American agriculture 15 years from now will be a vital, more profitable sector of the economy, successfully competing with foreign commodities, according to a new report released by the American Farm Bureau Federation.

The report said tomorrow’s farmers and ranchers will receive greater recognition for their efforts to conserve natural resources and use environmentally friendly technologies, while still providing consumers with the world’s safest and most abundant food supply.

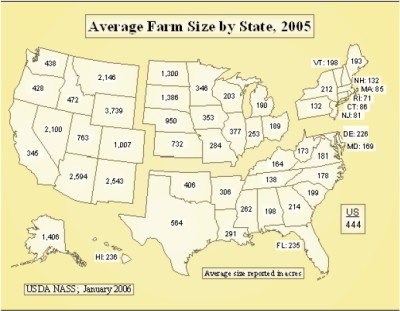

To some extent, today’s farmers are already sowing that path. “The size of farms are increasing, and the amount of equipment and values are continuing to increase as the average farm size increases,” said Chris Leliaert, vice president of Towers Perrin in Chicago and keynote speaker for the 19th Annual Agribusiness Conference sponsored by the Insurance Skills Center and being held March 15-16 in Sacramento, Calif. “As the size and value of farms increase, it creates significant exposure in regard to farms and agribusiness … With bigger equipment and larger farms, the insurance industry has had to react to that and write more capacity and broader coverages to reflect the change in exposure. The general liability versus straight farm liability is becoming more commonplace in the industry,” he said.

Cultivating coverages

There are generally two categories that insurers are concerned with regarding agriculture and farming. “With farm insurance, you’re insuring the farm. With agribusiness, you’re talking about once the product leaves the farm until it gets to the table,” said Nicolas Seperas, marketing and event management director for the Insurance Skills Center. “Anything from transportation risks, warehouse and processors, seed distributors, growers–just the whole line of taking goods that originated from the farm and are taken to the consumer–is agribusiness,” he explained.

With farming, farmers want their crops to be insured from both a production and revenue standpoint, said Dale Miller, senior risk management specialist for the United States Department of Agriculture Risk Management Agency. “One trend we’ve been noticing for the past five years or so is the desire for farmers to find a program that guarantees production level and revenue potential on a crop basis. Therefore, if production is lower or the price of cherries goes down that affects revenue; it could come into a claims perspective.”

From field to fork

One exposure area with regard to farming and agribusiness concerns food safety. Throughout the food chain, there has been more attention to food safety within the past five years because there’s more worry about how an outbreak of illness could cost growers and wholesale buyers millions of dollars. Eating produce contaminated by salmonella, E. coli or other bacteria can lead to stomach cramps, hospital stays and, in extreme cases, death.

Thus, fruit and vegetable growers are tracking products and training workers to ensure their fresh green beans, tomatoes and peaches are safe to eat, driven by demands from the grocery chains they supply and shoppers at their markets.

Big retailers such as Wal-Mart are encouraging growers to embrace new technology that allows them to more closely track produce with bar codes and scanners. Growers are using bilingual videos and posters to train seasonal workers on proper hygiene. Some small farms are treating the water they use to scrub veggies.

Two years ago, a hepatitis outbreak traced to Mexican-grown green onions sickened 600 people and killed four who ate at a Chi-Chi’s restaurant near Pittsburgh. The restaurant chain settled hundreds of lawsuits for more than $21 million. A few more lawsuits are pending.

About 12 percent of food borne illnesses in the 1990s were blamed on fresh produce, up from 4 percent in the 1980s, the Centers for Disease Control and Prevention estimated. Some retailers require independent auditors to check over growers and their safety habits. Yet for most growers, a renewed emphasis on food safety has created little change in the ways they pick, wash, pack and ship produce.

“You’re inspected by your customers. That probably keeps you on your toes as much as anything,” said John Wargowsky, executive director of Mid American Ag and Hort Services, whose organization works with Indiana and Ohio growers on food safety.

The public awareness about food safety also has created relatively little change for insurers, Leliaert said. “There’s obviously more concern today with regard to food safety because of public awareness, but we have very safe food in this country,” he said.

Entertaining at the farm

On the other hand, one area of growing concern for insurers, is agro-tourism, or agri-tainment. The terms basically refer to “when people go out to farms for various issues, such as to pick their own strawberries, have a hay ride, go out to the pumpkin fields, and other things of that nature,” said Casey Roberts, one of two co-chairs for agribusiness for the Insurance Skills Center, and commercial sales and marketing manager for Northwest Insurance Agency in Santa Rosa, Calif. Agro-tourism could be “anything like a cut your own tree farm, wineries and vineyards, corn mazes, and even bed and breakfasts that offer an agricultural tie-in,” Seperas added.

To supplement their incomes, many farmers have been opening up their properties to the public, Leliaert said. “A high percentage of the population lives in urban versus rural areas, and people want to have their country experience. Such farms have very significant exposures because they have a lot of people from the public on farm premises. And there are many things that could go wrong, dealing with livestock and equipment.”

“One of the things we are concerned with is when the farmer starts engaging in risks beyond standard farm exposures is how can we best address that?” Roberts noted. For example, a farm that opens its facilities to the public might need additional liability coverage because there’s more potential for the public to become injured.

“Most agri-tainment writing under the general liability policy has moved from standard to surplus lines carrier to get a significant higher premium to reflect that exposure,” according to Leliaert. Yet despite the potential risks at farms, the market is an attractive business.

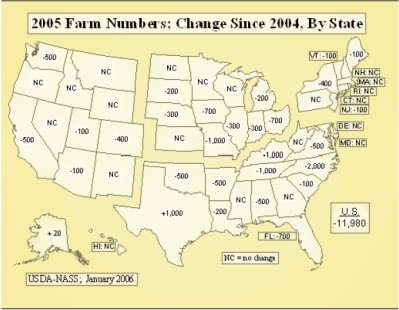

In the next 15 years, the American Farm Bureau Federation survey predicts government support for agriculture will look very different and global trade will drive agricultural profitability. Also, farmers will be more dependent on rural communities, but those communities will be less dependent on agriculture. America will have fewer farms producing a larger percentage of U.S. food and fiber, but there will be more small farms. Market forces will drive environmental practices. And technology will be more global in scope.

American agriculture is a “powerhouse producer,” said Edwin Raak of Michigan. That success has made the market more competitive, Insurance Skills Center’s Roberts added. “In my opinion, it’s a stable marketplace that, for the most part, has traditionally been profitable for carriers that have experience in it–and other carriers have noticed.”

Topics Agribusiness

Was this article valuable?

Here are more articles you may enjoy.

Zurich Insurance Profit Beats Estimates as CEO Eyes Beazley

Zurich Insurance Profit Beats Estimates as CEO Eyes Beazley  Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance  World’s Growing Civil Unrest Has an Insurance Sting

World’s Growing Civil Unrest Has an Insurance Sting