On October 29, 2012, when Hurricane Sandy made landfall along the northeast coast—a year to the day since the last northeastern superstorm and fourteen months since Hurricane Irene — the wind speeds recorded by the National Weather Service indicated the storm had diminished to “merely” a tropical storm.

While this technical distinction between hurricane and tropical storm made little difference for the people unfortunate enough to be in the path of Sandy’s storm surge, it appears to have created significant financial implications for homeowners, businesses, and the property insurers who protect them.

Through executive orders and press releases, governors from several states ordered property insurers to waive the hurricane deductibles in property policies covering the damage associated with Sandy.

For the property owner, the no-hurricane-deductible order lessens some of the financial burden associated with Sandy by shifting a portion of the claim costs back to its insurer. For the insurer, the no-hurricane-deductible order would impose a greater financial loss than contemplated since the coverage offered no longer coincides with the deductible credits charged on the policy.

In this article, we present a series of scenarios and descriptive information on the relationship among the insured value, the covered loss, and deductibles for a property policy. We also offer commentary along with estimates of the impact of removing hurricane deductibles from such property policies.

Being a highly regulated industry, states have the authority to determine whether conditions pertaining to a specific weather event warrant the adherence to or avoidance of hurricane deductibles. These executive decisions regarding Sandy will be a significant issue for insurers and consumers in these states and may come to define the insurance discussion in the coming weeks.

Types of Property Deductibles

There are two common types of deductibles for property policies. In the present discussion, the reference to “property policies” is meant to include homeowners policies and policies for commercial property.

There is an “all perils” deductible, which is typically expressed as a flat dollar amount such as $500 or $1,000, and there is a wind, hurricane, or tropical cyclone deductible, which is typically a fixed dollar deductible or expressed as a percentage of the insured value—commonly up to 5 percent.(In some discussions, a distinction is made between hurricane deductibles, which apply to damage solely from hurricanes, and windstorm or wind/hail deductibles, which apply to any kind of wind damage.)

For these latter policies, there will be an “all other perils” deductible that applies to non-wind, hurricane, tropical cyclone peril losses.

By assuming responsibility for a portion of the loss, policyholders have an incentive to take actions protecting their homes or businesses that will mitigate the total economic loss from an unforeseen event. These mitigating actions might include installing storm-doors or special windows that can withstand high winds, a roof that can withstand high winds, and exterior doors with reinforced jams.

By reducing its financial exposure to a covered loss, the insurer can reduce the rate charged for the insurance coverage, and the amount of the reduction will be directly related to the size of the deductible. It is common for the windstorm underwriting associations to write policies with a fixed-amount or percentage deductible for named storms.

Six Scenarios for Property Deductibles

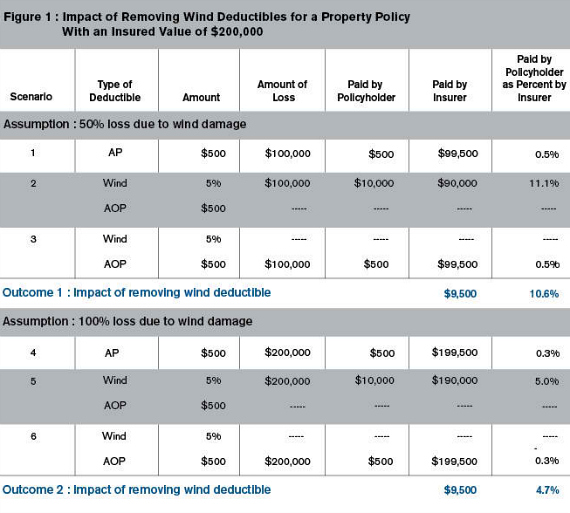

We developed six scenarios based on two assumed levels of loss, to illustrate the manner in which the presence or absence of hurricane deductibles might affect insured losses.

The table in Figure 1 outlines these scenarios, presenting the amounts paid by the policyholder and by the insurer. Under both assumptions, the insured value is $200,000.(Property policies typically cover the replacement value of the damaged property, which is less than the total value of the insured property. As of Sept. 2012, Zillow, an online real estate database, reported an average of $260,200 for single-family homes in New Jersey. An insured value of $200,000 would be a 75 percent replacement value for the average.)

The first three scenarios assume a 50 percent loss of the insured value; the last three scenarios assume a 100 percent loss of the insured value.

• For Scenario 1, there is a $500 standard all-perils deductible. For a $100,000 windstorm loss (50 percent of the insured value of $200,000), the policyholder would pay $500, the insurer would pay $99,500, and the deductible (the amount paid by the policyholder) would account for 0.5 percent of the amount paid by the insurer.

• For Scenario 2, there is a 5 percent wind deductible and a $500 deductible for all other perils (AOP). For the same $100,000 windstorm loss, the policyholder would pay $10,000, the insurer would pay $90,000 and the deductible would account for 11.1 percent of the amount paid by the insurer.

• Scenario 3 presents the same circumstances as Scenario 2, except the 5 percent wind deductible is disallowed and the $500 AOP deductible would be applied. Disallowing the wind deductible produces the same results as the $500 deductible policy under Scenario 1: the policyholder would pay $500, the insurer would pay $99,500, and the deductible would account for 0.5 percent of the amount paid by the insurer.

Removing the 5 percent wind deductible from the policy shifts $9,500 of the loss from the policyholder to the insurer. This shift increases the amount of losses paid by the insurer by 10.6 percent (from $90,000 to $99,500).

The three scenarios in the bottom half of Figure 1 follow the same line of reasoning but assume there was a 100 percent loss to the $200,000 insured value. Scenarios 4-6 use the same assumptions for the all perils, wind, and AOP deductibles that were used for Scenarios 1-3.

Under Scenario 4, the $500 standard all-perils deductible would account for 0.3 percent of the amount paid by the insurer. Under Scenarios 5 and 6, the removal of the 5 percent wind deductible shifts $9,500 in payments from the policyholder to the insurer. In this case, the shift would cause a 4.7 percent increase in the payment by the insurer; that is, the removal of the 5 percent wind deductible would increase the payments from $190,000 to $199,500, for a 4.7 percent increase in the amount paid by the insurer.

Impact of Removing Wind Deductibles on Insured Losses

In the preceding section, we found that removing the wind deductible could increase the amounts paid by insurers by 4.7 percent and 10.6 percent. These percentages take on increased significance when viewed in the context of total insured losses for Sandy.

Catastrophe modeling firm Eqecat recently predicted that the estimated losses for Sandy will be between $30 billion and $50 billion, with insured losses between $10 billion and $20 billion. While some insurers have been cautious to place an estimate on the insured losses, two weeks after the storm one major insurer (QBE) has predicted that insured losses will be in excess of $20 billion.

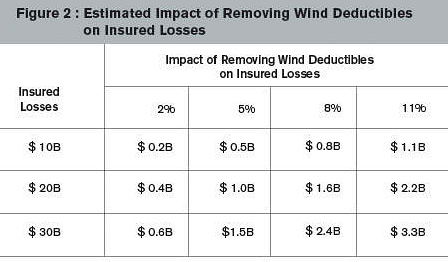

Given the uncertainty over the eventual insured losses, in the following analysis we assumed a wide possible range of insured loss amounts—between $10 billion and $30 billion.

The table in Figure 2 incorporates scenario outcomes from the preceding section and the estimated insured losses that have cited by forecasting services and the major insurer. Admittedly, ours were only two possible scenarios. Nevertheless, these estimates provide an indication of the potential impact of removing wind deductibles.

To estimate the aggregate impact of removing the wind deductibles, we expanded the range established in the prior section and assumed insured loss impacts of between 2 percent and 11 percent depending on whether or not the hurricane deductible is used.

Given the uncertainties associated with the total insured losses and the percentage impact of removing wind deductibles, the estimates in Figure 2 cover a wide range. However, based on a $20 billion middle value for the total insured losses and the 5 percent and 11 percent impacts for removing wind deductibles, the impact of removing wind deductibles could increase the total insured losses by $1.0 billion to $2.2 billion.

There are several reasons the actual impact of removing the wind deductibles might be higher or lower than the estimates in Figure 2.

First, the actual impact would depend on the percentage of policies that actually included wind deductibles. For policies without a wind deductible, the typical policy conditions might be better described by Scenarios 1 and 4 in the preceding discussion—where there is only an all-perils deductible.

Second, for policies with wind deductibles, the wind deductible may be as low as 1 percent or as high as 10 percent, and many policies are written with a $1,000 AOP deductible.

Substituting different combinations of the wind deductible percentage, and $500 or $1,000 for the AOP deductible in the scenarios in Figure 1 produces estimated increases that are below 4.7 percent and above 10.6 percent of insured losses.

And third, the percentage of loss to insured value will affect the impact of removing the wind deductibles. In Figure 1, compared to the 100 percent loss to the property (Scenarios 5 and 6 in Figure 1), the impact of removing the wind deductible was larger when the loss was only 50 percent of the insured value.

In reality the smaller the percentage of loss to insured value, the larger the impact of removing the wind deductible. If the actual losses consist of many claims representing small percentages of the insured value, the amounts paid by insurers could be larger.

Discussion

Several policy and technical issues associated with removing the wind deductibles may need to be considered. Insurers contemplated that the rates and associated premiums would be adequate to cover losses in excess of deductibles.

As shown above, waiving wind deductibles will shift a notable portion of the losses to insurers and impose a cost to the insurance product that had not been factored into the deductible credits and thus, the charged premiums.

It is reasonable to expect that charged premiums would have been higher if insurers had contemplated the possibility that state executives might waive hurricane deductibles. Waiving deductibles for Sandy may well have future pricing implications for carriers writing homeowners coverage.

For both property owners and insurers, the possibility that a government entity might unilaterally change the terms of an insurance policy can also be expected to have marketing implications and thereby introduce marketplace uncertainty.

The most unfortunate outcome would be for property owners to be unable to find an insurer willing to offer coverage with wind deductibles because of the uncertainty that the contemplated wind deductibles could be applied.

For a broad group of stakeholders, including elected officials, regulators, property owners, and insurers, careful attention should be given to the construction of property policies.

As shown in the preceding scenarios, small differences in the wind speed or the timing of a National Weather Service announcement that affects where the storm is a hurricane and where it is a tropical cyclone could have a significant difference in who is responsible for the damages from a devastating windstorm.

In the short term, a considerable amount of effort will go into sorting out whether property owners or insurers will be responsible for the significant losses in the wind deductibles associated with Sandy. In the long run, there is a need for improved clarity through clearer regulations or statutory actions concerning the applicability of wind deductibles.

Was this article valuable?

Here are more articles you may enjoy.

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles  CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer

CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer  Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’

Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’  Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows

Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows