New York Governor Andrew Cuomo has signed into law a phased-in system of paid family leave that will become effective on January 1, 2018, for New York employers.

On the state level, New York becomes the fifth state (joining California, New Jersey, Rhode Island and Washington) to pass a law granting eligible male and female employees paid family leave.

But New York’s will be the most comprehensive and generous paid family leave program in the nation.

Background and Essential Components

On the federal level, the Family and Medical Leave Act of 1993 provides individuals working for employers with 50 or more employees up to 12 weeks of protected leave annually for the employee’s own serious health condition, for the adoption or birth of a child or to care for a spouse, child or parent who is ill.

But under FMLA, which covers between 50 and 60 percent of the workforce, there is no requirement that the leave be paid. As a result, many employees who are eligible for FMLA leave simply cannot afford to take it.

By contrast, under the New York State Paid Family Leave Law, once it is fully phased in, eligible employees will be entitled to up to 12 weeks of paid family leave annually to care for an infant or family member with a serious health condition, for the birth or adoption of a child or to assist with family obligations when a family member is called into active military service.

It is important to note that the state law — unlike the federal FMLA — does not provide leave for an employee’s own serious health condition. In addition, the maternity/paternity coverage is post-birth; any pre-birth benefit is provided by FMLA or disability laws.

Who is Eligible for Paid Family Leave?

Unlike the FMLA, which applies only to employers with 50 or more employees, the state family leave law will apply to any New York employer covered by the workers’ compensation law. Any such employer will have to permit eligible employees to take paid leave and will make appropriate deductions from their employees’ pay to fund paid leave benefits.

Employees become eligible to receive benefits after meeting the following criteria:

- Employees working 20 or more hours per week: The employee must have worked for the employer at least 26 consecutive weeks preceding the first full day leave begins.

- Employees working less than 20 hours per week: The employee must have worked for the employer at least 175 days preceding the first full day leave begins.

To determine eligibility, the employer will count scheduled vacation time, personal time, sick or other leave approved by the employer, so long as all required contributions have been made by the employee. Periods of temporary disability will not be counted as weeks of employment or days worked to determine eligibility.

Funding: Who Pays?

The New York State Paid Family Leave Law is funded entirely by employees, not employers.

Beginning January 1, 2018, the employee contribution/wage deduction will be $1.65 per week. This employee contribution amount will be updated annually by the New York State Department of Labor.

Benefits

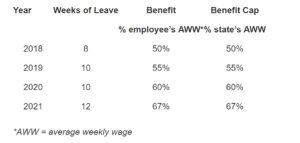

Employee benefits will phase in over four years. The benefit is a percentage of the employee’s average weekly wage, capped at the same percentage of the state’s average weekly wage. For example, for 2018, the benefit is 50% of the employee’s or state’s average weekly wage ($1,305.92), whichever is lower. For subsequent years:

Required Notice and Certifications

An employee requesting leave must provide the employer with proper notice.

Foreseeable leave, including an expected birth, placement for adoption or foster care, planned medical treatment for the serious health condition of a family member or a known military exigency requires 30 days’ advance notice before leave begins.

If the 30-day advance notice is not practicable, notice must be given as soon as practicable. If the employee fails to give advance notice and the event was foreseeable, the claim may be denied.

Intermittent leave requires that notice be given as soon as practicable before each day of the intermittent leave. The employee’s notice to the employer shall contain the qualifying event and timing and duration of leave.

Additionally, intermittent leave must be taken in daily increments (hourly increments are permitted under FMLA). Employees are entitled to be reinstated to their same or a comparable job. An employee eligible for both family leave and New York state disability benefits is entitled to receive both during a 52-week period.

Retaliation against employees is forbidden, and employers must continue health insurance benefits. Employees must use state and federal leave benefits concurrently and may not take more than 12 weeks, or other permissible maximum then in effect.

Tax Implications

According to the New York State Department of Taxation and Finance, the state’s new paid family leave program has tax implications for New York employees, employers and insurance carriers, including self-insured employers, employer plans, approved third-party insurers and the state insurance fund. The department offers the following guidance:

- Benefits paid to employees will be taxable non-wage income that must be included in federal gross income.

- Taxes will not be withheld automatically from benefits; employees can request voluntary tax withholding.

- Premiums will be deducted from employee’s after-tax wages.

- Employers should report employee contributions on Form W-2, using Box 14-State disability insurance taxes.

- Benefits should be reported by the state insurance fund on Form 1099-G and by all other payers on Form 1099-MISC.

- The department also notes that it is the responsibility of each employee and employer/insurance carrier to consult with its tax advisor.

Suggestions for Employers

The New York State Paid Family Leave Law goes into effect on January 1, 2018. Prior to that time, New York employers should take appropriate steps to make employees aware of their rights under the law and prepare their benefit and payroll functions to deduct the $1.65 weekly employee contribution to fund the benefits provided by the law. Employers also should revise their handbooks or other internal leave policies in order to comply with this new law.

This article originally appeared in an Anderson Kill publication.

Topics Commercial Lines New York Business Insurance Employee Benefits

Was this article valuable?

Here are more articles you may enjoy.

Experian Launches Insurance Marketplace App on ChatGPT

Experian Launches Insurance Marketplace App on ChatGPT  Judge Awards Applied Systems Preliminary Injunction Against Comulate

Judge Awards Applied Systems Preliminary Injunction Against Comulate  How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions

How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions  Insurance Broker Stocks Sink as AI App Sparks Disruption Fears

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears