Creating a business plan does not have to be a daunting task. Yet, only about 15 percent of agencies have a written plan or track to follow, according to a recent agency survey.

Now is a good time to plan for the coming year by reflecting on how the agency has been operating during the past year. Operations may need to be restructured to the way it should be run in the coming year, especially with the continuing soft market. What better way to start off the New Year than with a short and concise business plan?

Planning ahead requires an understanding of where you are now, how you got there, what works and what does not work. Once the current status is defined, then a roadmap to the future can be drawn. The rule of this game is to keep it simple.

Developing a business plan will help you be successful, stay on track, and provide you with direction during both difficult economic and fruitful times.

The business plan will help you figure out where you are now, and where you need to go. It also will help you outline your resources, providing you with an honest assessment of yourself and your business. The process should be kept simple to be useful and straightforward. Our simple planning techniques can be completed in less than a day.

Steps to Plan

- Write down what you want your revenues to be in one, three, five and 10 years, and your profit!

- Define what your firm is the best at, and what your biggest bang for your buck is (i.e., which niches or lines make the most money).

- What activities get you and your people off track (eat up your time)?

- Can you stop this?

- Delegate to others? Called staff stratification.

- Or limit when you do this (i.e. emails, filing, busywork)?

- What opportunities do you have?

To know what your opportunities are, you must first review the agency’s performance and analyze five areas of primary focus:

- Book of business;

- Sales;

- Financial performance;

- Employee productivity; and

- Market relationships.

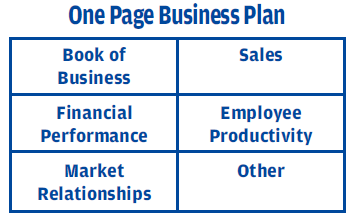

Using a single sheet of paper, draw a vertical line down the middle and two horizontal lines to split the page into thirds. The paper will have six equal size boxes. Prioritize the list of five areas of primary focus (book of business, sales, etc.). Write the top two topics on the top of the top two boxes, the next two topics on the top of the middle boxes and the fifth topic on the top of the lower left box. Leave the lower right box blank at this point. Now start planning!

Book of Business Composition

It is valuable to examine the composition of an agency’s book of business once a year. This is a great starting point because it defines the agency’s “personality.” The personality of an agency in turn will define what to expect in the other primary areas in the review process.

Sales Review

It is important to review new sales for the agency overall, and for each producer. An experienced producer in a typical agency should generate at least $40,000 to $75,000 in new commission dollars each year, depending on the size of book. For large firms with large accounts, the amount could be much higher.

The hit ratio for each producer needs to be determined. Hit ratios less than 25 percent to 33 percent cost the agency time and money.

Financial Analysis

The beginning of the year is also a great time to check the agency’s financial performance. It is relatively easy and it will need to be done for taxes anyway. For the financial review, income statements and balance sheets are needed. Don’t forget to obtain the summary accounts receivable and account payable reports.

First look at the changes in revenue and expenses compared to prior years. Have they gone up or down? What is the percentage of the change in each category? If there are major changes, what was the reason? Sometimes the change is because of a non-recurring event or a discretionary item.

Productivity Analysis

The next area to look at is employee productivity. The following information is needed: 1) an employee list, including the percentage of time each employee (and owners) spends on production, service, administration and management; 2) compensation for each employee; and 3) commissions and number of accounts each CSR handles.

It is important to begin the review with the big picture. Calculate revenue per employee, per CSR, and per owner/producer.

Market Relations

If the current never-ending soft market does or does not continue, insurance carriers may make some changes, such as changing profit sharing agreements, tightening up or loosening some underwriting, or pulling out of certain markets. Today’s agents and brokers need to have a clear understanding of what the carriers can do for them and how this fits into the overall agency plan.

Run a list of all of the carriers with volumes, commission rates (or commissions), loss ratios and contingents received. Analyze how the agency’s book of business stacks up with the existing markets. Compare all the insurance carriers and their products against what the agency has with the top five or 10 industry groups the agency writes. Then, most importantly, communicate your plan with them and get their input … markets love this!

The Final Ingredient

The last box can be used to write out the goals for any other key area for the agency. This could include automation, personnel changes, workflow issues or management issues.

Communicate the Plan

It is important to share these goals with middle management, producers, and the service and administrative staff. How can they help the firm reach its goals, if they don’t know what they are? This is a common complaint from agency staff; they want the communication of goals, plans by management and also rewards given to them individually, if they assist the firm in getting there.

Why You Need to Do This

Competition is keen. The continued soft market cycle continues to cause havoc, and agency value is at stake. This annual planning process and self-assessment is the key to success. If management does not know where they are, how can they possibly plan for tomorrow and know how to get there? Agencies without a plan are totally reactive to their environment and have little control over their future.

This simple planning technique can be done in less than a day. Through delegation, if time permits, each box in this plan can be expanded into several pages of a complete business plan. The beauty of the one-page plan is that it can be kept in management’s day planner and scanned for easy reference. Business plans need to be reviewed at least once a quarter.

Oak & Associates suggests an offsite planning meeting held at least once a year. Having an independent third-party facilitator also can assist in achieving this plan more quickly, letting others be involved in the brainstorming of the plan and having employee involvement to help the firm reach its goals.

The man without a plan is simply lost, like a rudderless ship. Make a choice. Take the time to plan ahead and be successful.

End Results & Benefits of Planning

- You will know exactly how you want your business to grow in 2013.

- You know how you could easily differentiate yourself from the competition.

- You could focus your firm’s sales efforts to make the most money, efficiently and effortlessly.

- Knowing all this can help you make daily decisions on what you do every day that comes your way.

- It focuses you on the best use of you and your firm.

- It gets your team on board because the direction is clear, especially if you provide rewards for them to follow the plan.

- You feel good that you are taking charge of your direction!

Was this article valuable?

Here are more articles you may enjoy.

Former Congressman Charged After Collision with State Trooper in Florida

Former Congressman Charged After Collision with State Trooper in Florida  Marsh McLennan Agency to Buy Fisher Brown Bottrell for About $316M

Marsh McLennan Agency to Buy Fisher Brown Bottrell for About $316M  GM Ends OnStar Driver Safety Program After Privacy Complaints

GM Ends OnStar Driver Safety Program After Privacy Complaints  AIG General Insurance Chairman McElroy to Retire May 1

AIG General Insurance Chairman McElroy to Retire May 1