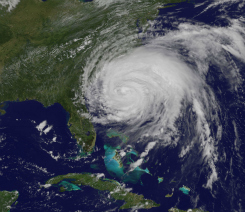

As the Atlantic hurricane season approaches, Maryland’s insurance regulators are asking homeowners, “Do you know what your homeowners insurance policy covers if your property is damaged?”

The Atlantic hurricane season will officially get underway this Friday, June 1.

Last August, Hurricane Irene caused more than $400 million in damage in Maryland. After the skies cleared, many Marylanders who filed claims learned that special deductibles applied, regulators said.

Flood insurance is available through the National Flood Insurance Program and some private insurers. Generally, there is a 30-day waiting period before new policies take effect.

Regulators are advising homeowners to avoid getting caught off guard. During National Hurricane Preparedness Week, which runs May 27 through June 2, Maryland’s Insurance Commissioner Therese Goldsmith is encouraging all Marylanders to read their insurance policies carefully.

The Maryland Insurance Administration offers guides and general information about insurance coverage at community outreach events and online, at www.MdInsurance.state.md.us. Further, insurance agents can help to explain specifically what is covered by the homeowners policy and what is not.

Some ways to prepare for disaster include:

• Inventory one’s home. Whenever possible, take photos or videos to support any claim one may need to file later. Smart phone users can download a free home inventory application, myHOME Scr.APP.book, from the National Association of Insurance Commissioners.

• Determine if the home is insured to its full replacement cost.

• Keep the policy information in a waterproof, fireproof safe or off-site, such as in a safe deposit box. Or scan it and save it to a flash drive and keep it in an emergency kit.

• Consider purchasing flood insurance. Coverage is as low as $129 a year. Visit www.FloodSmart.gov or call 1-888-379-9531 for more information.

Topics Catastrophe Natural Disasters Flood Hurricane Homeowners Maryland

Was this article valuable?

Here are more articles you may enjoy.

Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows

Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows  Zurich Insurance Profit Beats Estimates as CEO Eyes Beazley

Zurich Insurance Profit Beats Estimates as CEO Eyes Beazley  Palantir Decamps to Miami Co-Working Space in Surprise Move

Palantir Decamps to Miami Co-Working Space in Surprise Move  Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance