From 2002 through 2013 property/casualty insurers paid out $54 billion in claims losses on almost 9 million residential properties, but the majority of those losses occurred between 2008 and 2013, according to a report released in August 2014 by Verisk Insurance Solutions – Underwriting.

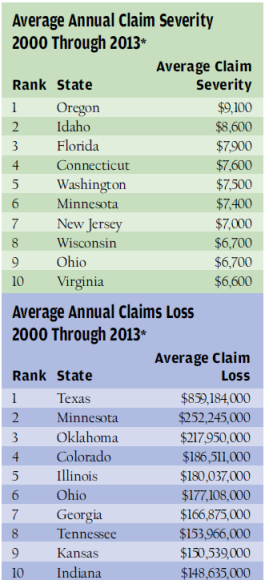

The highest average hail claim losses per year occurred in the Midwest and the so-called “Hail Alley” states, but that’s not the case with average annual claim severity.

In the report, “Property Hail Claims in the United States: 2000-2013,” Verisk analyzed data from its A-PLUS property loss database, which includes 95 percent of claims paid by U.S. homeowners insurers.

Nearly 70 percent of losses during the study period occurred during the final six years. Likewise, during that time the average claim severity was 65 percent higher than it was from 2000 through 2007, according to the report.

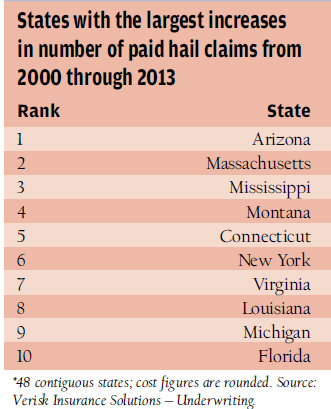

The analysis found that not only are hail claims increasing, they are getting more expensive. It also reveals that the increase in the number of claims and the increase in average claim severity are not necessarily geographically related.

Two Midwest states — Minnesota and Ohio — are found on the report’s “top 10” lists for average annual claims loss and for average claim severity. While Texas held the top spot for average annual claim loss during the 14-year period, Oregon ranked No. 1 for average annual claim severity.

Minnesota was one of the top three states for total catastrophe losses in three of the past seven years. The state also has the second-highest average annual hail claims loss since 2000 and the sixth-highest average hail claim severity. Higher roof replacement costs in Minnesota may account for some of the comparatively high hail claim loss in the state. The report states that “a complete roof replacement in Minnesota costs about 20 percent more than a similar roof replacement in Texas.”

None of the states on the top 10 list for average annual loss ranked in the top 10 list of states with the largest increases in the number of paid hail claims. Connecticut, Florida and Virginia appeared on both the top 10 claim severity list and the one for increased annual paid claims.

Topics Trends Profit Loss Claims

Was this article valuable?

Here are more articles you may enjoy.

Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial

Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial  AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’

Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’  Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows

Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows