The results from a study commissioned by the Vermont Insurance Agents Association (VIAA) show that Vermont’s economy is positively impacted by the state’s independent insurance agencies.

“These phenomenal survey results show the significant economic contributions that Vermont’s independent agents make every day and how the communities where they live and work benefit,” said Mary Eversole, VIAA’s executive director. “Our members know their customers, provide good jobs with longevity, and, unlike direct writers, buy locally.”

The study was conducted by Bertoni Marketing Consulting. Results reveal that principal member agencies of VIAA play a significant role in the Green Mountain State as employers, taxpayers, consumer spenders and charitable contributors.

The study was conducted in May 2013 and 56 percent of VIAA’s membership responded. The survey represented all areas of the state and included agencies of various sizes based on the number of employees. The average age of a respondent was 61 years, and the agencies surveyed were both new and old with a minimum of one year and a maximum of 192 years. All study results are for the year 2012.

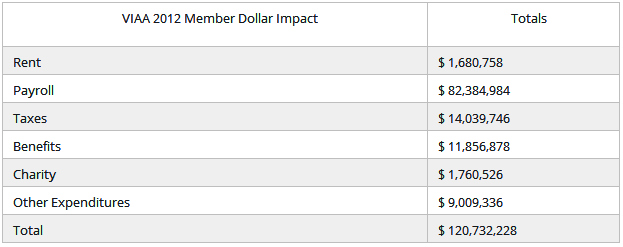

The financial contribution of VIAA’s member agencies in Vermont during 2012 was $120,732,228.

The following is the breakdown of independent agencies’ financial contribution to the state:

Payroll: Among all survey respondents, the average payroll was $876,436 for 2012. Using the payroll and FTE count from survey respondents, estimated pay per FTE was $61,271. The average benefits paid by independent agencies in Vermont were $126,137.

Office Space: Approximately 45 percent of VIAA agencies own their offices followed by 40 percent that rent or lease their space. The total estimated rent paid by independent agencies in Vermont in 2012 was $1,680,758, which provides additional income to local communities throughout the state.

Office Supplies and Services: VIAA members also made significant purchases of new equipment, office supplies, advertising, legal and accounting, repairs and maintenance and remodeling with average expenditures of $95,844. In 2012, more than $9 million was spent by independent insurance agencies in these segments of the economy.

Philanthropy: Independent agents are very involved in their local communities as volunteers along with religious, civic and cultural activities. In 2012 independent agencies contributed more than $1.7 million to charities, with an average of $18,729 per agency. The average charitable contribution by VIAA’s largest agencies (more than 11 employees) was nearly $50,000.

Mature, Well-Established Businesses

The survey found that the majority of agencies are mature, well-established businesses in their communities and 19 percent of the agencies are more than 100 years old. Twenty-one percent of the agencies are between 51-75 years old and 32 percent of the agencies are between 31-40 years old.

In addition to their economic impact, independent insurance agencies also write and service a significant segment of personal and commercial lines insurance written in Vermont. According to the most recent Independent Insurance Agents & Brokers of America (IIABA)/A.M. Best Study, VIAA members also hold more than 51 percent share of the personal lines market in comparison to direct writers that hold a 36.5 percent market share. Independent agents dominate the commercial lines segment at 79 percent market share versus nineteen and one-half percent by direct writers.

Vermont’s independent agency system works closely with domestic carriers that contribute to the vibrant insurance industry, VIAA said.

According to the Vermont Domestic Property and Casualty Companies Association (Union Mutual, Vermont Mutual, Granite Mutual, Vermont Accident, Northern Security, New England Guaranty, Green Mountain, Co-operative Insurance Companies), they employ 360 people, with an average salary of $89,623 and total compensation was over $32 million in 2012. Their premiums represent business done in the state and the money stays in the state. These companies also contribute significantly to Vermont’s tax base with local property taxes of $328,766 and premium taxes of more than $2.6 million paid in 2012.

Source: Vermont Insurance Agents Association

Was this article valuable?

Here are more articles you may enjoy.

Why New York’s Attorney General Objects to Trump’s Bond Insurer

Why New York’s Attorney General Objects to Trump’s Bond Insurer  North Carolina Adjuster and Son Charged With Embezzlement in Roof Jobs

North Carolina Adjuster and Son Charged With Embezzlement in Roof Jobs  Marsh McLennan Agency to Buy Fisher Brown Bottrell for About $316M

Marsh McLennan Agency to Buy Fisher Brown Bottrell for About $316M  4,800 Claims Handled by Unlicensed Adjusters in Florida After Irma, Lawsuit Says

4,800 Claims Handled by Unlicensed Adjusters in Florida After Irma, Lawsuit Says