Florida’s questionable claims rose 23 percent from 2010 to 2012, according to the National Insurance Crime Bureau’s (NICB) 2010-2012 Florida questionable claims referral reason analysis.

Questionable claims (QC) are those claims that NICB member insurance companies refer to NICB for closer review and investigation based on one or more indicators of possible fraud. A single claim may contain up to seven referral reasons. NICB analyzes QCs by loss city, core-based statistical area, policy type, loss type, policy and loss type combined and referral reasons.

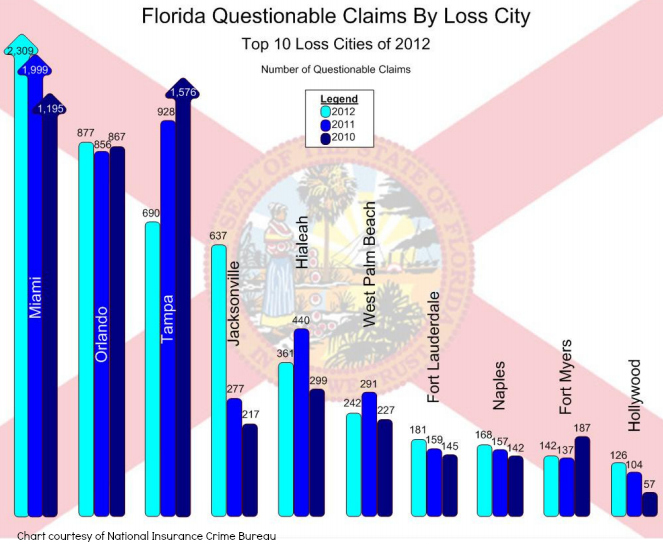

In 2010, there were 8,723 Florida QCs referred to NICB from its member insurance companies. In 2011, the number increased to 9,670 and rose again in 2012 to 10,693 — an increase of 23 percent from 2010’s figure.

The top five cities in Florida generating the most QCs last year were Miami (2,309), Orlando (877), Tampa (690), Jacksonville (637) and Hialeah (361).

The top five core-based statistical areas reporting QCs in Florida last year were Miami-Fort Lauderdale-Pompano Beach (4,686), Tampa-Saint Petersburg-Clearwater (1,260), Orlando-Kissimmee-Sanford (1,211), Jacksonville (748) and Cape Coral-Fort Myers (306). The top five loss types were: personal injury protection, bodily injury, other automobile, collision and property damage.

NICB said it’s important to note that QCs represent a fraction of overall claims traffic. Nationally in 2012, QCs totaled 116,268 out of an overall claims population of more than 70.5 million — or 0.164 percent. The volume of QC referrals can increase or decrease over a given period of time and may be caused by a number of factors, including better reporting by the industry and an increase or decrease in fraudulent activity.

Source: National Insurance Crime Bureau

Was this article valuable?

Here are more articles you may enjoy.

Progressive Set to ‘Maximize’ Growth, Building on Q1

Progressive Set to ‘Maximize’ Growth, Building on Q1  Fannie and Freddie Hit Pause on Replacement-Value Requirements for Home Insurance

Fannie and Freddie Hit Pause on Replacement-Value Requirements for Home Insurance  Worsening Weather Igniting $25 Billion Weather Derivatives Market

Worsening Weather Igniting $25 Billion Weather Derivatives Market  Reserve Strengthening for Casualty Lines Not Over: Moody’s

Reserve Strengthening for Casualty Lines Not Over: Moody’s