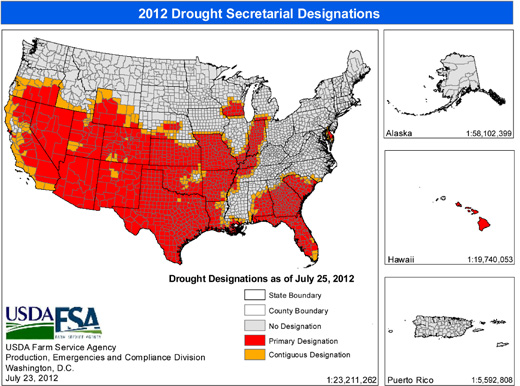

U.S. crops are taking a beating in the worst drought since 1988 but most farmers are not sweating like they did 24 years ago when a drought hit as they were just starting to recover from a farm depression that brought down a big slice of the Midwestern economy.

While financial losses from the 2012 drought in the world’s largest food exporting nation will no doubt top the $40 billion of losses in 1988 — an inflation-adjusted $78 billion today — U.S. farmers face this drought in their strongest financial position in history, buoyed by less debt, record-high grain and land prices, plus greater production and exports, according to agriculture bankers, farm managers and economists.

In addition, much stronger crop and livestock insurance programs than in 1988 will make a huge difference — and some farmers, by collecting insurance but selling remaining harvests at record prices, may even come out ahead of last year, economists say.

Hardest hit will be the dairy, beef, hog, poultry and fish farmers squeezed by soaring feed costs. But they too are better insured than 24 years ago.

“The farm economy is much healthier than it was in 1988,” said Dave Miller, director of commodity research for the Iowa Farm Bureau. “We were coming out of the farm crisis. You had an extended period of low prices for grains, particularly 1985, ’86, ’87.”

In 2011, U.S. farm income totaled $98.1 billion, a record high — even with significant crop and pasture losses from drought in Texas and other states. U.S. farmer assets are estimated at $2.2 trillion for 2012, with a debt-to-asset ratio of 10.3. In 1988, farm assets totaled $655 billion and the debt-to-asset ratio was 16.9.

Jim Farrell, chief executive of Farmers National Company of Omaha, noted that grain farm balance sheets and much better crop insurance will be keys this time around.

According to the U.S. Agriculture Department’s Risk Management Agency, in 1988 only 55.8 million acres of corn, soybeans, wheat and other crops were covered by crop insurance. A total of $1.1 billion in indemnities were paid. By contrast, in 2011 a total of 265.4 million acres of U.S. crops were insured with payouts of $10.8 billion.

RMA said total 2012 participation data will not be known until later this year. But farm economists and advisers said they expected that cash-rich farmers insured at least as many grain acres as last year.

Farrell said a key beneficial change in crop insurance has been the shift to price-based payouts on liabilities, instead of just percentage of average production.

“We have a component to determine the fall price for our corn and soybean crops for the insurance, so if the markets continue to go up our coverage goes up with those prices. In 1988 we didn’t have that. The price was fixed and the only thing that varied was how poor your crop was,” Farrell said, contrasting this to the more flexible insurance available in 2012.

“The guaranteed price in the spring for corn was nationally $5.68 and soybeans $12.55. If the fall price is higher, you can take advantage,” Farrell said.

Topics USA Agribusiness

Was this article valuable?

Here are more articles you may enjoy.

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance  State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup

State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup  US Supreme Court Rejects Trump’s Global Tariffs

US Supreme Court Rejects Trump’s Global Tariffs  AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’