U.S. property/casualty insurers’ and brokers’ operating earnings are expected to modestly improve in 2014, and the overall insurance rate increases will “probably moderate into 2015,” said investment and research firm Keefe, Bruyette & Woods (KBW) in its new report.

According to the report, the returns are no longer either poor enough to sustain the recent pace of insurance pricing improvement or rich enough to stimulate meaningful rate softness outside of a few lines. KBW published its report, titled “2014 Outlook: Prepare for a Soft Insurance Rate Landing,” on Dec. 10.

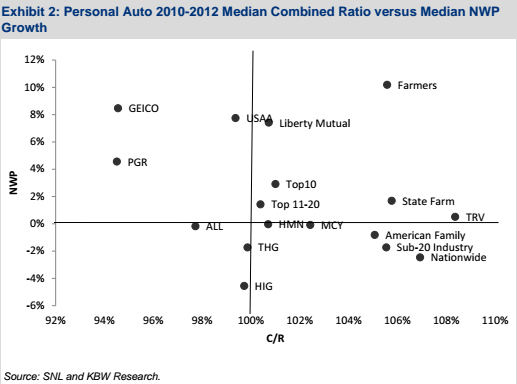

Commenting on personal auto, KBW said it generally favors insurers with significant scale and analytical advantages or specialized niches that offer competitive advantages and targeted pricing advantages. It cited insurers such as Progressive, GEICO, and USAA that displayed both growth and profitability advantages in personal auto lines.

“We think smaller generalist personal lines insurers will face an incrementally tougher environment over the next few years,” according to the report.

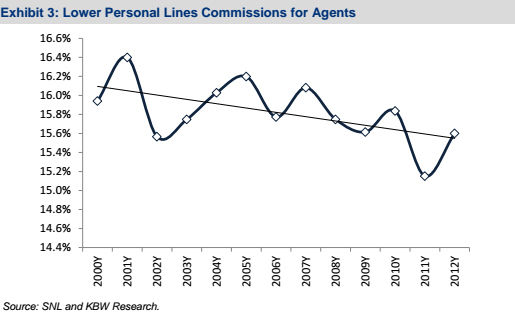

KBW said many competitors are responding to the relevance of scale within the “commoditized personal auto insurance industry” by lowering expenses and upgrading their segmentation skills. This strategy includes lower agent compensation, which seems consistent with commoditized products’ lower required agent service levels, the firm said. It pointed to a trend of modestly falling median commission ratio among majority-personal insurers in recent years.

In longer-term, lower personal lines’ commissions “should de-motivate” agent activity, KBW said, and that could drive more share to larger, often direct-to-consumer, insurers. The increased concentration is already taking place; KBW pointed out that, since 2000, the top-10 auto insurers’ market share has grown from 57 percent to 63 percent.

“Leading personal auto insurers’ rhetoric signals more competitive pricing in 2014, in our view,” KBW said.

Within homeowners lines, KBW said the rate environment is slightly better than auto’s. It said the homeowners lines’ year-to-date combined ratio through September was 103.9 percent, which is “significantly below recent years, but still inadequate.”

KBW said that unlike auto rates which have fluctuated modestly, average homeowners premiums have doubled since 2000. “We believe rate increases should continue,” KBW said, but leading insurers could curtail coverages and raise deductibles to improve margins, it added.

In standard commercial lines, KBW said the industry returns are now within a few points of targets, and 2014 rate increases are “likely to stay in the low-single-digit range.” It said the 2013 profitability — even after taking into account low interest rates — appears to be “approaching the point at which pricing started to decline in the past hard market.”

If historical precedent holds, commercial rate increases could drift downward during the latter part of 2014, KBW forecast.

Most commercial lines’ loss ratios, except for auto, are within a few points of last hard market’s peak results, KBW observed. It said the industry probably needs a couple of points above past peak underwriting returns to balance lost net investment income. “But again, low-to-mid-single digit rate increases in 2014 can probably deliver that,” KBW said in the report.

In specialty commercial lines, the outlook is similar to that of standard commercial lines, KBW said. “We expect mid-single-digit rate increases through most of 2014 as companies strive to improve core underwriting results amid likely less-favorable reserve development,” it said.

And while specialty commercial rate hikes will likely decelerate overall, KBW said there are specific lines where more resilient increases could be expected. These lines include workers’ compensation, public company directors’ and officers’ liability (D&O), marine and onshore energy. It also said specialty insurers face potentially less-favorable loss reserve development going forward. KBW said specialty insurers’ loss reserves were “slightly deficient” as of year-end 2012, with the deficiency largely stemming from workers’ comp, non-proportional assumed liability reinsurance, and products liability.

KBW also observed in its report that after shrinking for several years, excess and surplus lines (E&S) writers are now growing as “some fringe risks” have come back from the standard market.

Topics Trends Carriers Auto Excess Surplus Personal Auto Market

Was this article valuable?

Here are more articles you may enjoy.

Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial

Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial  Insurance Broker Stocks Sink as AI App Sparks Disruption Fears

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears  Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance  Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows

Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows