The insurance community has at least two reasons to be interested in a new report on middle market companies, particularly those who are doing business in California.

According to a report released this week from American Express and Dun & Bradstreet, the middle market is becoming an increasingly important sector in the nation’s economy.

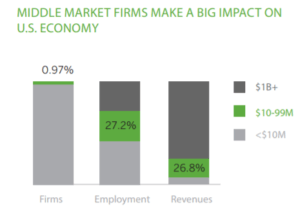

The 179,782 companies that make up the middle market in the U.S. generate a combined $9.3 trillion in revenues, and employ roughly 52.7 million workers in total, the report shows.

California alone has roughly 21,716 middle market companies – defined as between $10 million and $1 billion in annual revenues – which make up slightly less than 1 percent of all firms in the state, according to the report.

That’s a small percentage in a state that’s loaded with $1 billion-plus corporations, but those middle market firms pack an economic punch.

The report shows they contribute more than one-in-four dollars and employ more than a quarter of U.S. workers in the private sector. Overall, middle market firms were also responsible for more than half of the 51.8 million new jobs that have been created in the U.S. since 2011, according to the report.

Geri Stengel, a research advisor for American Express, believes the insurance industry should pay close attention to the report.

The industry over a six-year period studied ranked in the top 5 among all industries in growth rate at 109 percent, she said

And there’s a flipside to take note of. The growth in the middle market equates to selling opportunities for those interested in focusing on that segment.

“Given the fact that middle market firms are responsible for over half of the net new jobs, if I were an insurance provider, I would be going after those middle market firms,” Stengel said.

She said the research shows that middle market firms weathered the recession better and recovered from the recession better than small and large businesses.

According to the report, the overall number of firms declined between 2011 and 2017, but the number of middle market firms nearly doubled, as did revenues at those firms.

“Those companies thrived, not just survived, the period after the recession,” Stengel said.

The recession may be a reason for California’s 13th ranking in overall growth of middle market firms in the report.

Rust Belt states, such as Michigan and Ohio, lost more middle market companies during recession than did California, so those states had a longer way to go toward recovery, Stengel said.

Middle market growth in Michigan and Ohio experienced a triple-digit percentage increase since 2011, putting them in the report’s top 10 for highest growth. Texas, Indiana, Delaware, Illinois, Missouri, Louisiana, North Carolina, and Utah were the others in the top 10.

“I think it’s a reflection of California’s economy and also California has a thriving small business economy,” Stengel said. “They’re still the No. 1 state in terms of overall number of middle market companies, so they are very important to the overall California economy.”

California is among the 10 states where middle market firms have the most headquarters. Others are: Texas; New York; Florida; Illinois; Pennsylvania; Ohio; New Jersey; Michigan; and Georgia. Those are the largest states in terms of population and number of businesses, which may explain the high number of middle market firms.

Nearly one-third of all middle market firms were in manufacturing and wholesale trade, while the growth rate among middle market firms in these two industries more than doubled in the last six years, the report shows.

Middle market firms are also increasingly owned by women. The number of women-owned middle market firms rose more than 119 percent between 2011 and 2017, according to the report.

Topics Trends USA California Commercial Lines Business Insurance Michigan Ohio

Was this article valuable?

Here are more articles you may enjoy.

Zurich Insurance Profit Beats Estimates as CEO Eyes Beazley

Zurich Insurance Profit Beats Estimates as CEO Eyes Beazley  US Supreme Court Rejects Trump’s Global Tariffs

US Supreme Court Rejects Trump’s Global Tariffs  Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’

Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’  Fla. Commissioner Offers Major Changes to Citizens’ Commercial Clearinghouse Plan

Fla. Commissioner Offers Major Changes to Citizens’ Commercial Clearinghouse Plan