As 2021 comes to a close, Insurance Journal is looking back on its top stories of the year.

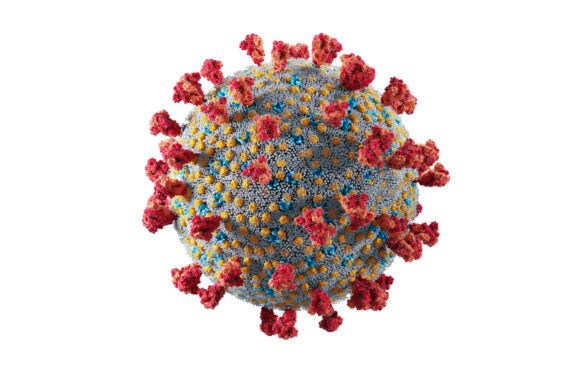

In the East region, the ongoing COVID-19 pandemic remained top of mind for many readers. Beyond the pandemic, readers also took interest in diversity and inclusion efforts within the insurance industry, as well as the impact of the rise of ransomware.

Here’s a look back on the top 10 Insurance Journal East stories of 2021:

Amazon Loses Bid to Halt New York Warehouse COVID Safety Probe

The top read story in Insurance Journal’s East section this year involved a topic that’s been at the top of everyone’s minds for the second year in a row: COVID-19. In August of this year, a federal judge dismissed Amazon.com Inc’s lawsuit to block New York’s attorney general from investigating the online retailer’s ability to protect warehouse workers from COVID-19. U.S. District Judge Brian Cogan in Brooklyn rejected Amazon’s claim that Attorney General Letitia James acted in bad faith by trying to police its pandemic response, and stop its alleged retaliation against workers who were unhappy the company wasn’t doing more.

James sued Amazon in February over its treatment of thousands of workers at a Staten Island fulfillment center and a Queens distribution center. She has accused Amazon of prioritizing profits over safety, and improperly disciplining two employees who protested working conditions, one of whom was fired.

James is seeking a court-appointed safety monitor, while Amazon is seeking to dismiss her case, which is pending in a state court in Manhattan.

New York Court: Uber Drivers Are Employees Eligible for Unemployment Insurance

The New York Supreme Court, Appellate Division, Third Judicial Department held that Uber drivers can be considered employees eligible for benefits such as unemployment insurance. The finding upheld two previous April 2019 decisions by the Unemployment Insurance Appeal Board stating that Uber qualifies as its drivers’ employer and is liable for unemployment insurance contributions.

Uber Technologies Inc operates a smartphone app that connects customers with available drivers to pick them up and transport them to their destination. Drivers are typically considered independent contractors, and as a result, lack the same protections granted to regular employees under U.S. labor law, such as health and unemployment insurance and workers’ compensation.

In this case, claimant Colin Lowry served as a driver for Uber in its upstate New York market when he applied for unemployment insurance benefits after he stopped participating on the platform.

The New York Department of Labor initially found that Lowry was an employee of Uber, making Uber liable for his unemployment insurance claim. Uber objected to the finding, but following a hearing, an administrative law judge upheld the determinations. The Unemployment Insurance Appeal Board affirmed, and Uber again appealed.

The New York Supreme Court in its ruling found evidence to support the findings that Uber exercised enough control over its drivers to establish an employment relationship with them. This is because Uber controls drivers’ access to their customers, calculates and collects fares and sets drivers’ rate of compensation.

With this in mind, the New York Supreme Court affirmed the Unemployment Insurance Appeal Board’s findings that Uber has an employment relationship with its drivers, making it liable for unemployment insurance contributions. In its ruling, the court specified that while Uber also operates a separate New York City market, the December decision is limited to drivers in the upstate New York market where Lowry served as an Uber driver.

Salesperson Injured Leaving Employer Happy Hour Could Receive Workers’ Comp

East readers took interest this year in another court case decided in favor of the worker, but this time in Pennsylvania. The December case sparked debate over whether a traveling salesperson injured in a car accident after an employer-sponsored happy hour was still considered “on the job” at the time of the accident because he had to drive past the highway exit to his home on the way to the event. The Pennsylvania Supreme Court says that he was, and he could be eligible for workers’ compensation.

Most of the debate in this case centers on the traveling employee doctrine, something the Pennsylvania Supreme Court says it has never specifically addressed until now. The doctrine states that when a traveling employee is injured in the course of business, they are considered on the job at the time of their injury unless their employer can prove they were acting outside of the scope of their employment.

Although the Pennsylvania Supreme Court found that Peters was in the course of his employment during the event, because there is conflicting testimony as to where Peters was traveling from during the accident, the case was remanded back to the workers’ compensation judge for additional findings consistent with the Pennsylvania Supreme Court’s opinion.

Penn. Court Says Tavern Entitled to Business Income Coverage for COVID-19 Losses

COVID-19 takes the spotlight once again with another top read story in the East region concerning a Pennsylvania tavern’s pandemic-related losses. The Pennsylvania Court of Common Pleas for Allegheny County found that an insurer could have to pay for a Pennsylvania tavern’s business interruption losses after it shut down due to the COVID-19 pandemic because of a two-letter word in its policy.

The court ruled in favor of MacMiles LLC, doing business as Grant Street Tavern, granting insurance coverage for the tavern’s loss of business income during the pandemic, partly because of the word “or” in its insurance policy. The court found that while some courts have interpreted “direct physical loss of or damage to” property to require some form of physical harm to property in order for the insured to be entitled to coverage, it said these interpretations conflate “direct physical loss of” with “direct physical . . . damage to” and ignore that these two phrases are separated by the word “or.”

Because of the word “or” in the policy, the court found that “direct physical loss of” means something different than “direct physical…damage to.” The court also determined that based on the ordinary, dictionary definitions of the terms “direct” and “physical”, Grant Street Tavern could suffer “direct” and “physical” loss of use of its property without any tangible harm to property.

New York is Latest State to Legalize Recreational Marijuana

In April, New York legalized recreational marijuana, allowing adults over the age of 21 to possess and use marijuana – even in public. The legalization bill was signed by former Governor Andrew Cuomo, though legal sales of recreational-use cannabis won’t start for an estimated 18 months until regulations are set.

With this move, New York became the second-most populous state, after California, to legalize recreational marijuana. Legalization backers told the Associated Press they hope the Empire State will add momentum and set an example with its efforts to redress the inequities of a system that has locked up people of color for marijuana offenses at disproportionate rates.

“By placing community reinvestment, social equity, and justice front and center, this law is the new gold standard for reform efforts nationwide,” said Melissa Moore, New York state director of the Drug Policy Alliance.

Problem Solving, Exploration, Change: Gallaudet Students Reach for the Stars

Based in Washington D.C., Gallaudet University is the world’s only university in which all programs and services are specifically designed to accommodate deaf and hard of hearing students using English as well as ASL and it’s hoping to make a difference in the insurance industry with it’s risk management and insurance program.

The RMI program at Gallaudet is relatively new, launching in 2015 with a donation from Philadelphia Insurance Companies (PHLY) Founder James Maguire.

The Maguire Foundation and PHLY began working together in 2015 to start a summer internship for deaf students at PHLY, making it the first insurance company to hire deaf risk management insurance interns from Gallaudet University. PHLY has hired two interns from Gallaudet each summer since then.

“People like me who have been in the business for 40 years will be getting out of the business, and what we want to do is fill those jobs with people that traditionally haven’t had an opportunity to get into industries like insurance, such as minorities and people with disabilities,” said Sean Sweeney, Maguire’s nephew and a board member at Gallaudet University. “And we see this as a great way to transform society by giving people that traditionally didn’t get a shot a chance to get into an industry that’s stable, that’s long-term and that provides high paying jobs.”

No time seems better than now. Pew Research Center in a recent report found that during the third quarter of 2020, about 28.6 million baby boomers – those born between 1946 and 1964 – reported that they were out of the labor force due to retirement. This is 3.2 million more boomers than the 25.4 million who were retired in the same quarter of 2019, the report stated.

As new generations enter the workforce, expectations for the work environment are changing, Carrier Management previously reported. As a result, insurance companies are facing increased pressure to evaluate their focus on diversity and inclusion to recruit and retain young talent.

New York Regulator Issues Guidance for Insurers Writing Cyber Policies in the State

The New York State Department of Financial Services (DFS) in February issued new guidance spelling out best practices for New York-regulated property/casualty insurers that write cyber insurance. This served as the first guidance the regulator issued on cyber insurance in particular.

As part of the guidance, called the Cyber Insurance Risk Framework, DFS is calling on regulated insurers to establish a formal strategy, approved by the insurer’s board or other governing entity, for measuring cyber insurance risk based on the insurer’s size, resources and geographic distribution, among other factors.

In particular, insurers are urged to take measures to manage and eliminate exposure to silent cyber insurance risk, which occurs when cyber exposures exist within a traditional property and liability policy that does not specifically include or exclude cyber risk.

Former DFS Superintendent Linda Lacewell, in an interview for Insurance Journal’s Insuring Cyber Podcast, previously discussed how the shift online due to the COVID-19 pandemic has led to new vulnerabilities that cybercriminals are exploiting. One particular example of this exploitation is the rapid rise in ransomware attacks.

Massachusetts Appeals Court Finds Landowner Not Responsible for Tenant’s Dog

Also in February, The Massachusetts Appeals court found that the owner of a property where a pit bull was unleashed and unfenced did not breach a legal duty to protect a passerby from the dog, as the dog was kept on the property by the landowner’s tenant.

This case came about after Victor Creatini said he was taking a bike ride with his dog on a leash beside him when a pit bull ran into the street and attacked his dog, causing him to fall from his bike and suffer injuries. Although Creatini suffered injuries when he fell off of his bike, he was not attacked or bitten by the pit bull. Still, he claimed that his injuries were a foreseeable consequence because the pit bull was not stored properly on the landowner’s property.

The appeals court, however, found that while the risk of harm to passersby from a tenant’s dog might be a foreseeable event for a landlord in some circumstances, that was not the case in this situation.

New York Court Finds Insurer Not Responsible for Theater’s COVID-19 Losses

It seems February was a busy month for litigation that drew attention among Insurance Journal East readers. The Supreme Court of the state of New York, Nassau County, in February dismissed a movie theater’s claims that its insurer is responsible for covering its COVID-19 related losses and that its insurance brokers were negligent in providing insufficient coverage.

This came about after plaintiff Soundview Cinemas Inc., which operates a movie theater and is based in Port Washington, New York, was closed due to New York Governor Andrew Cuomo’s March 2020 executive order declaring a disaster emergency for the state amidst the COVID-19 pandemic.

“While the court is sympathetic to the economic consequences resulting from the closure of plaintiff’s movie theater, the court concurs with the majority view that loss of use of the premises due to COVID-19 related government orders does not constitute direct physical loss of or damage to property that would trigger business income coverage under the policy,” the decision stated. “Extra expense coverage is also inapplicable, and civil authority coverage is not triggered.”

The insurance brokers’ motion to dismiss the case was granted.

New York Regulator to Collect, Publish Insurer Diversity Data to Promote Transparency

In a move that furthers some of its previous efforts around diversity and inclusion, The New York State Department of Financial Services (DFS) in March called on its regulated insurers to prioritize diversity of leadership and said it would begin collecting and publishing diversity data from insurers this year to promote transparency.

These new actions were spelled out in a circular letter DFS to New York-regulated insurers and come amid a push by the department to promote diversity, equity and inclusion (DEI) within the state’s insurance industry.

The announcement came following the first day of the second annual DEI Conference, co-hosted by the American Council of Life Insurers (ACLI), the American Property Casualty Insurance Association (APCIA) and the Life Insurance Council of New York (LICONY). Former DFS Superintendent Linda Lacewell said in remarks during the conference that DFS is in the process of building a separate office of diversity and inclusion in order to further its efforts in this area.

“While the insurance industry’s public statements of support for diversity and DEI initiatives are important and necessary, our challenge is to move beyond words and good intentions to actions and real change,” Lacewell said in the letter.

Related:

- Top 10 National Insurance Journal Stories of 2021

- Top 10 East Insurance Journal Stories of 2021

- Top 10 Midwest Insurance Journal Stories of 2021

- Top 10 South Central Insurance Journal Stories of 2021

- Top 10 Southeast Insurance Journal Stories of 2021

- Top 10 West Insurance Journal Stories of 2021

- Top 10 International Insurance Journal Stories of 2021

Was this article valuable?

Here are more articles you may enjoy.

Baldwin Posts Fourth Quarter Loss; Carlisle Takes Over Underwriting Group

Baldwin Posts Fourth Quarter Loss; Carlisle Takes Over Underwriting Group  Trump’s Hormuz Assurances Are Only a Partial Fix, Shippers Say

Trump’s Hormuz Assurances Are Only a Partial Fix, Shippers Say  Commercial P/C Market Softest Since 2017, Says CIAB

Commercial P/C Market Softest Since 2017, Says CIAB  Georgia Insurance Law Is About to Get an Upgrade With Multiple Changes

Georgia Insurance Law Is About to Get an Upgrade With Multiple Changes