance carriers are not very favorable about mid-term changes. … But on the flip side if you’re that business owner and you’re paying for insurance and exposures that you just don’t have, you’re not very happy about it,” he said.

Collado said agents and brokers seeking mid-term changes are bound to experience pushbacks from carriers. But, he said, “as an industry we should try to fight to represent our clients well and if there are adjustments to exposures, they should be changed.”

The problem is “that while written premiums are down because sales are down, payrolls are down, the severity of the classes of business that they’re writing are not,” said Blanquez.

Good Companies

He said he’s now focusing on the good accounts, “the ones we want to get our underwriters to go to the mat on and apply the maximum credits.” As to the risks that are priced correctly, “if somebody wants to come in today and undercut the market just to pick up the account then that’s fine,” Blanquez said.

Agents and brokers need “to get with their insured and see where they’re going and see what’s going on with their business,” Gorrell said.

It’s certain receipts are going to change and both agents and insureds need to “be really mindful of what the next year is going to hold,” she said.

The problem is the difficulty in predicting what receipts are going to be going forward, so it probably would be a good thing for agents to check with their insured periodically, she said.

“My concern would be to make sure they keep an eye on, if their receipts are way down to correct it during the year so these insureds don’t end up paying more premium than they need to,” she said.

Gorrell added that it’s important on the wholesale side to be mindful as well. “I haven’t had an account that hasn’t gone down in sales a little bit. It’s just the way it is.”

Still, said Blanquez, “you have to walk that fine line to make sure that you maintain underwriting integrity but at the same time you don’t want to lose all of your business. … Companies, underwriters, brokers — that’s where we’re all leaning on each other relationship-wise to figure out what it’s going to take to keep the business. At the same time we can’t gut the policy, we can’t gut the rate because that’s not really the way we should act in this type of situation.”

Same as It Ever Was

Some things haven’t changed in the energy sector year over year. Insurance capacity is still up and pricing is still competitive for oil and gas-related businesses, with one glaring exception: commercial auto. Like last year, commercial auto is where claims are coming from and the market continues to be a tough one.

Commercial auto aside the insurance marketplace for energy businesses has plenty of capacity and pricing is competitive to down, which is great for the buyer, Collado said. “Oftentimes when there’s adversity in an industry, it is sometimes double-whammied by the insurance market. But in this particular situation, the energy environment, we have a very positive buyers’ market. … That’s even over last year.”

Blanquez said general liability in the energy sector is in one of the softest cycles in a while. “The capacity that came into the market when we were in the middle of the oil boom, it’s still there. … But auto has been and will continue to be probably in the next year or two a hardening line. It seems like it gets more and more tight and the prices continue to go up because the claims activity is absolutely continuing to increase,” Blanquez said.

Claims frequency continues to rise but it’s the claim amounts that are really soaring, he said. “The courts are ruling a much higher dollar amount than they were three or four years ago,” he said.

Collado estimated that the loss ratio in commercial auto is running about 140 percent. “Auto is a huge loser because the drivers are hard to find. We’ve even heard of companies asking to get under-aged drivers approved and we’re in some case getting that successfully done,” he said.

With the downturn in oil prices Collado said the number of requests to allow drivers under the age of 18 may go down, but he’s still seeing such requests, especially for lower skilled driving jobs.

The Recovery

While the price per barrel of crude oil hovered around $60 on May 21, no one’s really expecting a recovery to $100 per barrel in the near future.

As to when and how high, “if you get a room of five people you’ll get five different answers,” Blanquez said. “The common thread in the conversations is that it will recover, there’s no doubt that it will. The moving target is, one — how quickly and two — what is the new price going to be, because $100 a barrel-plus that’s not going to happen any time soon.”

But he said a price of $70 per barrel by the end of the year may not be out of reach. “That would be a huge, an awesome recovery. I think everybody in the industry would be happy with $70, compared to where it was,” Blanquez said.

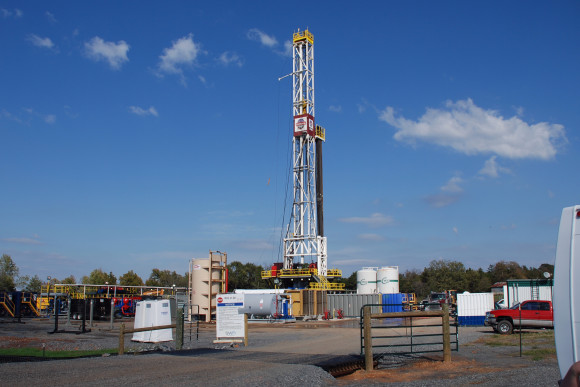

(Photo source: U.S. Geological Survey)

Related:

Was this article valuable?

Here are more articles you may enjoy.

Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial

Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial  Experian Launches Insurance Marketplace App on ChatGPT

Experian Launches Insurance Marketplace App on ChatGPT  CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer

CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer  State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup

State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup