Nuclear verdicts in the United States are breaking records with 27 court cases each awarding compensation of more than US$100 million during 2023, according to Swiss Re executives.

Social inflation in US rose to 7% in 2023 – a 20-year high – a situation that is being driven by litigation costs from mega-jury awards, said Dr. Jérôme Jean Haegeli, group chief economist, for Swiss Re, who spoke during a press briefing at this week’s reinsurance Rendez-Vous de Septembre in Monaco.

Joining Haegeli at the briefing to discuss a Swiss Re report on social inflation and litigation trends was Gianfranco Lot, chief underwriting officer, property & casualty reinsurance.

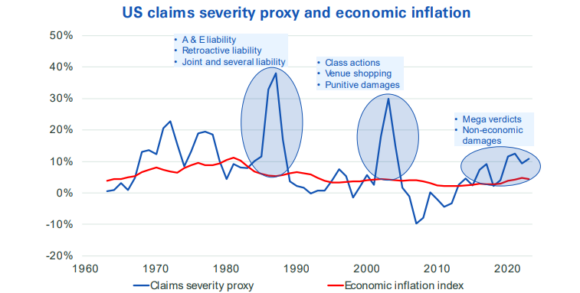

“Social inflation is super costly for consumers, corporations and insurance companies as well,” Haegeli said, noting that social inflation now exceeds economic inflation as the main casualty-claims driver, leading to underwriting losses, higher premiums and reduced insurance capacity. (Swiss Re defines social inflation as the increasing severity of liability claims beyond that explained by economic factors.)

“US commercial casualty insurance losses grew by an average annual rate of 11% over the last five years, reaching US$143 billion in 2023,” said the sigma report, titled “Litigation costs drive claims inflation: indexing liability loss trends.”

To put this number into context, the US casualty claims total was 33% more than last year’s global insured losses from natural catastrophes of $108 billion in 2023, the report said, noting that the current cycle of social inflation has existed in the US since around 2015. (Other social inflation cycles have occurred in the mid-1980s and the late 1990s. See graphic below).

Claims severity proxy is on a calendar year basis.

When insurers and reinsurers began incurring losses and saw these negative trends during the current cycle, they started to re-underwrite their books and cut limits, which has had an impact on the supply of insurance and reinsurance, Lot explained during the press briefing.

The report noted median limits purchased for liability towers (or stacked liability insurance programs) declined by an average of nearly 25% in nominal terms and 46% in inflation-adjusted terms between 2014 and 2023, which was a period of increasing loss costs.

Lot pointed to industry sectors that have seen casualty limits drop precipitously over the past decade, such as the construction industry, which has seen limits drop by approximately 60%, manufacturing by 39% and the chemical industry by 50%. In addition, the number of insurance panel participants has risen by 25% over the past 10 years.

“The reason for the increase [in panelists] is that social inflation is leading to reduced capacity in the insurance market,” a Swiss Re representative explained in an emailed statement. “The rate environment has not kept up with loss trends, which means that insurance companies need to find ways of reducing exposure. One way is to limit the shares that insurers are willing to sign in the programs. The need for insurance is still there, so to be able to place the risk in insurance programs, more panelists are needed.”

At the same time, insurers responded by raising premiums. “[B]y the first half of 2024, US liability premium rate increases had re-accelerated to 7% year-on-year, from 3–5% in the preceding six quarters, defying a broader deceleration of commercial insurance rates,” Swiss Re said in the report.

“Insurance rate increases have not compensated for rising loss costs, raising combined ratios for bodily injury-exposed liability lines and delivering cumulative underwriting losses of US$43 billion between 2019-2023,” said Haegeli and Lot in their presentation.

The report explained that the five-year average (2019–2023) direct combined ratios (via exposure to bodily injury claims) have been 105% for other liability occurrence, 109% for commercial auto liability, and 106% for medical malpractice, with cumulative underwriting losses for these three lines over the same period totaling $43 billion.

Haegeli noted the 7% rise in social inflation in the US in 2023 is “double the size of what has been seen in the last 10 years, but it’s not reflected if you look at the insurance rates.”

The report cautioned that social inflation ultimately can lead to insolvency for insurers, reinsurers and their customers. “Persistent and underpriced social inflation can ultimately affect the insurance industry’s ability to provide risk transfer, the lack of which causes significant disruption at local and national level,” the authors said. “For example, one of the main causes of the collapse of Australian insurer HIH in 2001 was persistent under-reserving of long tail-lines, specifically on account of an under-estimation of the effects of social inflation.”

Haegeli said the trucking industry is one of the sectors most affected by mega verdicts and, as a result, could be at risk of insolvency if they can’t buy adequate insurance coverage.

“If you don’t have the capacity for the right price to provide to the insureds, then the real economy is always going to be exposed more to bankruptcies,” he said during the press briefing. “So it’s not just the cost of insurance which matters here. If [insurance is] less available because the price is not right, then you are exposing companies to more insolvencies, so corporate America is also exposed.”

The report noted some trucking companies are reducing excess coverage to manage costs, as these covers are seeing rate increases of more than 75%.

“According to a 2023 report by the US Chamber for Commerce Institute for Legal Reform, there are fewer insurers in the trucking market today, and many of the ones left now offer reduced coverage,” the report added. “This means trucking companies are finding it increasingly difficult to secure adequate insurance cover, and are being forced to assume more risk than they have in the past.”

Drivers of Social Inflation

The Swiss Re report attributed the outsized jury awards in the US principally to bodily injury cases, which can generate outsized awards. “Driving factors include the trial bar’s use of psychology-based strategies and litigation funding, as well as jurors’ attitudes to issues like social injustice and negative sentiment toward corporations.”

While the US is the epicenter of social inflation and is a predominantly US phenomenon, other countries such as Australia, UK and Canada show signs of social inflation and share some of the driving forces such as the expansion of mass tort, but these countries are “not as exposed to runaway awards,” said the report.

“Tort law in continental Europe differs significantly from the US, primarily due to the absence of juries and the influence of civil law traditions. In most European countries, tort cases are adjudicated by professional judges rather than juries,” the report said, acknowledging, however, that class actions and litigation funding are growing rapidly in Europe..

The report went on to discuss the impact of third-party litigation funding (TPLF) – a process through which commercial or consumer litigants and law firms finance their case and other legal costs with the help of third-party investors.

“Litigation funders back claims in many areas relevant to insurers such as trucking accidents, product liability mass tort, and bodily injury and medical liability claims. TPLF is correlated with higher awards, longer cases and greater legal expense. Litigation funding is also inefficient as more than half of the awards remain within the professional litigation industry,” the report said.

“We expect social inflation in the US to continue for the foreseeable future, and that it will remain mostly a US phenomenon,” said Swiss Re in a commentary accompanying the report. “While economic inflation is abating, there are no signs of a let up in social inflation pressures. And in our view, the current rate of increase is unsustainable: We estimate the impact on casualty business in the US will outweigh the earnings benefit of higher interest rates within one to two years.”

Based on current trends, Swiss Re estimates that the impact of social inflation will outweigh the benefit of higher interest rates on casualty lines in one-to-two years.

Possible Solutions?

It cited several steps that could help resolve this growing problem, such as “tort reform, regulation of the use of third-party litigation funding, in particular around disclosure rules, risk mitigation at the corporate level and, in the insurance industry, use of new technology and data analytics to improve underwriting discipline and claims management, and more proactive preparation of defense cases insurance.”

The first significant wave (cycle) of runaway social inflation occurred during the US liability crisis of the 1980s when changes to legislation and case law significantly expanded the scope of tort liability, the report explained. “Corporations and their insurers were retroactively held liable for environmental damage and huge asbestos-related claims.”

The market eventually returned to balance when tort reform measures slowed rapidly rising liability costs, while insurers and reinsurers moved to re-underwrite their asbestos and environmental risks. “A subsequent focus on insurability and alternative risk transfer restored market balance.”

Related:

Was this article valuable?

Here are more articles you may enjoy.

Munich Re Unit to Cut 1,000 Positions as AI Takes Over Jobs

Munich Re Unit to Cut 1,000 Positions as AI Takes Over Jobs  Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’

Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’  Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial

Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial  How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions

How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions