The 75th anniversary of the construction of the iconic Golden Gate Bridge’s was celebrated on May 27, and the massive project was remembered as a major undertaking for contractors and the city – as well as insurers.

The 75th anniversary of the bridge drew spectators, media and officials to celebrate the engineering feat: A 1.7-mile-long bridge that rises to 746 feet above the ocean, is supported by cables more than 3-feet thick and weighs in at more than 887,000 tons.

According to the Golden Gate Bridge Highway & Transportation District, which operates the bridge spanning the gap between the Pacific Ocean and San Francisco Bay, it serves up to 40 million vehicles per year. The bridge was built by 10 different prime contractors and numerous subcontractors, and 11 men died while working on the bridge. Of those, 10 died during an incident in which a section of scaffold fell through a safety net.

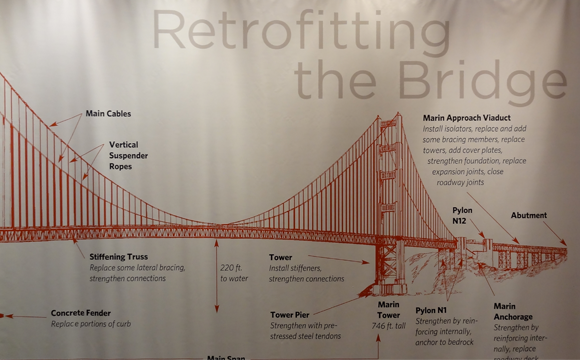

Work on the bridge continues occasionally with minor repairs and upgrades. The Oct. 17, 1989 Loma Prieta earthquake was a catalyst for an extensive seismic retrofit program that the structure is still undergoing today.

Back when the project was first undertaken, a local insurance company in northern California was one of several insurers involved in the deal.

Novato, Calif.-based Fireman’s Fund Insurance Co. insured part of the $35 million completion bond when on Nov. 4, 1930 voters within the Golden Gate Bridge and Highway District went to the polls and put up their homes, farms and business properties as collateral to support the bond to issue to finance the bridge.

“We are so proud to share in the rich history of this iconic bridge whose extraordinary architecture and beauty has led it to become a symbol of the gateway to San Francisco,” Lori Fouché, president and CEO of Fireman’s Fund said in a statement.

Another insurer on the project was Hartford, Conn.-based The Hartford Financial Services Group Inc.

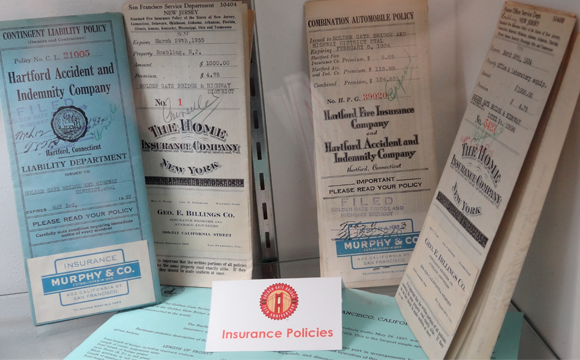

Neither Fireman’s Fund nor Hartford had many historic details on insurance the project with the exceptions of some nostalgic historic images and a few minor factoids.

According to Hartford, the Hartford Accident and Indemnity Co. became involved in the first contract on the project when Writ Wilson & Co. of Minneapolis wrote the bond for the E.J. Longyear Exploration Co. to take samples of bedrock surrounding the site.

Images documenting the bridge and its construction show policies with Hartford, The Home Insurance Company New York and Murphy & Co. Insurance. On one photo is combination automobile policy issued to the Golden Gate Bridge and Highway District Etal with visible information that includes a Feb. 9, 1934 expiration date with a Hartford Fire Insurance Co. premium of $5.85, and a Hartford Acc. And Ind. Co. premium of $118.98 for a combined premium of $124.83.

A Fireman’s Fund spokeswoman said the Novato, Calif.-based firm insured part of the $35 million construction bond, but she wasn’t sure how much of that bond Fireman’s Fund was involved with.

A lot has changed in the insurance industry since the Golden Gate was built, but a lot has stayed the same, according to Manfred Schneider, head of engineering for North America for Allianz Global Corporate & Specialty Americas, who noted that 75 years ago those insuring the project didn’t have the advantage of computers and had to crunch any numbers “manually.”

But he said looking back at the project it was a good risk to take.

“They were not gambling. Not at all. Not at all,” he said.

According to the website CaliforniaHistorian.com, the bridge opened in 1937 and has remained undamaged, withstanding high winds, years and years of massive loads, temperatures extremes, and even earthquakes like the 1989 Loma Prieta earthquake caused no damage.

Nearly a dozen of the nation’s leading bridge engineering firms submitted proposals for construction of what was to become at the time the longest and tallest bridge built at nearly 9,000 feet long and almost 800 feet high, according to the site.

Today such a project would be dealt with much the same from a construction standpoint, but what many large scale projects today include more and more is business interruption insurance, according to Schneider.

Nowadays many contractors seek, or are required to obtain, delay in startup (DSU), or advance loss of profit (ALOP) insurance, he said.

Of course, environmental requirements are becoming more common nowadays as well, according to Schneider.

These requirements, which he said have increased dramatically in the last five to 10 years, can lead to higher replacement or costs on projects, he added.

Schneider declined to offer his estimate of how much such a project would be insured for in present day, but he didn’t mind offering his thoughts on how insuring projects like the Golden Gate Bridge may change in the next 75 years?

“I predict that we will see a concentration on the insurance market such as we have seen in the past on the manufacturing market,” Schneider said.

He believes the number of carriers and brokers who deal in construction will dwindle, leaving customers with fewer options.

But what Scneider struggles with foreseeing in coming years, he said, is how technology will develop.

“The problem is I cannot foresee how technology will develop,” he said. “Every day our world is getting more IT related. Overall I see more of a trend that IT risks will become more critical. How this will influence construction projects is difficult to predict. The heavy equipment such as what was used on the Golden Gate Bridge will be similarly insured as it was 75 years ago.”

Topics Construction Contractors

Was this article valuable?

Here are more articles you may enjoy.

State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup

State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup  Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles  AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’