A new interactive database with extensive information on insurer investments in fossil fuels was unveiled today by California Insurance Commissioner Dave Jones.

Jones released the results of his Climate Risk Carbon Initiative, which include information on the amount of oil, gas, coal and utilities investments held by insurance companies, and whether the insurers have divested from thermal coal, the amount of thermal coal divested and any future commitments to divest.

Jones last January called on insurance companies to voluntarily divest from thermal coal investments and required insurers with more than $100 million in annual premium to disclose publicly their investments in fossil fuels.

Declaring that “climate change is real and it poses risk,” the commissioner held conference call with the media on Wednesday to talk about the results of the disclosure and give a demonstration of the database on the California Department of Insurance website.

“Investments in carbon – oil, gas, coal – face significant potential financial risk from climate change as governments, private companies, and markets continue to move to reduce the burning of carbon,” Jones said. “As a financial regulator, I want to make sure that insurance companies are invested in assets that retain value, not decrease in value, so that insurers have sufficient assets to pay claims.”

Insurers already carefully examine the risk of their investments, said Mark Sektnan, president of the Association of California Insurance Companies, which is part of the Property Casualty Insurers Association of America.

“Basically we’re already doing this stuff,” Sektnan said.

Insurers are required to make high-quality, low-risk investments, and if a carrier determines that fossil fuel or coal is a bad investment then they won’t invest, he said.

He said insurers will continue to invest wisely, and “not likely based on some political agenda.”

While Sektnan believes these type of investments are likely a small part of most insurers’ portfolios, he warned that “anytime there’s regulatory overreach where insurers are being required to take actions that don’t reflect the best interests of their policyholders could be a problem.”

Katie Pettibone, vice president of state affairs for the American Insurance Association’s Western region, issued the following statement:

“Insurers remain committed to addressing all related risks from weather patterns and extreme weather events. Insurers are constantly looking at their investments, analyzing all types of current and future risks – insurers are required via the Risk Management and Own Risk and Solvency Assessment Model Act (ORSA) to employ rigorous risk management disciplines. The risk of stranded assets is not new and is, in fact, an important part of our members’ credit analysis process. AIA and our members will continue to remain engaged with the department on all risks impacting the solvency of the companies and will review the report in greater detail.”

The NAIC has for several years poked into how insurer investments may be impacted by climate change through a risk disclosure survey that has been used in the past to criticize the industry for a lack of preparedness in addressing climate-related risks and opportunities.

Jones is part of a broader push by regulators and some large international insurers to get out of investments in fossil fuels, which they see as not only a good move for the environment but as steering away from investments at risk of being stranded due to a growing interest in renewable energy and a tougher stance by governments on reducing carbon emissions.

Mark Carney, the governor of the Bank of England and the chair of the G20 Financial Stability Board, in a September 2015 speech at Lloyd’s of London issued a strong warning to insurers and the financial services industry about the risk posed by carbon investments.

In his speech Carney said a reduction in burning fossil fuels as outlined by the Intergovernmental Panel on Climate Change to limit global temperature rises to 2 degrees above pre-industrial levels would render the vast majority of oil, gas and coal reserves “literally unburnable without expensive carbon capture technology, which itself alters fossil fuel economics.”

The CDI database enables visitors to search by categories like company name, premium volume, total investment holdings and percentage of fossil fuel investments. Users can generate reports of the top carriers measured by fossil fuel or coal holdings, coal divestment, premium and other criteria.

According to the database, the total fossil fuel investments reported by insurers is $520.7 billion – $424.6 billion by life insurers and $73.3 billion by property/casualty insurers.

Insurers have already divested more than $4 billion in thermal coal and other fossil fuel investments, and have committed to disposing of an additional $881 million in thermal coal investments, according to Jones.

The data also showed that 670 companies divested some or all of their coal holdings, or had no coal holdings to divest, and 325 companies acknowledged that they would refrain from making future investments in thermal coal.

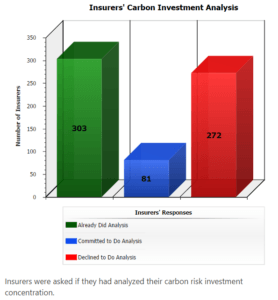

The database contains several interactive graphics, such as bar and pie charts. Users can click on a chart to see, for example, an insurer analyses their carbon investments. A bar chart shows 303 insurers already conducted an analysis, while 81 have committed to do an analysis and 272 declined to do an analysis.

Users can click on any one of those bars and get a list of insurers in that particular category. The list includes information like the results of the department questionnaire, total premium, fossil fuel investments, coal divested.

Other breakdowns include insurers responses to Jones’ request to voluntarily divest from thermal coal – 604 reported no coal to divest, 66 divested some or all coal while 537 did not agree to divest coal.

Individual carriers are searchable by company name or National Association of Insurance Commissioners number. Insurers can also be searched by categories like top total premium, top assets under management, top coal invested and top insurers by amount of coal divested.

Ceres, a sustainability leadership advocate, praised the new database and Jones’ call for divestments.

“Clearly Commissioner Jones and the California DOI have once again shown their leadership on climate risk disclosure,” said Cynthia McHale, director of the Ceres insurance program. “They are a leader within the United States and they are a leader globally.”

McHale, who has been speaking with insurers about their investments and the climate for several years, believes that not all insurers are looking at their risk from investing in fossil fuels.

“I’m sure they are looking at their investments. Insurance companies are very sophisticated investors,” she said, adding that divesting from coal examining fossil fuel holdings is not the norm for many carriers. “I’m sure maybe some insurance companies are doing that, I’m not of the understanding that most insurance companies are analyzing those issues deeply.”

Jones and his battle against climate change may be far from over.

“We’re not done yet,” Jones said on the media call.

He said the department will use the data being gathered when conducting independent exams of insurance companies.

“We encourage other regulators to use this data as well,” he added.

He also commended insurance companies that are engaged in divesting from coal and examining their carbon-based investments.

“The results are very positive for the number of insurance companies that announced they are divesting and the number of insurance companies that they are analyzing or will analyze these risks,” Jones said.

Related: