What’s the big deal with a hard property/casualty insurance market?

Everyone likes one, said Art Davis, president of Colony Specialty, a member of the Argo Group. “You make a lot of money, have good returns.”

The problem is, Davis said during a presentation at the Texas Surplus Lines Association’s mid-year meeting in Whistler, B.C., they don’t happen very often and they don’t last very long. The market turns and it’s suddenly a buyers’ market. The prices come down and there are no significant events to stop the freefall.

At that point, Davis said, we as an industry “may overshoot. No kidding, we always overshoot, we always give away too much. Until we get to the part of the cycle where capital flees because we don’t have any returns … Until we get to that point where we say we can’t take it anymore.”

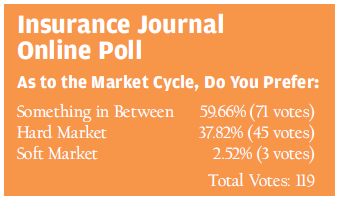

While it may be tempting to look at the hard market portion of the property/casualty insurance cycle as being equivalent to its soft market counterpart, that’s not the case. And, there are periods of transition between the two extremes, he said.

“The hard market is a very, very small portion of the cycle,” Davis said. “From 1970 to 2012 we had three hard markets. They lasted about three years each.”

Life was good during those times, but hard markets are difficult to sustain and they may ultimately be damaging.

“A hard market is actually kind of destructive. As much as we enjoy the good times, they’re not really required for prosperity,” he said.

The industry experienced a firm market in 2012 – 2013, not a hard one.

“Companies are making money … it seems to be a pretty healthy market right now. We haven’t hit that bottom area where we get destructive,” Davis said.

Things are getting a bit more challenging, though. After holding firm on pricing, reinsurers now are lowering prices pretty significantly, he said. “At the end of last year the reinsurers were all saying to us … ‘no, we’re going to hold our line. … We need to be responsible and we’re not giving up rate.’ Then came one month and boom! Prices dropped … and they continue to drop.”

Davis said he expects reinsurance prices to drop 15 to 20 percent. When the pricing declines “get to us as primary insurers what do we do with it? We tend to give it all back.”

What would it take to trigger another hard market?

Some are “predicting a $100 billion event would be required to change to a hard market. I’m not sure a hard market is worth that,” Davis said. He added that he’s also not certain a $100 billion event would do it.

He did say, for those still longing for a hard market no matter how destructive it may be, it’s been “14 years since the last one, so you can look for the next hard market in 2019.”

Topics Trends Pricing Trends Market

Was this article valuable?

Here are more articles you may enjoy.

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance  World’s Growing Civil Unrest Has an Insurance Sting

World’s Growing Civil Unrest Has an Insurance Sting  Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows

Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows  State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup

State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup