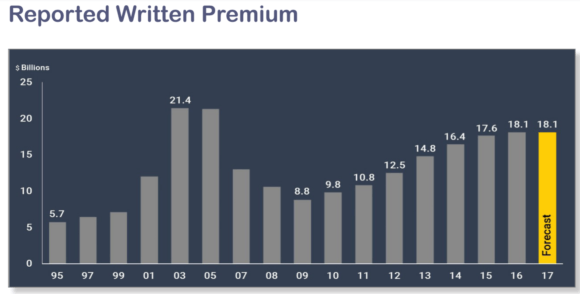

Written premiums from workers’ compensation insurers in California for the year are expected to be flat at $18.1 billion compared with 2016 thanks largely to rate decreases, according to analysts with the Workers’ Compensation Insurance Rating Bureau.

Premiums doubled from 2009 to 2015 along with increasing rates and a growing economy. The rates continued to grow in 2016, but at slower than the double-digit rates of growth experienced in 2010 through 2014, according to the analysts.

Slow to flat growth of written premiums are expected to continue throughout the year.

“Our expectation for ’17 is that growth in the economy will tend to offset lower rates and we’re expecting premiums to come in pretty flat for 2017,” Dave Bellusci, executive vice president and chief actuary of the WCIRB, said on a conference call to discuss a new report out from the bureau.

The WCIRB issued a report that summarizes the state of the California workers’ comp system as of mid-2017. The report highlights the cost of workers’ comp based on premium paid by California employers and how those costs are distributed.

The report also summarizes cost drivers in the system, such as the frequency and cost of claims, and provides a summary of insurer combined loss and expense ratios and returns on equity over time.

While increases in workforce and average wages were the primary drivers of premium growth in 2015 and 2016, recent rate decreases have begun to reduce premium growth, according to the report.

The report states that savings from the state’s workers’ comp reform law, Senate Bill 863, have driven down average insurer rates 15 percent since the first half of 2015. It notes that the insurance commissioner has approved five reductions in advisory pure premium rates since 2015, totaling 27 percent from the Jan. 1, 2015 level.

The WCIRB’s governing committee last week voted to authorize the WCIRB to submit a Jan. 1, 2018 Advisory Pure Premium Rate Filing to the commissioner with rates that average $2.01 per $100 of payroll. That is 14.3 percent less than the industry average filed pure premium rate of $2.34 as of July 1.

Current charged rates are lower on average than those charged in the late 1970s as long-term declining claim frequency has largely offset rising medical costs, according to the report.

The report states that California continues to have the highest rates in the country due largely to the following: high frequency of permanent disability claims; high medical costs per claim; a more prolonged pattern of medical treatments; higher than average costs of handling claims and delivering benefits.

The report draws on a biannual report issued by the Oregon Department of Consumer and Business Services. The last report showed California and New Jersey had the nation’s most expensive workers’ comp rates, while North Dakota had the lowest rates in the nation. California’s rates were 188 percent above the national median, according to that report.

The state may fare better in the next report out of Oregon, as rates have been on the decline, Bellusci noted.

“Since 2015, we’ve seen rates gradually decline,” he said.

He said rates are nearly 15 percent below the rate during first half of 2015, which was $3.04 per $100 of payroll. They are now $2.58.

That may improve California’s standing in the Oregon report, but Bellusci expects the state to continue to have the nation’s highest rate.

“Even at that level (of decline), our expectation is that California is probably the highest cost state in the country,” he said.

The report calls out claims frequency as among the most significant cost drivers in the system, and much of that pressure is coming from the Los Angeles County area, according to Tony Milano, vice president and chief actuary of the WCIRB, who was on the conference call with Bellusci to discuss the report.

“Since 2010, the L.A. county area … has continued to increase in terms of claims frequency while other areas have been flat or declining,” Milano said.

Related:

- Report Shows California and New Jersey Have Highest Workers’ Comp Rates

- California Workers’ Comp Committee Votes for Higher Pure Premium Filing

- Nearly 60% of Payments in California Comp in 2016 Were for Medical Services

- California Commissioner Lowers Workers’ Comp Pure Premium

- California Comp Bureau Testifies on Lower Rates at Pure Premium Hearing

- California Worker’s Comp Governing Committee Votes for Lower Mid-Year Filing

Topics Trends California Carriers Workers' Compensation Oregon

Was this article valuable?

Here are more articles you may enjoy.

Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance

Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance  Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance  Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows

Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows  State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup

State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup