Insurance companies that deliver a great customer experience are rewarded over the long-term by both consumers and investors, according to a new consulting study. The analysis by Watermark Consulting claims that insurers with a great customer experience far outperform the market and their peers.

The study is based on an analysis of stock market returns for insurers that lead in customer experience versus those that lag.

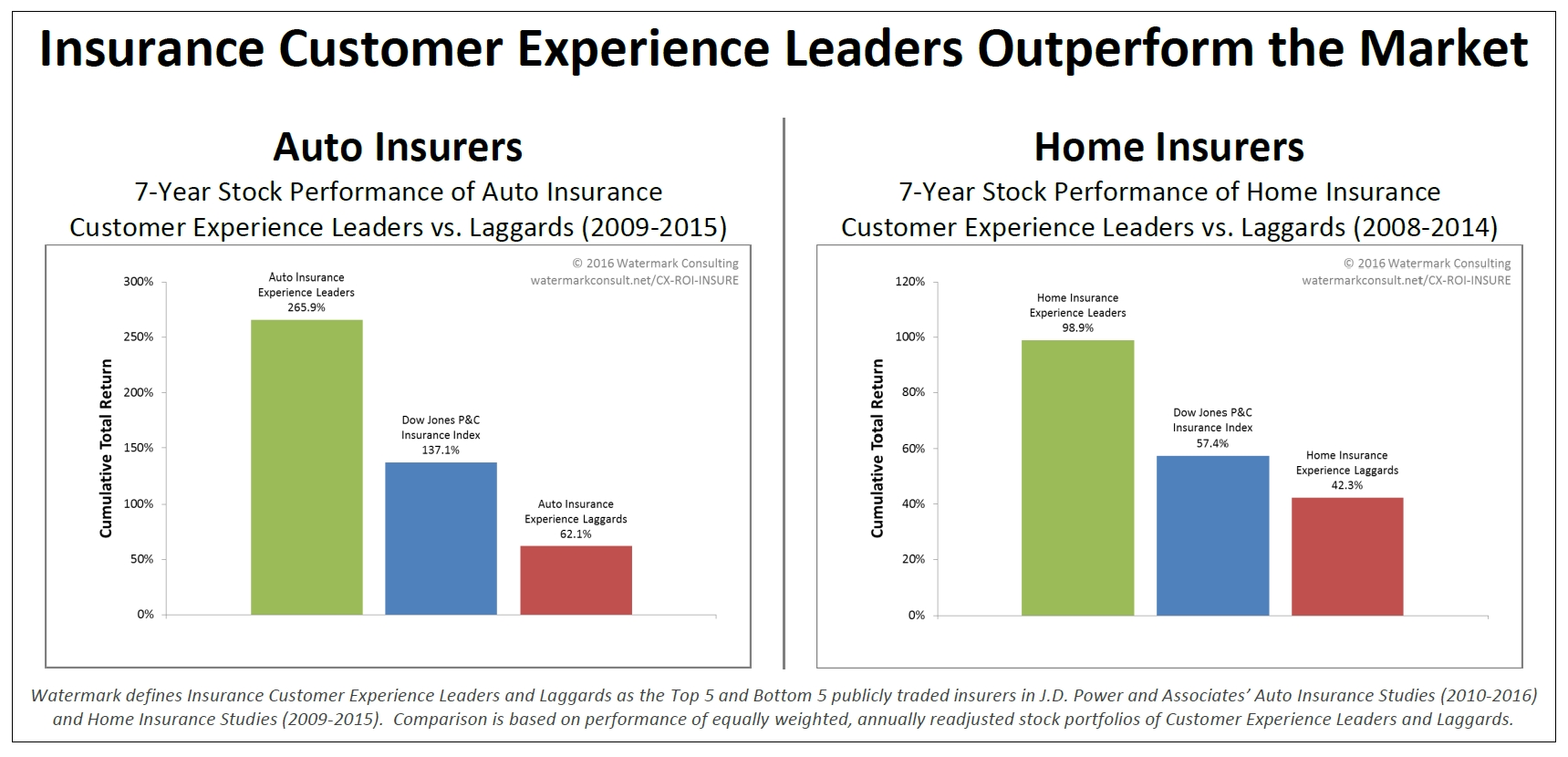

The analysis focused on model portfolios of the Top 5 (Leaders) and Bottom 5 (Laggards) publicly traded insurers in J.D. Power and Associates’ annual Insurance Satisfaction Studies. It looked at auto insurer rankings for the period 2010-2016 and home Insurer rankings for 2009-2015.

According to Jon Picoult, founder and principal of Connecticut-based Watermark Consulting, the fortunes of insurance customer experience leaders and laggards diverged dramatically. Leaders far outperformed the industry index, while laggards trailed it, and the performance gap wasn’t small.

Some highlights from the study:

- Auto insurance customer experience leaders outperformed the industry, generating a total return that was 129 points higher than the Dow Jones Property & Casualty Market Index while laggards trailed far behind, posting a total return that was 75 points lower.

- Over the seven year period, the auto insurance leaders generated an average annual return which was nearly triple that of the laggards.

- The home insurance customer experience leaders outperformed the industry, generating a total return that was 42 points higher than the Dow Jones Property & Casualty Market Index, while the home insurance laggards trailed behind, posting a total return that was 15 points lower.

- Over the seven year period, the home insurance leaders generated an average annual return which was double that of the laggards.

“Insurance providers may publicly tout the importance of customer-centricity, but behind the scenes, many are skeptical that such a strategy pays off,” Picoult said. “As a result, they continue to cling to archaic business practices that create complexity and confusion, further stoking customer frustration.”

But insurers that impress policyholders reap the rewards – in the form of increased loyalty, greater wallet share, stronger word-of-mouth and a more competitive cost structure, he said. According to the report, the leaders enjoy higher revenues and lower expenses.

Picoult said insurance companies are “struggling to set themselves apart in a marketplace that increasingly views their products as commodities” and he suggested that the best way for them to break out is to “deliver an end-to-end customer experience that turns everyday policyholders into true raving fans.”

Related:

- Why Customer Satisfaction Is Falling for Large Auto Insurers, Rising for Small: J.D. Power

- What Insurance Industry Can Learn from Amazon About Customer Satisfaction

- Auto Insurance Customers Disappointed in Their Insurers’ Websites: J.D. Power

Topics Carriers Homeowners

Was this article valuable?

Here are more articles you may enjoy.

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears  Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance  Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles  Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows

Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows