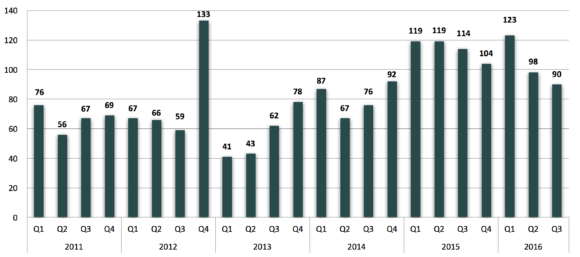

Deal count for the third quarter (Q3) of 2016 was down relative to the record-breaking Q3 of 2015, but was still the second-most active Q3 in the past 10 years. There were 90 announced transactions in Q3 2016 compared to 114 in Q3 2015 (a decrease of 26.7 percent). Forty-one deals closed in July, 19 in August, and 30 in September. By comparison, historical Q3 deal counts in the past five years were 59 in 2012, 62 in 2013, 76 in 2014, 114 in 2015, and 90 in 2016 (average of 78 per year).

For the first nine months of 2016, there were 311 announced transactions compared to 352 in the first nine months of 2015. Some 46 percent of all acquired agencies were property/casualty (P/C) firms, 40 percent were multi-line agencies and 14 percent were employee benefits firms. Specialty distributors made up 18 percent of the total deal activity year-to-date. This is a decrease from 23 percent recorded in the first nine months of 2015.

Private-equity backed buyers were the most active acquirers with 157 closed transactions in the first three quarters of 2016 (compared to 158 in the first three quarters of 2015). This represented 50.5 percent of all deal activity in the first nine months of 2016. Independent agencies completed 76 transactions, and public brokers accounted for 27 deals over the same period. Insurance companies, banks and other buyers closed 51 deals so far in 2016.

The top five buyers for the year represented 32.8 percent of total deal activity through Q3 2016 and the top 10 accounted for 47.3 percent.

BroadStreet Partners Inc. and AssuredPartners Inc. were the most active acquirers, closing 22 deals each.

BroadStreet is on pace to surpass its deal flow from last year of 26 closed transactions. It typically applies a co-ownership structure to its acquisitions, where agency owners and key employees retain some ownership in the agency.

AssuredPartners was the second-most active acquirer in 2015 with 34 transactions.

Acrisure LLC was listed as the third-most active acquirer in the first nine months of 2016 with 20 announced deals. Acrisure does not announce all of its deal closings, so it is difficult to discern the actual number closed so far in 2016, but it is estimated to be more than 40.

Arthur J. Gallagher & Co. (AJG) and Hub International Ltd. closed 19 deals each through the first three quarters of 2016. Hub continued to expand internationally by aggressively acquiring agencies in Canada. AJG was the most active public broker in the marketplace during the first three quarters of 2016. Both Hub and AJG’s acquisitions were evenly spread throughout the country and consisted of both retail and wholesale agencies.

For the first three quarters of 2016, The Hilb Group and Confie Seguros Holdings each closed 13 deals, USI Insurance Services LLC and Risk Strategies Co. Inc. each closed seven deals, and Alliant Insurance Services Inc., OneDigital Health and Benefits, and Higginbotham Insurance & Financial Services closed five, four, and four deals, respectively.

Overall, acquisition activity is down from the record set in 2015, but we are seeing demand remaining strong. Private equity-backed brokers continue to drive the market, and buyers continue to be aggressive in their search for growth and talent.

Sources: SNL Financial, Insurance Journal, other publicly available sources and MarshBerry proprietary databases All transactions in chart/table are announced deals involving public company acquirers, banks, and private equity groups as well as private company acquirers. All targets are U.S. only. This data displays a snapshot at a particular point in time and has not been updated to reflect subsequent changes in prior years, if any. MarshBerry estimates that only 15 to 30 percent of all transactions are actually made public. Past performance is not necessarily indicative of future results.

Securities offered through MarshBerry Capital Inc., Member FINRA and SIPC, and an affiliate of Marsh, Berry & Co. Inc. 28601 Chagrin Blvd., Suite 400, Woodmere, Ohio 44122 (440-354-3230). Except where otherwise indicated, the information provided is based on matters as they exist as of the date of preparation.

Was this article valuable?

Here are more articles you may enjoy.

Maine Plane Crash Victims Worked for Luxury Travel Startup Led by Texas Lawyer

Maine Plane Crash Victims Worked for Luxury Travel Startup Led by Texas Lawyer  Married Insurance Brokers Indicted for Allegedly Running $750K Fraud Scheme

Married Insurance Brokers Indicted for Allegedly Running $750K Fraud Scheme  Florida Senate President Says No Major Insurance Changes This Year

Florida Senate President Says No Major Insurance Changes This Year  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market