A report this month from consulting firm McKinsey & Company says market forces and technology are changing the role of the agent in the property/casualty insurance distribution.

The report, titled “Agents of the Future: The Evolution of Property and Casualty Insurance Distribution,” advises that to adapt and thrive, P/C agents must deepen their expertise and focus on their operational efficiency. The 28-page report can be found at McKinsey & Company’s website (a PDF file).

The McKinsey report takes a critical look at the agency business landscape. The report points to the “new economic realities” that have blurred the once clear division of labor between carrier and agent. Carriers are now interacting more directly with customers, at lower cost and often with more consistent service levels — but agent commission structures remain largely unchanged.

These new realities are leading many carriers to reconsider how they allocate their distribution budgets and what role agents should play in the system, according to the report.

The report cited four major trends that are transforming the agent’s traditional role:

• A diminished role in risk selection and pricing: The increasing sophistication and accuracy of predictive models and the rise in straight-through underwriting are decreasing the agent’s role in risk selection in both personal and small commercial lines.

• The rise of multichannel: The walls between distribution channels (agent, online, phone, self-service) are crumbling, most notably in personal auto. Customers jump from one channel to another as they move from information-gathering to purchase and beyond.

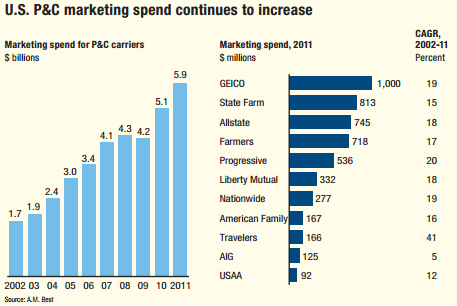

• The ascendance of the carrier brand: Carriers have invested billions of dollars building and strengthening their brands, and consumers increasingly identify with their carrier rather than their agent.

• Commoditization in personal auto: Auto insurance accounts for 70 percent of personal lines premiums. Many agents report that auto acquisition has the thinnest margins of any line and can even be unprofitable. These numbers “paint a difficult picture for future profitability.”

The report said that as carriers operate in this more complex distribution landscape, their investments must be balanced across a number of areas, e.g. direct channels, advertising and the creation of contact centers.

“This shift is putting pressure on their ability to maintain the level of commissions they pay to agents. Inevitably, carriers will need to consider rewarding agents more directly for those efforts that uniquely add value, such as retention and cross-selling,” according to McKinsey.

To succeed in this changing environment, the report advised that there are three core capabilities that agents must develop:

• Defining and reaching a target market: Successful agents will move beyond the local market paradigm and take a broader view of their market with clearly defined target customer segments and associated product offerings. They will need to increase their digital presence, expand their communication channels, e.g. social media, and find new ways to meet potential customers, e.g. affinity groups.

• Expertise: The broader retail market has created an appetite for more tailored, personalized products, which translates into a demand for more customized and deep expertise from insurance advisors. Consumers will turn to agents for advice on holistic insurance packages for their personal needs or for industry-tailored advice on small commercial policies.

• Operational efficiency and scale: Technology will be a source of increased operational efficiency, but increased scale will also be required. To achieve scale, agents can grow organically or through acquisition or by banding together with other small agencies or outsourcing certain functions to carriers or third-party providers. Agents may also need to search for new revenue sources, such as life insurance, group benefits or tax advice.

The McKinsey report said many agents are “not currently positioned to succeed” in a world where scale and operational efficiency, sophisticated marketing tactics and deep product expertise are critical. But on a brighter note, the report said several agency models are already doing well, including traditional commercial lines agents; large multi-line agents; agents with leveraged or lower-cost models; teams of specialized agents; small niche, expertise-driven agents; and small virtual agents.

Topics Carriers Agencies Tech Property Casualty

Was this article valuable?

Here are more articles you may enjoy.

Experian Launches Insurance Marketplace App on ChatGPT

Experian Launches Insurance Marketplace App on ChatGPT  Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles  Munich Re Unit to Cut 1,000 Positions as AI Takes Over Jobs

Munich Re Unit to Cut 1,000 Positions as AI Takes Over Jobs  Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows

Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows