Let’s start with three basic ideas about property/casualty insurance distributed through independent agents and brokers — a sector with more than $200 billion in written premium annually.

1) P/C insurance resembles a commodity, with few competitive differentiators. By and large, competitive price, product, and commission are basic tickets of entry to this marketplace. Independent agents and brokers don’t want to represent carriers that can’t provide these three basics.

2) The buying decision is largely made by the agent rather than the policyholder. After all, prospects looking for insurance use the independent agency system because they want the agent’s expertise and connections rather than buying coverage directly themselves.

3) Ease of doing business (EDB) in every aspect of the carrier-agent interface is profoundly important to independent agents because it directly affects their productivity and profitability, as well as their quality of work life.

This means service — EDB — is a primary competitive differentiator between carriers.

Since EDB is a key strategic issue, knowing how well you and your key competitors perform is critically important for effective management. But what is EDB?

For the past four years, we have been measuring EDB performance industry-wide. We identified 10 EDB Factors, including traditional carrier-agency interface issues such as claims, underwriting, policy services, technology, and marketing support. They also include more subtle issues such as the carrier-agent working relationship and their impact on the agent-policyholder relationship. We asked independent agents and brokers across the country whether EDB is critical in their buying decision, how important each of the 10 EDB Factors are to them, and how the carriers they represent perform against those factors.

Finally, we asked agents what carriers could do to make it easier to do business with them. Over the four years of the survey some 10,000 agents have provided nearly 50,000 ratings of carriers.

Here’s what we’ve found.

- Industry-wide there are significant gaps between how important agents said each of the EDB Factors is and the performance ratings they gave carriers on most of those Factors. There is opportunity for improvement.

- Interestingly, there has been relatively little change in industry-wide performance over the years. One standard measure is the EDB Index — literally the gap between Importance and Performance ratings weighted by the Importance. Over the past three years the Index has shown a very small, steady up-tick.

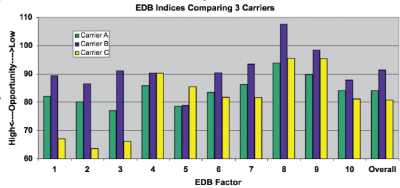

- There is a great deal of individual variation in performance from one carrier to another. We see the EDB Index for different carriers range from lows in the ’60s to high-performing mid-’90s. The EDB Performance chart shows EDB performance ratings for three different carriers. Notice how Carrier A, a moderate performer, shows moderate performance across the board and an overall EDB Index of nearly 85. Carrier B turns in a strong performance, even exceeding expectations on Factor 8. Carrier C rates at or above 90 on 3 Factors while falling into the ’60s on the first 3 Factors.

- Within a carrier there is also often significant variation across demographics, such as geography, respondent role, line of business focus, agency size, and other areas. And even though there has been little industry-wide change in performance, some carriers have improved while others have gotten lower ratings.

- In the sales process — from inquiry and rating to underwriting — agents want better technical, organizational, and personal support in moving quickly from a prospect to a policyholder. One agent summed it up this way: “Quick response and flexibility are the main reasons we write new business with carriers.”

- Agents want fast and fair “post-sale” support — such as policy issuance, amendments, renewals, billing, and claims services — in order to retain customers.

What carriers should do

Gaining the competitive advantage that comes with being easier to do business with doesn’t happen without awareness, commitment, and effort. Our experience is that it doesn’t have to include the huge price tag some may expect either. To lock in agents and build a sustainable advantage, to capitalize on EDB strengths, and to overcome EDB vulnerabilities, carriers can take these seven steps:

- Measure EDB performance; if it’s not measured, it’s not likely to be well managed.

- Benchmark EDB performance against key competitors.

- Assess how EDB performance affects your business results.

- Decide which factors are most important to address in 2007.

- Communicate the importance of EDB throughout the management team, ensuring the organization as a whole is aligned — and acts on — this strategic edge. This extends to how individuals as well as departments, functions, and processes affect EDB performance.

- Set EDB performance goals and interim business targets, track against those targets, and hold management accountable for achieving them.

- Build short and long term plans to achieve EDB goals.

Nearly 50,000 carrier ratings over the last four years show relatively little change in EDB performance which represents a stable industry benchmark. For those who recognize the strategic importance of EDB and focus on improving performance, there is plenty of opportunity.

Nort Salz is principal and co-founder at Deep Customer Connections Inc., a Massachusetts-based consulting firm. DCC helps carriers gain and sustain business by being easier to do business with. He can be reached at: nort.salz@deepcc.com

Was this article valuable?

Here are more articles you may enjoy.

What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers  Trapped Tesla Driver’s 911 Call: ‘It’s on Fire. Help Please’

Trapped Tesla Driver’s 911 Call: ‘It’s on Fire. Help Please’  Winter Storm Fern to Cause Up to $6.7B in Insured Losses

Winter Storm Fern to Cause Up to $6.7B in Insured Losses