Mitt Romney wants to change the U.S. tax code’s treatment of healthcare costs, but his vice presidential pick is one step ahead: Paul Ryan has proposed a plan to scrap a generations-old tax break enjoyed by millions of Americans.

While much attention has been focused on Ryan’s proposals for changing the Medicare health plan for the elderly, the tax healthcare exclusion affects three times as many Americans and is one of the costliest tax breaks at up to $200 billion a year.

Most working Americans today get their health insurance through their employers and pay no taxes on the benefits. But self-employed people have to get healthcare on the open market, a situation that Romney has framed as unfair.

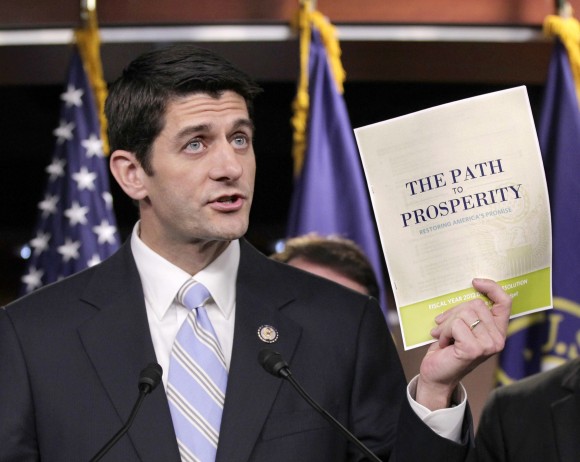

Ryan, pegged four days ago as Romney’s running mate in the U.S. presidential election, had advocated moving away from the employer-based system and adopting a set of capped tax credits that Americans would get to cover their healthcare costs.

“At the heart of the problem is the federal tax exclusion for employer-provided health coverage,” Ryan wrote in a 2010 policy document. “Ownership of health insurance must be shifted away from third parties to those who are actually using it.”

The Ryan campaign did not respond to a request for comment.

The tax exclusion for employer-provided healthcare costs the U.S. Treasury in the range of $100 billion and $200 billion a year. That makes it one of the biggest tax breaks, along with the deductions for mortgage interest and charitable giving.

Since former Massachusetts Governor Romney has been vague on the subject, Democrats have been only too eager to use Ryan’s ideas to fill in the blanks before the Nov. 6 election.

The healthcare tax exclusion “is the backbone of how we cover 150 million Americans in our healthcare system,” said Neera Tanden, president of the liberal Center for American Progress and top domestic adviser to Obama during his 2008 campaign. She called Ryan’s credits proposal a “radical” change.

STUCK WITH MORE OF THE BILL

Ryan has proposed the credits in several venues, including his 2010 policy manifesto, the “A Roadmap for America’s Future.”

Moving away from the tax exclusion could raise healthcare costs for workers if, instead, they were to get tax credit, even some backers of the plan say.

“If you were sicker you’d be stuck with more of the bill,” said Will McBride, an economist with Tax Foundation, which backs market-based policies. “That is where the efficiency comes from; it puts a cap on the subsidy.”

Ryan’s plan sets up high-risk pools at the state level to help those who may be denied coverage because of pre-existing conditions like cancer, but costs could still rise for some sicker patients under the tax credits approach.

Many conservative policy experts favor the tax credit idea, in the belief that making consumers pay more of their healthcare expenses will curb health cost inflation. Health care spending has been rising faster than overall inflation for many years and was a major driver of the historic 2010 healthcare overhaul backed by President Barack Obama’s and his fellow Democrats.

Most Republican lawmakers want to repeal that law, which they derisively call “Obamacare.” Romney agrees, but has not spelled out how he would handle the healthcare tax exclusion.

“What I would do is level the playing field and say individuals can buy insurance on the same tax-advantaged basis that businesses can buy insurance,” Romney said at a campaign event in Orlando in June.

More broadly, Romney told Fortune magazine in an interview this week he wants to “preserve tax preferences for middle-income taxpayers such as homeownership, charitable giving and healthcare.”

Avik Roy, a Romney adviser and a fellow at the Manhattan Institute think tank, predicted the candidate would likely back proposals similar to those offered by Ryan. “I would expect if the Romney administration were in power and something along these lines came out, then Romney would sign it,” said Roy, who stressed he was not speaking for the campaign.

CAPPED CREDIT

The fact that about two-thirds of non-elderly Americans obtain health insurance through their employment is an artifact of history, dating to the World War II era.

Under the system, individuals who work for employers without health coverage must fend for themselves in the individual market, where they lack the buying clout to get a good deal and where patient protections are weaker.

Individuals without workplace coverage can deduct health care costs, but only if they exceed 7.5 percent of a person’s income – a high bar that most individuals do not reach.

Ryan’s plan would give a tax credit of $2,300 for individuals and $5,700 for families to pay for healthcare coverage, according to Ryan’s Roadmap.

Patients could apply the credit to employer plans and companies could still claim the benefit as a business expense.

An advantage of the system would be that it could provide universal access and let patients shop for coverage.

However, former Obama adviser Tanden said the credits would not cover all medical costs, so more people would be uninsured.

DEMOCRATS’ ANSWER

The Democrat’s answer to the problem of self-employed people relying on the open market is in Obama’s healthcare law, which tightens regulation of insurers and sets up a new system of marketplace “exchanges” to give patients more buying power.

It also includes a so-called Cadillac tax on health plans with costly and generous coverage. That tax penalizes insurers with a 40 percent tax on the annual value of plans exceeding $10,200 for individuals and $27,500 for families, set to take effect in 2018.

Republican economist Douglas Holtz-Eakin said Democrats have criticized similar proposals in the past, but they believe the tax break is too generous as well, evidenced by their Cadillac tax.

“It will always be a frustration of mine,” said Holtz-Eakin, an architect of 2008 Republican presidential candidate John McCain’s health plan.

Was this article valuable?

Here are more articles you may enjoy.

Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial

Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial  Former Broker, Co-Defendant Sentenced to 20 Years in Fraudulent ACA Sign-Ups

Former Broker, Co-Defendant Sentenced to 20 Years in Fraudulent ACA Sign-Ups  State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup

State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup  Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers